- Ki Young Ju highlights Bitcoin’s shift to deflationary status.

- Strategy rapidly accumulates 555,000 Bitcoins, surpassing mining rates.

- Deflation influences Bitcoin’s price behavior and institutional dynamics.

Ki Young Ju, CEO of CryptoQuant, announced on May 10 that Bitcoin has become deflationary, with Strategy acquiring Bitcoin faster than miners can produce. This development highlights Bitcoin’s evolving market dynamics amid Strategy’s significant holdings.

Bitcoin’s deflationary nature, as indicated by Ki Young Ju, signifies a major shift influenced by Strategy’s acquisition strategy, impacting broader perceptions and potential institutional strategies.

Strategy’s Aggressive Bitcoin Acquisitions Outpace Mining

Ki Young Ju has declared on the X platform that Bitcoin is now deflationary, with Strategy (formerly MicroStrategy) amassing Bitcoins faster than they are mined. Strategy holds around 555,000 Bitcoins in an illiquid state, indicating no intent to sell. This represents a shift from the traditional understanding of Bitcoin’s supply dynamics.

Bitcoin’s deflation indicates a pivotal change in market fundamentals. Strategy’s purchase strategy exceeds mining production, leading to an annual deflation rate of -2.23%. This trend highlights a potential shift in how large holders maintain liquidity and influence market conditions.

The announcement by Ki Young Ju has rippled across market debates. While other institutional players may hold even higher deflation rates on their Bitcoin holdings, market observers note that Strategy’s actions might represent a broader trend of institutional interest in retaining rather than trading Bitcoin.

Rising Institutionals and Potential Regulatory Repercussions

Did you know? Ki Young Ju’s acknowledgment of Bitcoin’s deflationary trend parallels historical cycles where institutional players, like Grayscale in 2020, absorbed significant supply, impacting liquidity and driving shifts in market behavior.

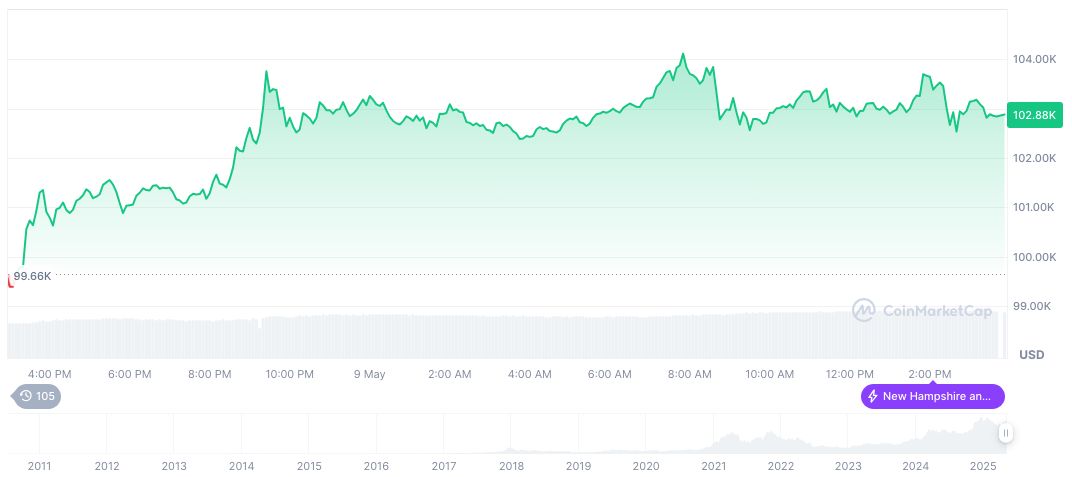

According to CoinMarketCap, Bitcoin currently trades at $103,488.37, with a market cap of $2.06 trillion. Recent data shows a strong extension of its bullish run with price increases across multiple time frames, reflecting steady growth and enhancing its market dominance of 62.34% within the crypto ecosystem.

Experts from Coincu suggest that Bitcoin’s deflation trend, prompted by large-scale institutional purchases, could lead to regulatory scrutiny and prompt developments in policy adaptations. The increased institutional participation underscores Bitcoin’s evolution into a mature asset class, potentially prompting a reevaluation of its role in global financial structures.

Source: https://coincu.com/336836-bitcoin-deflationary-strategy-acquisition/