MicroStrategy Inc. has recorded a profit exceeding $2 billion from its Bitcoin holdings as the cryptocurrency’s price surges past $42,000.

MicroStrategy’s substantial Bitcoin investment has generated a significant return. Under the direction of Executive Chairman Michael Saylor, the business intelligence firm began its Bitcoin investment journey in August 2020.

As of November 30, MicroStrategy owned 174,530 Bitcoins, acquired for approximately $5.28 billion at an average cost of $30,252 per Bitcoin.

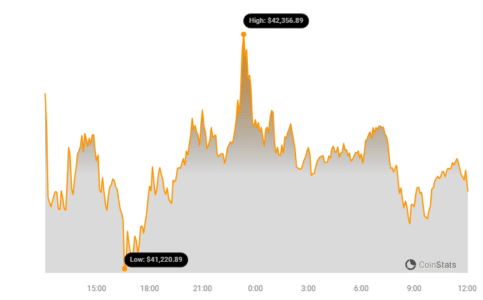

As Bitcoin’s price soared to $42,000 on Monday, the value of MicroStrategy’s holdings skyrocketed to roughly $7.3 billion, translating to a profit north of $2 billion. Despite a slight pullback to $41,700, the firm’s profit remains substantial.

Bitcoin had not seen such heights since April 2022, preceding the collapse of the Terra ecosystem. In the 2022 bear market, Bitcoin’s value plummeted below $16,000, posing a significant threat to MicroStrategy’s investment.

See Also: Ethereum Price Is Gaining Pace Above The $2,200 Resistance, Is $2,500 Feasible?

Nevertheless, Michael Saylor persisted in growing the company’s Bitcoin portfolio, leveraging a mix of debt and equity to fund the purchases.

On Monday, MicroStrategy’s shares experienced a 6% uptick in trading.

MicroStrategy added 16,130 Bitcoins to its treasury. This move drew praise from billionaire investor and Galaxy Digital CEO Mike Novogratz, who lauded Saylor as a “legend.”

El Salvador’s President Nayib Bukele also announced that his Bitcoin investment profits has exceeded $3 Million due to the recent increase in Bitcoin price.

The price of Bitcoin stands at about $41,593 at press time having crossed the $42,000 briefly yesterday.

Source: https://bitcoinworld.co.in/michael-saylors-microstrategy-nets-over-2b-profit-as-bitcoin-rallies-near-42k/