The ongoing government shutdown outlook has jumped significantly on Kalshi. Bitcoin’s correlation with the Nasdaq has tightened as ETF data shows that long-term investors didn’t panic during the selloff.

Shutdown Forecast Surges As Market Confidence Weakens

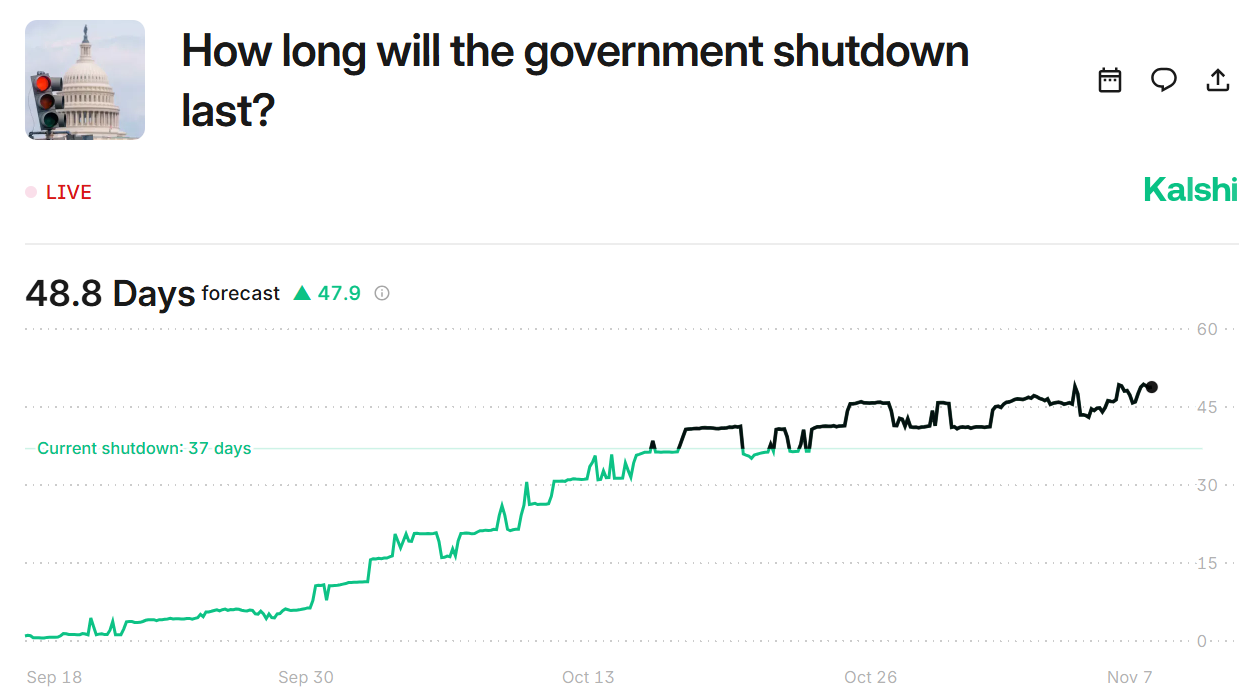

The US government shutdown is now expected to last far longer than earlier estimates, according to updated forecasts from prediction platform Kalshi. The market shows a nearly fifty-day shutdown.

This marks the strongest jump in expectations since the impasse began. The forecast gained more than forty points this week as traders priced in deeper political gridlock and slower progress toward a deal.

The growing forecast reflects weakening confidence across financial markets. The shutdown has lasted over thirty days. Still, there are new estimates that show that there may be an extra month before the shutdown is settled. Hence, traders can expect to experience continued economic pressure, delayed information news and a sluggish risk appetite among the key asset assets.

Bitcoin Tracks Nasdaq Closely As Shutdown Pressure Intensifies

Bitcoin moved lower as the shutdown outlook worsened. The asset traded almost identically to the Nasdaq during the latest decline. Charts from market analyst Daan Crypto Trades show that both markets moving in near perfect sync on the one-minute timeframe.

Every change in the prices of tech stocks appeared immediately in BTC price. This behavior has become more visible during the past week as uncertainty intensified.

The analyst said this correlation appears during periods of fear. Bitcoin behaves like a high-beta tech asset when macro pressure grows. Traders react to political risk by selling both stocks and crypto at the same time. The result is a tight link between the Nasdaq and Bitcoin until the broader environment stabilizes.

Long-Term Holders Stayed Steady During Market Stress

Fresh data from Bloomberg ETF analyst Eric Balchunas adds another layer to the picture. Bitcoin ETFs took in new cash yesterday despite selloffs on crypto exchanges. However, the group recorded almost $1 billion in outflows during the recent 20% drawdown.

That means 99.5% of all ETF assets remained invested throughout the volatility. Balchunas noted that most ETF holders are long-term investors who do not react to short-term stress.

Somehow the bitcoin ETFs took in cash yest and have seen <$1b in outflows during the 20% drawdown = 99.5% of the assets hung tough. Told y’all the ETF-using boomers are no joke. So who’s been selling? To quote that horror movie, “ma’am, the call is coming from inside the house” pic.twitter.com/1WnSTwkmFG

— Eric Balchunas (@EricBalchunas) November 7, 2025

The fact that their positions remained the same shows that institutional demand did not plunge during the downturn. It was through exchanges and not buyers from ETFs that contributed to the on-chain selling pressure and the fall BTC price.

Source: https://coingape.com/kalshi-sees-nearly-50-day-shutdown-bitcoin-mirrors-nasdaq/