According to a new report by CryptoQuant, Bitcoin is flashing a key technical divergence on Binance following the U.S. Federal Reserve’s decision to hold interest rates steady.

While BTC’s spot price has remained relatively flat, forming equal lows just above $104,000, open interest across Binance has continued to decline, suggesting a wave of market-wide deleveraging.

Open Interest Drops While Price Holds Steady

Data from Binance shows that Bitcoin has repeatedly bounced from the $104,000 zone, a level that has absorbed significant sell pressure and now serves as a clear demand area.

However, this price stability contrasts with the progressively lower lows in open interest, indicating that leveraged positions are being unwound despite the absence of price breakdowns.

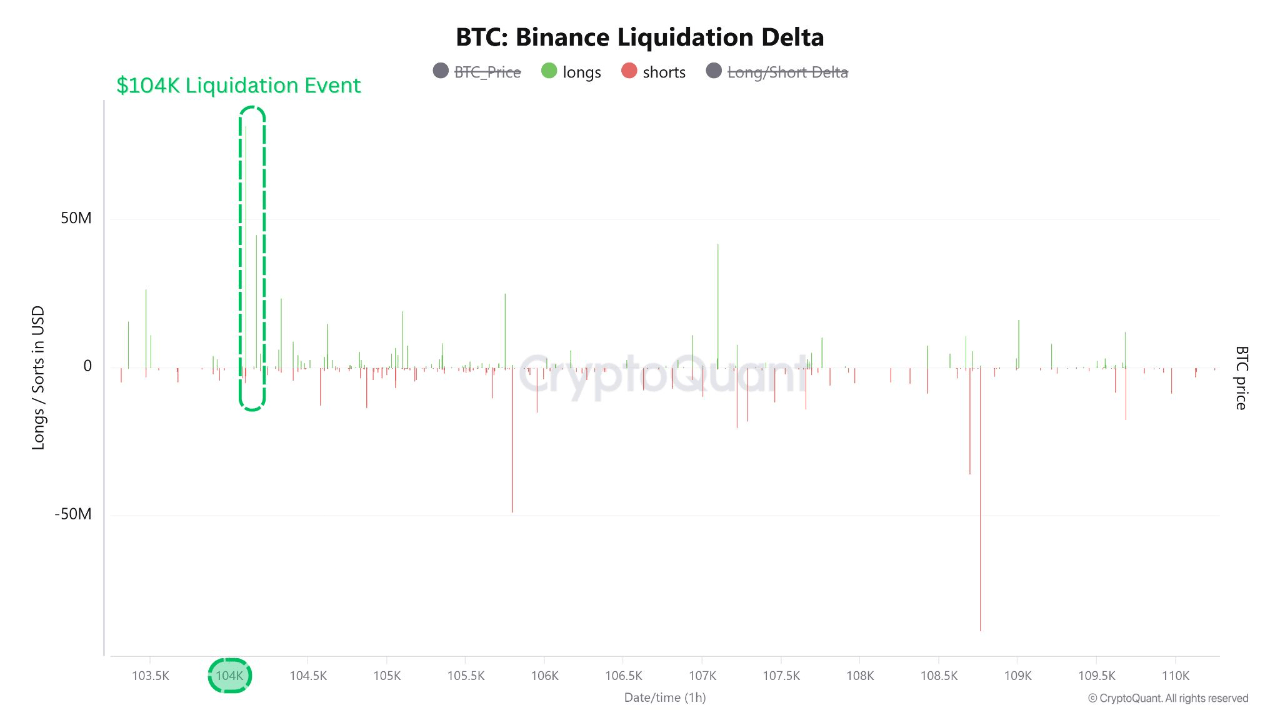

$104K: The Long Liquidation Cluster

The BTC: Binance Liquidation Delta chart reveals that long positions were heavily liquidated at the $104K level, as shown by green spikes in the delta metric.

This suggests that many traders entered the market late, chasing the previous rally, only to be flushed out by liquidation events. On the other hand, short liquidations were minimal, reinforcing that the correction primarily targeted overly aggressive longs.

Bullish Outlook Following the Shakeout

CryptoQuant analysts interpret this combination—price stability, fading open interest, and liquidation exhaustion—as a potentially bullish signal. The recent reset in the derivatives market occurred in tandem with the Fed’s rate pause, a macro backdrop historically supportive of risk-on assets like Bitcoin.

Given this context, CryptoQuant concludes that the path of least resistance may now be higher, especially if the market continues to stabilize and late leverage has been sufficiently cleared.

Source: https://coindoo.com/long-liquidations-mount-at-104k-is-bitcoin-ready-to-climb/