- Matrixport signals Bitcoin consolidation from macroeconomic and seasonal trends.

- Bitcoin’s performance in August and September historically weak.

- Fiscal uncertainty and capital flows drive Bitcoin outlook.

Matrixport, a leading digital asset platform, reported on July 25 that Bitcoin may experience consolidation due to U.S. fiscal uncertainty and seasonal trends impacting August and September.

The report highlights potential market caution amid strong macro drivers and institutional interest, signifying a period of consolidation affecting Bitcoin’s value.

Bitcoin Weakness Historically Evident in August and September

Matrixport released a report on July 25, 2025, suggesting Bitcoin might remain in a consolidation phase through August and September. The report cites both technical and macroeconomic factors contributing to this expectation, including, notably, US fiscal policy shifts and elevated profit-taking by investors.

Bitcoin’s expected consolidation results from historical patterns showing these months as typically weaker. With profit-taking pressure rising and capital moving toward stablecoins, institutional and retail investors remain cautious. Matrixport Analyst noted, “Data from the past decade has shown that August and September are among the weakest-performing months for Bitcoin… the average return, particularly in August, is close to zero.” Despite potential catalysts like increased ETF flows and speculated SEC approval for Ethereum staking, market enthusiasm has not fully materialized.

Bitcoin Price Tied to Fiscal Policies, Trading Over $115K

Did you know? Over the past decade, August and September have shown zero or negative average returns for Bitcoin, with only three years of positive performance, underscoring a seasonal trend of caution among investors.

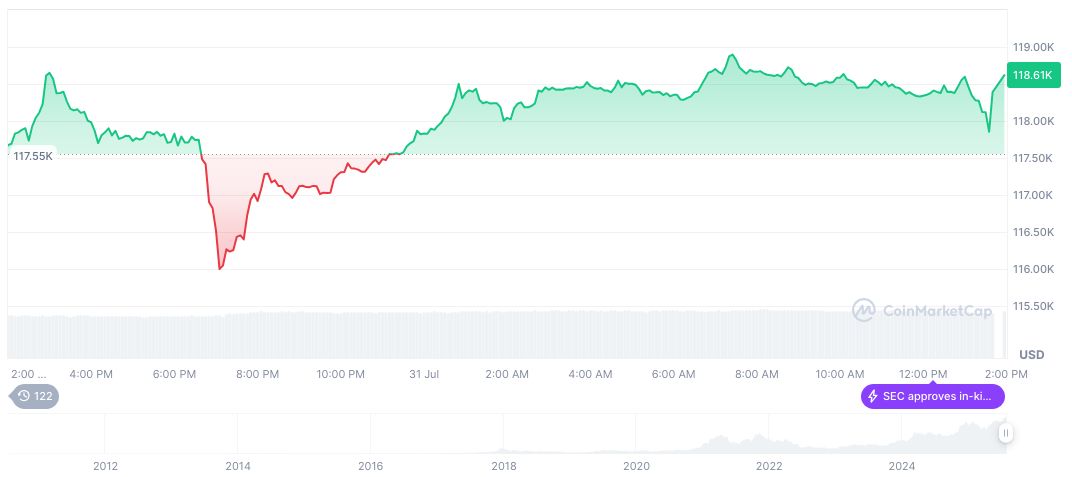

Currently, Bitcoin (BTC) is trading at $115,049.43, as reported by CoinMarketCap, with a market cap of $2.29 trillion and a dominant market share of 61.25%. Over the past 30 days, Bitcoin has increased by 7.24%, despite a 3.05% drop in the last 24 hours. The cryptocurrency’s 24-hour trading volume reached $78.13 billion, marking an 8.80% change, reflecting recent market adjustments.

Insights from Coincu research team suggest Bitcoin’s price movements tie closely to fiscal policies and macroeconomic themes. According to the Matrixport Report, July 25, 2025, “Bitcoin is now ‘technically overbought,’ with further upside dependent on fresh catalysts such as policy developments or macroeconomic shifts.” The observed 19.42% increase over 90 days aligns with periods of fiscal instability, reinforcing that Bitcoin remains a pivotal asset amid global economic shifts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/matrixport-bitcoin-macro-analysis-august/