- Metaplanet targets 30,000 BTC holdings by 2025 end.

- Agenda includes achieving 1% of all Bitcoin by 2027.

- Initiatives promote Bitcoin adoption for corporations globally.

Simon Gerovich, CEO of Japanese listed firm Metaplanet, reaffirms plans to bolster Bitcoin holdings to 30,000 BTC by year’s end, intensifying corporate adoption.

This move underscores Metaplanet’s leadership in institutional Bitcoin accumulation, bolstering corporate balance sheets amid market volatility.

Metaplanet’s Bold Strategies in Bitcoin Accumulation

The Japanese firm Metaplanet, under CEO Simon Gerovich, maintains its objective to significantly bolster its Bitcoin reserves, targeting 30,000 BTC by year-end. Their roadmap remains clear and unchanged, emphasizing both daily execution and long-term goals. As Simon Gerovich remarks, “Our goal of reaching 30,000 BTC in corporate reserves this year is unchanged, and we have a clear roadmap for daily execution and long-term growth.”

Aiming to hold 1% of Bitcoin by 2027, Metaplanet implements transparency through proof of reserves and performance dashboard data. The firm’s funding initiatives include ¥9.5 billion raised for immediate Bitcoin purchases, illustrating commitment to their strategic outlook.

Bitcoin Market Resilience and Metaplanet’s Influence

Did you know? Despite volatility, Bitcoin’s 13.15% increase in the last 60 days reflects a broader trend of resilience in the face of market fluctuations, highlighting ongoing corporate interest and adoption.

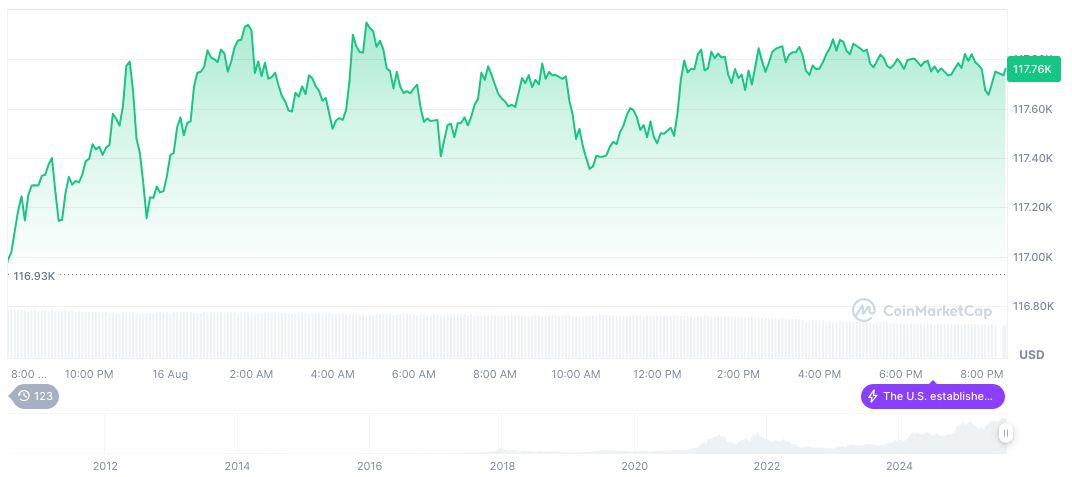

Bitcoin, symbolized as BTC, currently trades at $117,608.30 with a market cap of $2.34 trillion. Dominating 58.68% of the market, it witnessed a -0.13% dip over 24 hours, according to CoinMarketCap on August 17, 2025. Over the last 60 days, Bitcoin increased by 13.15%, emphasizing its robust market standing amid fluctuations. Trading volume stands at $46.24 billion, showcasing vibrant market activity.

Expert analysis from Coincu’s research team notes potential financial outcomes given Metaplanet’s actions may spur further institutional investment. Increased corporate adoption could stabilize Bitcoin’s market presence, with long-term effects possibly reshaping traditional treasury management approaches.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/metaplanet-bitcoin-holdings-goal-2025/