| Key Points: – Metaplanet added 1,241 BTC and Strategy acquired 13,390 BTC at ~$99,856 each, now holding 568,840 BTC total. |

Bitcoin held steady near $105K as institutional demand surged, with Metaplanet and Strategy acquiring over 14,000 BTC combined. Uniswap hit a record $3 trillion in trading volume. Coinbase officially joined the S&P 500, signaling deeper crypto integration into traditional finance.

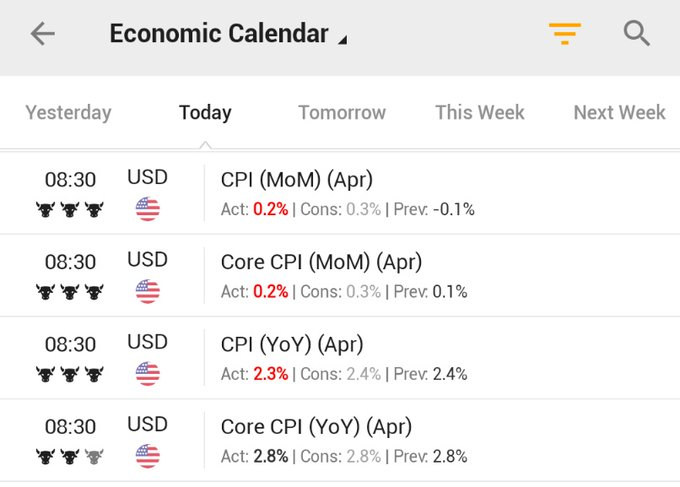

Market sentiment remains mixed amid softening inflation and looming catalysts. U.S. CPI dropped to 2.3%, its lowest since 2021. Traders brace for FTX’s $5B payout and May’s options expiry, both critical events for short-term volatility.

Global outlook brightened with geopolitical progress and growing crypto adoption. The U.S. and China reached a tariff-reduction deal, while Russia and Ukraine resumed peace talks. Yet, the $20M Coinbase hack threat highlights persistent security vulnerabilities.

Last week’s Highlights (May 12 – May 18)

Top Market News

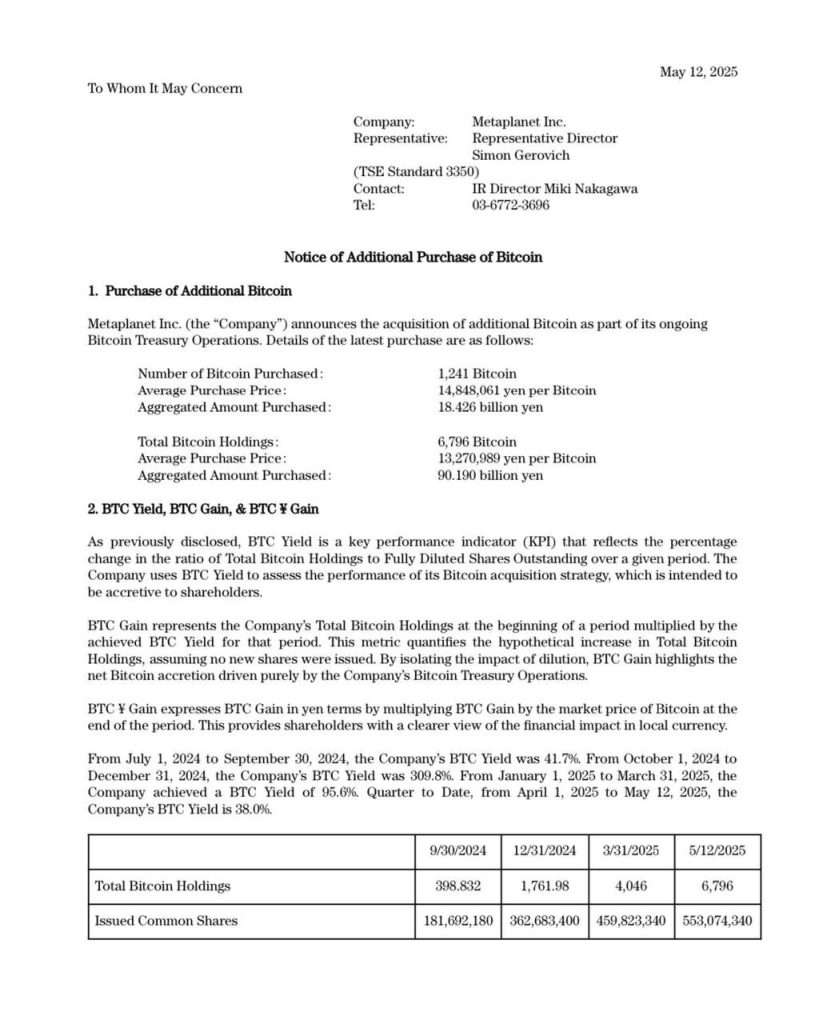

The cryptocurrency market has witnessed significant institutional adoption this week, with major players like Metaplanet and Strategy making substantial Bitcoin purchases.

Metaplanet added 1,241 BTC to their holdings, while Strategy acquired 13,390 BTC at approximately $99,856 each, bringing their total holdings to an impressive 568,840 BTC with an average purchase price of $69,287.

In the DeFi sector, Uniswap achieved a remarkable milestone by becoming the first DEX to reach $3 trillion in total trading volume. The platform now processes around $3 billion daily, commanding a 23% market share and surpassing PancakeSwap.

Meanwhile, traditional finance continues to embrace crypto as Coinbase (COIN) officially joined the S&P 500 index, replacing Discover Financial Services.

Infrastructure development continues to advance with VanEck launching a tokenized government bond fund operating across multiple chains including Ethereum, Avalanche, Solana, and BNB Chain.

Additionally, 21Shares has partnered with Sui blockchain to promote global adoption of the SUI token and expand into the U.S. market, while Dubai takes steps toward crypto adoption through a partnership with Crypto.com.

Security remains a critical concern in the crypto space, as evidenced by the recent Coinbase incident where hackers obtained sensitive customer data. Despite a $20M Bitcoin ransom demand, CEO Brian Armstrong has taken a firm stance by refusing to pay and instead offering a $20M reward for information leading to the attackers’ capture.

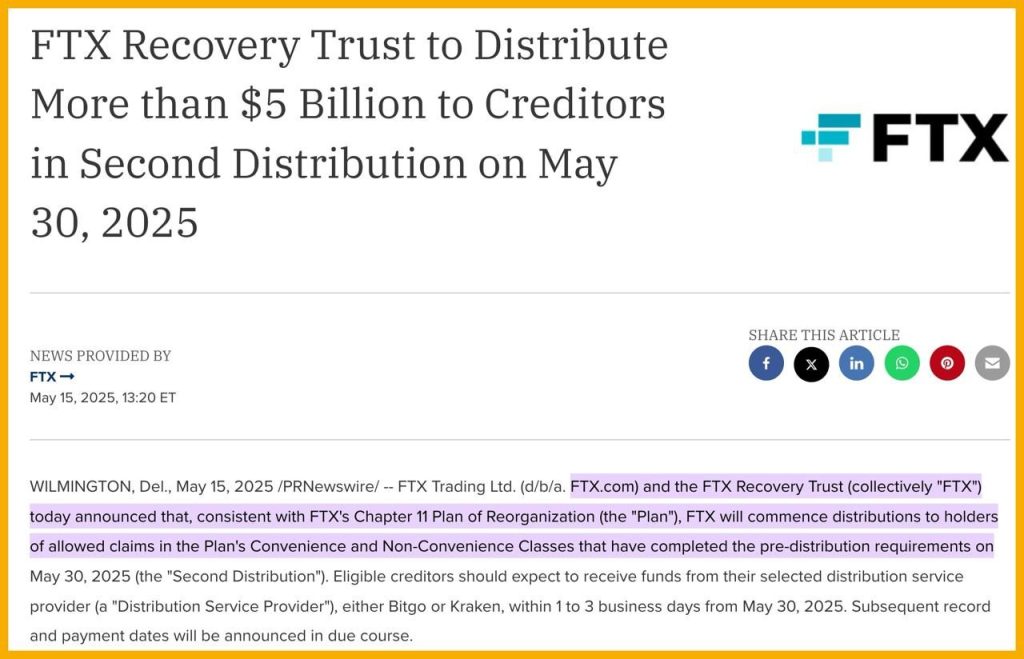

Meanwhile, the FTX Recovery Fund continues its creditor reimbursement process, with plans to distribute over $5 billion in its second distribution phase on May 30, 2025.

Macroeconomic News

U.S. CPI Data for April 2025:

- CPI: 2.3% (Expected 2.4% – Previous 2.4%), lowest since February 2021

- Core CPI: 2.8% (Meeting expectations, unchanged from previous month), lowest since March 2021

Fed Chair Jerome Powell’s statements:

- Maintains 2% inflation target

- Considering average inflation targeting approach

- Fed to adjust policy framework and communication to better align with current economic reality

Key Economic Events This Week

This week doesn’t have many major events, mostly speeches from FED officials.

🗓️ Monday, May 19

- Speech by New York Fed President John Williams

- Speech by Fed Vice Chair Philip Jefferson

🗓️ Tuesday, May 20

- Interest Rate Decision by Reserve Bank of Australia (RBA)

- Speech by Richmond Fed President Tom Barkin

- Speech by St. Louis Fed President Alberto Musalem

- Speech by Federal Reserve Governor Adriana Kugler

🗓️ Thursday, May 22

- U.S. Initial Jobless Claims (Expected: 230,000 | Previous: 229,000)

- Speech by New York Fed President John Williams

🗓️ Friday, May 23

- Speech by Kansas City Fed President Jeff Schmid

- Speech by Federal Reserve Governor Lisa Cook

🗓️ Sunday, May 25

- Graduation Speech by Fed Chair Jerome Powell

Economic Indicators and Market Sentiment

The cryptocurrency market has reached a significant milestone with Bitcoin hitting a new all-time high of $105,000, though it’s currently trading sideways. This has led to increased Bitcoin dominance while altcoin values have declined.

Major geopolitical developments are shaping the global economic landscape. A breakthrough US-China trade agreement has been reached, with both nations significantly reducing tariffs – the US lowering Chinese import tariffs to 30% and China reducing US goods tariffs to 10%.

Additionally, Russia and Ukraine have conducted their first direct talks in three years, making progress on ceasefire terms. Meanwhile, Binance Alpha continues to attract attention through its exclusive Airdrop and IDO offerings.

The market is entering a crucial phase as May 19 marks the anniversary of the 2021 BTC crash that sparked the “Sell in May” sentiment. Two significant events are approaching: FTX‘s second $5 billion debt distribution and the expiration of May options contracts. These factors combined make this a critical period for market participants.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/338371-bitcoin-soars-to-105k-on-heavy-accumulation-by-giants/