Michael Saylor’s Strategy, previously known as MicroStrategy, has made another Bitcoin purchase despite the panic in the crypto market and the current BTC price action. This latest purchase also comes as the MSTR stock continues its decline, down over 5% today in premarket trading.

Strategy Buys 130 Bitcoin for $11.7 Million

In a press release, the company announced that it acquired 130 BTC for $11.7 million at an average price of $89,960 per Bitcoin and has achieved a BTC yield of 27.8% year-to-date (YTD). It now holds 650,000 BTC, which it acquired for $48.38 billion at an average price of $74,436 per Bitcoin.

As CoinGape reported, Saylor had hinted at another Bitcoin buy yesterday in his conventional Sunday X post. He posted the company’s portfolio tracker with the caption, “What if we start adding green dots?” which indicated that they had again resumed buying BTC just after a week’s hiatus.

What if we start adding green dots? pic.twitter.com/a19bD33KzD

— Michael Saylor (@saylor) November 30, 2025

Strategy didn’t buy any Bitcoin two weeks ago after it made one of its largest purchases the previous week. The company had purchased 8,178 BTC for $836 million, funding the purchase through its STRE offering.

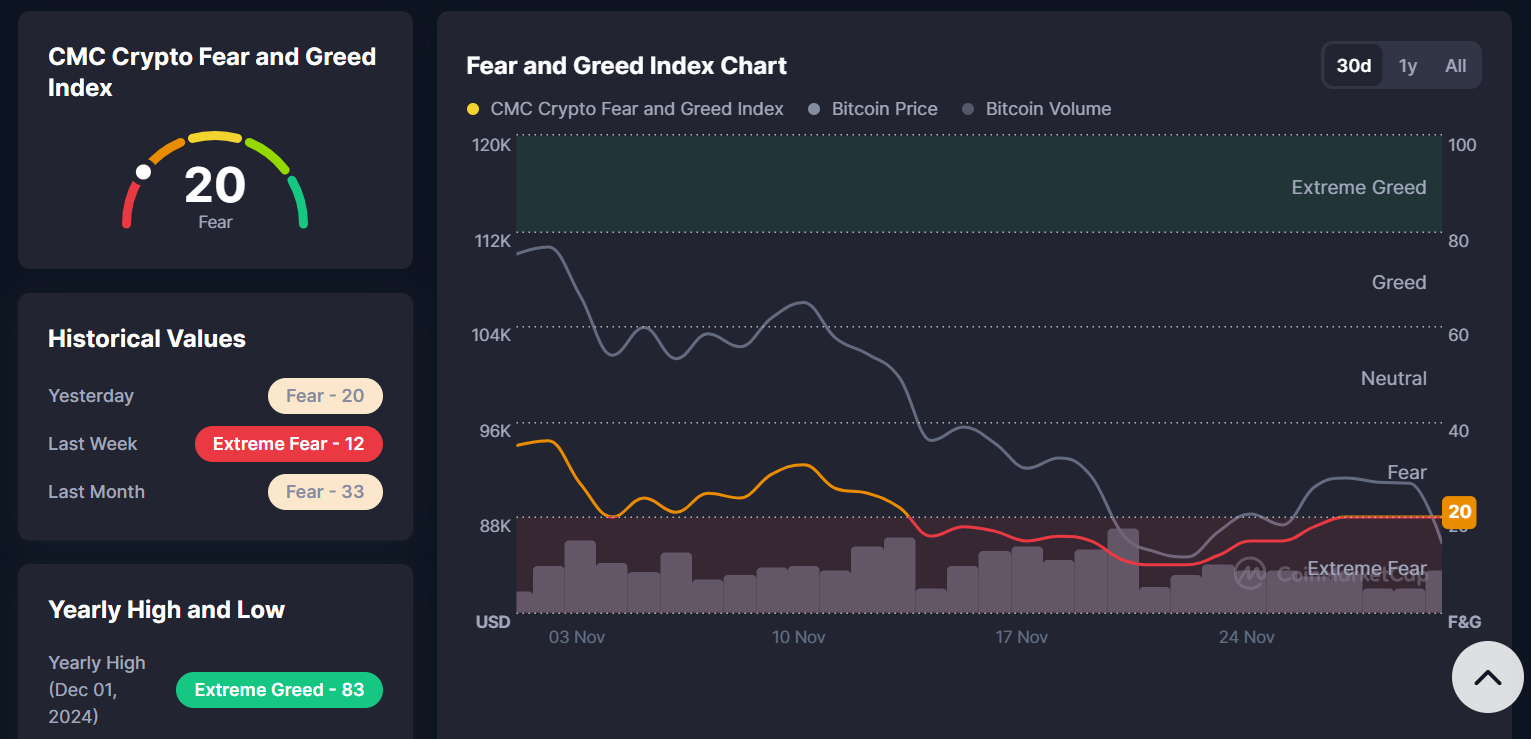

Meanwhile, this latest purchase comes as the crypto market sentiment slips into fear, following the BTC price crash below $90,000 yesterday. CoinMarketCap data shows that the ‘Fear and Greed’ Index is at 20, which signals panic among market participants.

Strategy already indicated it plans to keep accumulating Bitcoin even if the flagship crypto enters a bear market. The company recently alluded to the 2022 crypto winter and how it kept buying BTC even when the crypto’s price fell below their average purchase price.

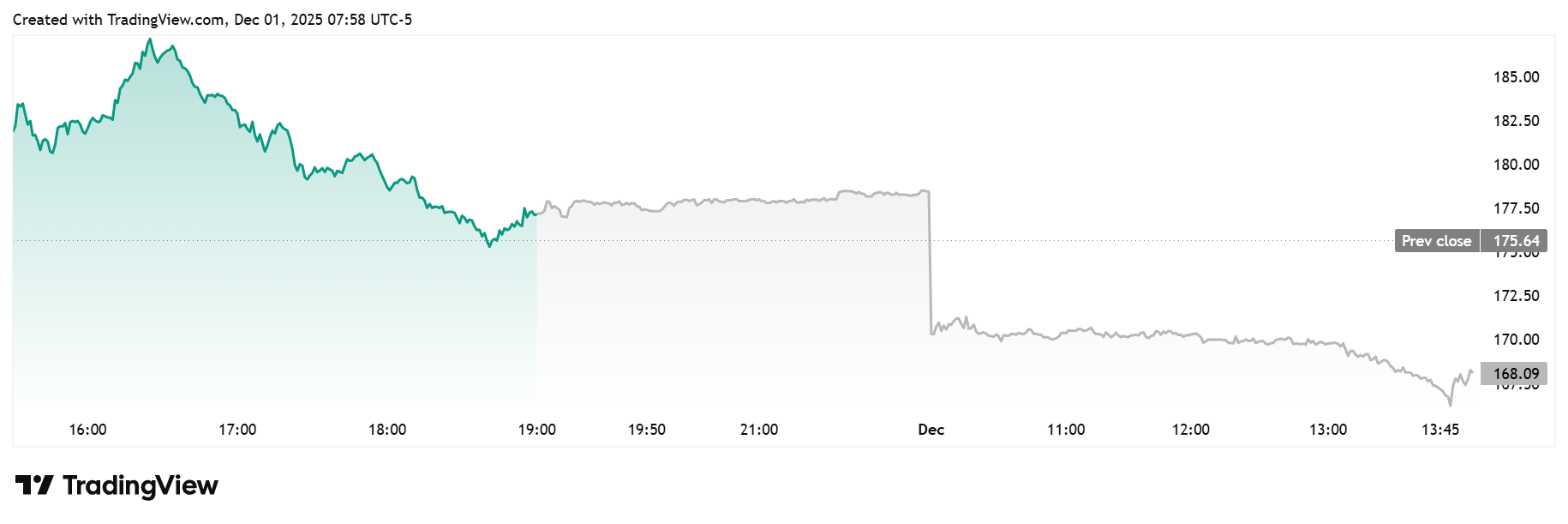

Meanwhile, the MSTR stock is also on the decline alongside Bitcoin. TradingView data shows that the stock is down over 5% today, trading at around $168 in premarket trading.

USD Reserve For Dividend Payments On Preferred Stocks

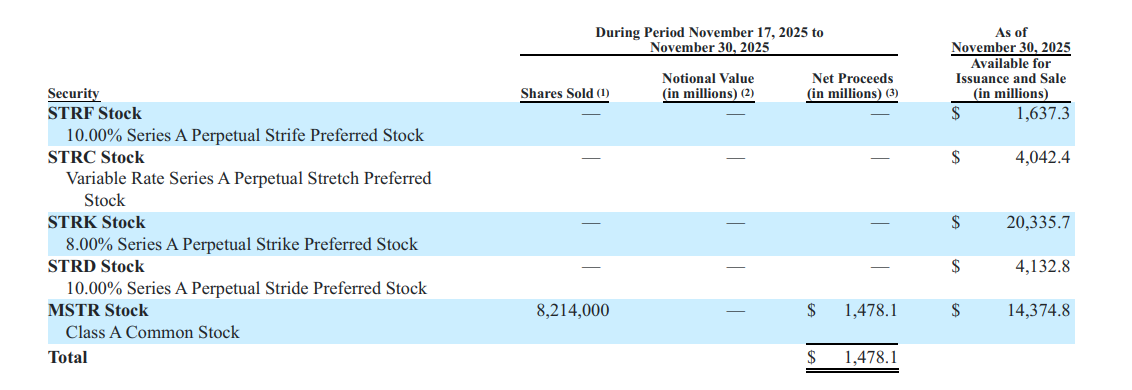

Strategy announced that it has established a USD reserve of $1.44 billion to support the payment of dividends on its preferred stock and interest on its outstanding indebtedness. This comes just after the company’s CEO, Phong Le, stated that they might have to sell some of their BTC holdings if the mNAV falls below one and they are unable to raise capital for dividend payments.

However, he also mentioned that selling their Bitcoin would be their last resort. Meanwhile, the company revealed that it funded the USD reserves using proceeds from the sale of shares of the MSTR stock under its at-the-market (ATM) offering program. The SEC filing shows that the company sold 8.2 million shares and raised net proceeds of almost $1.5 billion, which it used to set up the reserve and fund the latest BTC purchase.

Strategy intends to maintain the USD reserve in an amount sufficient to fund at least twelve months of dividends. It also intends to strengthen the reserve over time, to ultimately cover 24 months or more of its dividends.