- Merger and financing bolster Bitcoin strategy

- Inspired by MicroStrategy, increasing Bitcoin treasuries

- Market interest in corporate Bitcoin investments growing

Merger and $51.5M PIPE Financing Propel KindlyMD’s Bitcoin Strategy

KindlyMD, Inc. (NASDAQ: NAKA) announced the acquisition of an additional $51.5 million in private equity public offering financing (PIPE) on June 20, 2025, to bolster its Bitcoin reserves. Operating in partnership with Nakamoto Holdings Inc., KindlyMD aims to increase its financial contributions in Bitcoin.

The financial strategy, inspired by MicroStrategy’s approach, highlights a growing trend of corporate Bitcoin treasuries. The funds, led by Cohen & Company Capital Markets, will primarily facilitate Bitcoin purchases, reinforcing institutional narratives in crypto markets.

Market Dynamics: Bitcoin’s Price and Institutional Interest Surge

Did you know? MicroStrategy-inspired corporate strategies have historically led to increased Bitcoin purchases, positively impacting market dynamics.

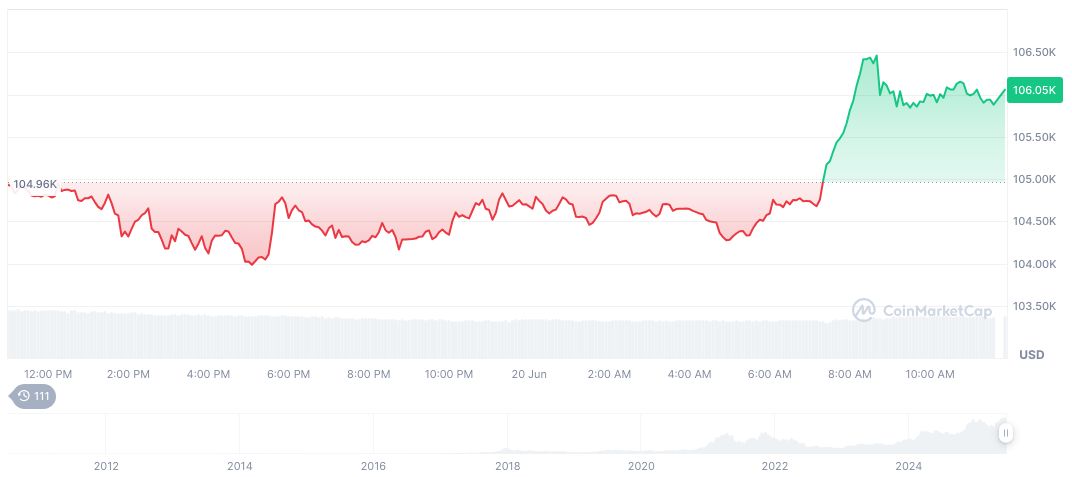

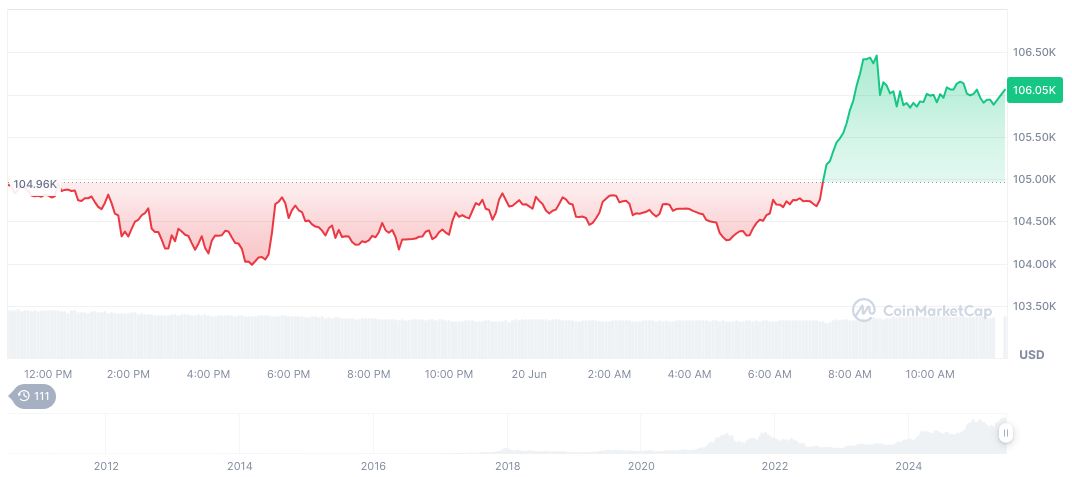

Bitcoin (BTC) currently trades at $105,892.44 with a market cap of $2,105,288,522,841. It holds a 64.14% market dominance, with a fully diluted market cap of $2,223,741,179,610. Recent 24-hour trading volume is at $41,193,556,241, showing a 5.01% decrease. Over 90 days, BTC price rose by 25.88%, according to CoinMarketCap data.

“Investor demand for Nakamoto is incredibly strong. This additional financing was raised in under 72 hours, adding the option for more working capital in addition to acquiring bitcoin. We continue to execute our strategy to raise as much capital as possible to acquire as much bitcoin as possible.” – David Bailey, Founder & CEO, Nakamoto Holdings

Market Dynamics: Bitcoin’s Price and Institutional Interest Surge

Did you know? Insert a historical or comparative fact related to this topic.

Bitcoin (BTC) currently trades at $105,892.44 with a market cap of $2,105,288,522,841. It holds a 64.14% market dominance, with a fully diluted market cap of $2,223,741,179,610. Recent 24-hour trading volume is at $41,193,556,241, showing a 5.01% decrease. Over 90 days, BTC price rose by 25.88%, according to CoinMarketCap data.

Coincu’s research insight highlights that the merger underlines institutional interest in Bitcoin as a strategic reserve asset, potentially leading to enhanced corporate investments. Projected market dynamics could encourage more publicly traded companies to explore similar strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344525-kindlymd-bitcoin-reserve-expansion/