- Michael Saylor plans further Bitcoin acquisitions amid market price shifts.

- Saylor calls Bitcoin a key treasury asset for MicroStrategy.

- Potential market shifts expected as BTC holdings increase.

Michael Saylor of MicroStrategy announced on social media that ‘Bitcoin is on Sale,’ signaling potential future acquisitions by the company.

This statement aligns with MicroStrategy’s historical pattern, where market anticipation often precedes sizable Bitcoin purchases, potentially influencing Bitcoin valuations and associated assets like MSTR.

Bitcoin Market Trends and Institutional Impact

Did you know? Michael Saylor’s strategic investments in Bitcoin began in 2020, consistently elevating the narrative of Bitcoin as digital gold and a secure store of value for institutional treasuries.

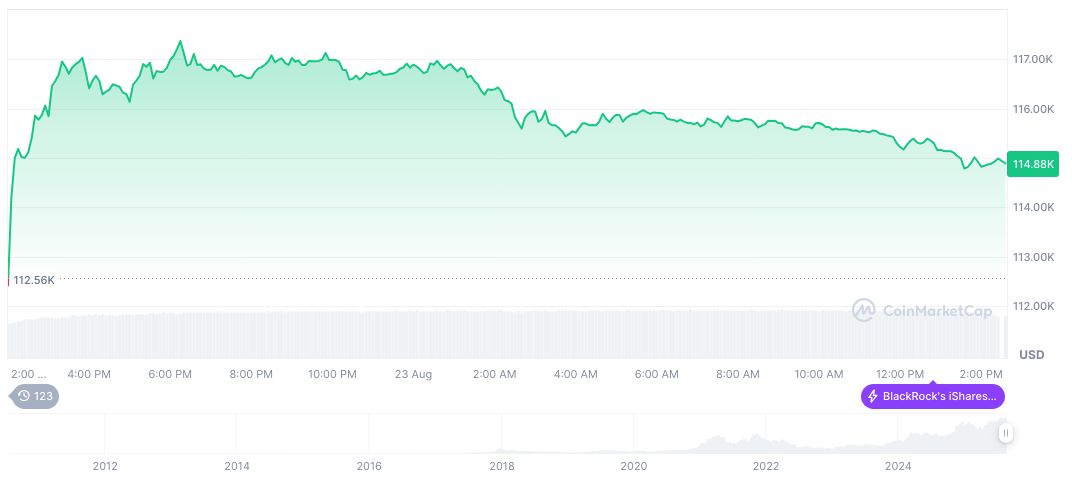

According to CoinMarketCap, Bitcoin (BTC) last traded at $114,708.86, showing a 0.18% dip over 24 hours. The market cap stands at $2.28 trillion, while the circulating supply is 19.91 million coins. Over the past 90 days, Bitcoin appreciated by 4.32%, underscoring volatility and investor interest.

The Coincu research team suggests further Bitcoin allocations may bolster institutional trust in BTC as a hedge against inflation. The historical move often triggers ripples across equity markets, particularly those intertwined with Bitcoin’s liquidity and supply metrics.

Market Insights and Future Predictions

Did you know? Michael Saylor’s strategic investments in Bitcoin began in 2020, consistently elevating the narrative of Bitcoin as digital gold and a secure store of value for institutional treasuries.

Michael Saylor, Executive Chairman of MicroStrategy, stated, “MicroStrategy has outperformed every asset class and the Magnificent 7 in the past five years by adopting the Bitcoin Standard. Track daily results at Strategy.com.

The Coincu research team suggests further Bitcoin allocations may bolster institutional trust in BTC as a hedge against inflation. The historical move often triggers ripples across equity markets, particularly those intertwined with Bitcoin’s liquidity and supply metrics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/michael-saylor-bitcoin-acquisitions/