- MicroStrategy updates stock issuance policy; Bitcoin and MSTR stock affected.

- MSTR stock drops 8% after policy announcement.

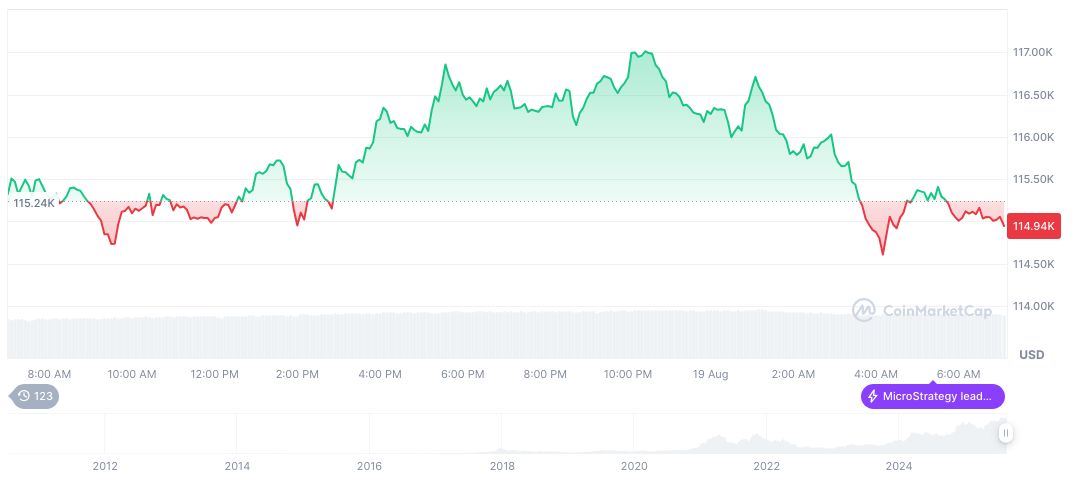

- Bitcoin price falls 8.6% from previous highs.

Michael Saylor’s MicroStrategy, also known as Strategy, saw its stock price plunge to a near four-month low following a revised stock issuance policy amidst Bitcoin’s price decline.

This move concerns shareholders due to potential dilution but suggests increased future Bitcoin purchases, impacting investor sentiment and market dynamics.

MicroStrategy Stock Policy and Market Reaction

MicroStrategy, led by Michael Saylor, updated its stock issuance guidelines, allowing greater flexibility. This move comes after Bitcoin’s price fell, impacting the firm’s trading strategy. Investors saw this as a divergence from the company’s previous restrictions, prompting a reevaluation of stock value and issuance strategy. Michael Saylor stated, “Strategy today announced an update to its MSTR Equity ATM Guidance to provide greater flexibility in executing our capital markets strategy.” The policy, which allows issuance when trading below 2.5 times net asset value, aims at facilitating debt repayment and operational funding. Market observers noted the shift’s potential implications for shareholder value, sparking debates on its broader impacts. Michael Saylor’s announcement stated that this change was necessary to maintain strategic flexibility, aligning with their capital allocation objectives.

Bitcoin, trading at $113,602.39, continues to dominate the market with a market cap, according to CoinMarketCap, of over 2.26 trillion, accounting for 59.14% market dominance. The current trading volume exceeds 72 billion, experiencing a 7.05% 24-hour change. The supply sits at 19,908,840 with a max supply of 21 million, illustrating Bitcoin’s robust yet volatile nature.

Did you know? MicroStrategy’s shift in stock issuance policy marks a notable move since it transformed into a major Bitcoin treasury, reflecting similar strategic shifts seen in 2021 amidst Bitcoin volatility.

Bitcoin’s Volatility and Strategic Response by MicroStrategy

Did you know? MicroStrategy’s shift in stock issuance policy marks a notable move since it transformed into a major Bitcoin treasury, reflecting similar strategic shifts seen in 2021 amidst Bitcoin volatility.

The Coincu research team suggests that the policy change may lead to increased BTC holdings, a potential buffer against volatility and a strategic move in light of historical stock issuance effects on market perception. This adjustment portrays a dynamic approach to managing cryptocurrency assets amidst fluctuating markets.

Bitcoin, trading at $113,602.39, continues to dominate the market with a market cap, according to CoinMarketCap, of over 2.26 trillion, accounting for 59.14% market dominance. The current trading volume exceeds 72 billion, experiencing a 7.05% 24-hour change. The supply sits at 19,908,840 with a max supply of 21 million, illustrating Bitcoin’s robust yet volatile nature.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/microstrategy-stock-policy-bitcoin-impact/