- Bitcoin’s influence on corporate strategies.

- Michael Saylor’s role in crypto expansion.

- Market response to Strategy’s bitcoin shift.

Michael Saylor’s Bitcoin Vision: Transforming Corporate Strategies

Bitcoin is revolutionizing equity markets, according to Michael Saylor. On May 20, he stated Bitcoin’s role in transforming these markets, leading Strategy’s rebranding to focus solely on Bitcoin. This represents a major pivot from its software roots to becoming a foremost Bitcoin asset entity. Michael Saylor pushes crypto expansion

Bitcoin’s Market Influence and Strategic Corporate Realignments

Strategy’s refocusing brings immediate changes, aligning corporate strategies with Bitcoin’s growth potential. Such actions depart from traditional treasury models, emphasizing Bitcoin as a strategic holding. Michael Saylor aptly stated, “Bitcoin is changing the equity capital markets,” supporting the indication of a shift in the global investment landscape.

Market reactions highlight significant interest. Comments from industry proponents suggest a potential model for future corporate strategies. Bitcoin’s rising value has reaffirmed Saylor’s stance, with strategic investors closely monitoring Strategy’s evolving actions.

Market Data and Future Insights

Did you know? Saylor’s commitment to Bitcoin mirrors historical shifts seen in the late ’90s when tech companies pivoted to digital, altering capital market landscapes.

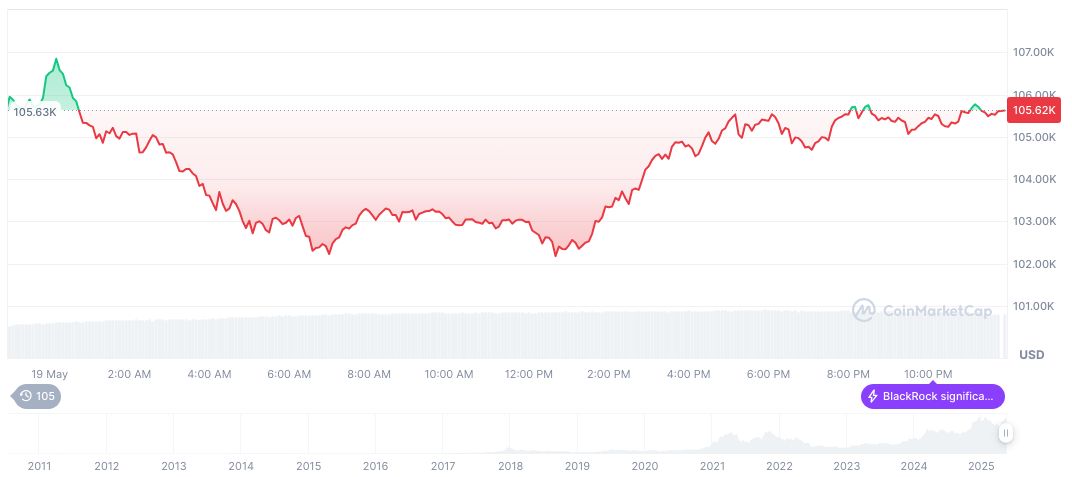

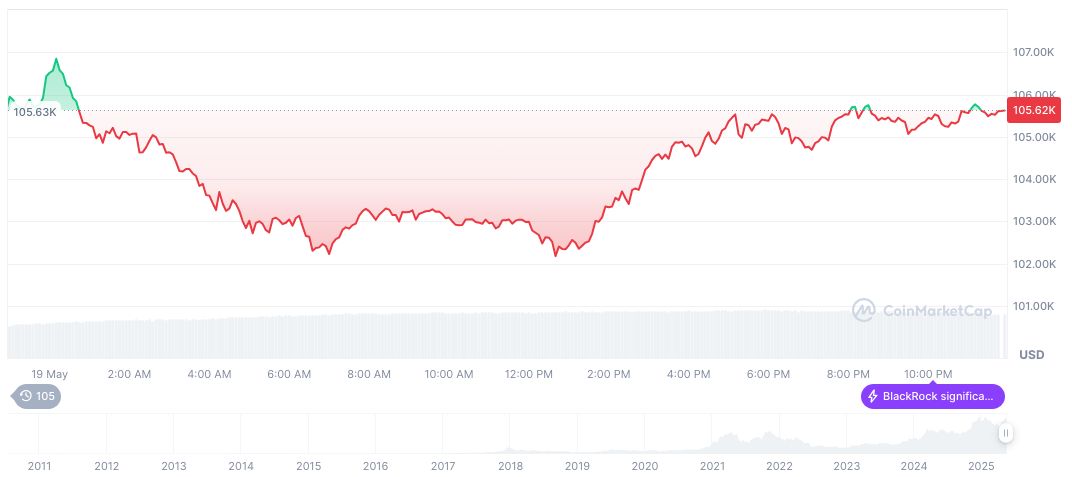

Bitcoin (BTC) currently trades at $105,489.76, with a market cap of 2,095,812,572,206.58 and a dominance of 63.13%, noted at CoinMarketCap. Its price enjoyed a 24-hour increase of 0.56%, and a remarkable 7-day rise of 1.16%. Trading volume reached $51 billion, marking a 24.07% decrease.

Coincu’s research suggests potential financial shifts as more organizations adopt Bitcoin-focused models. Historical data indicates this alignment may foster long-term corporate stability, with regulatory frameworks potentially evolving to accommodate Bitcoin’s financial role.

Source: https://coincu.com/338753-bitcoin-transforming-equity-markets/