- Jim Chanos critiques corporate Bitcoin treasury value, drawing parallels with past market bubbles.

- Warning likens current trends to 2021’s SPAC frenzy, suggesting possible overvaluation.

- Market implications highlight a potential shift in investor confidence.

Wall Street veteran Jim Chanos has criticized corporate Bitcoin treasuries, likening the trend to the SPAC craze of 2021. This statement was made on July 18, highlighting potential market vulnerabilities.

Chanos’ warning raises questions about sustainability amidst rapidly changing market conditions, prompting scrutiny of corporate Bitcoin valuation strategies.

Chanos Equates Bitcoin Treasuries to SPAC Speculation

Jim Chanos, the well-known Wall Street short-seller, has equated the current hype surrounding corporate Bitcoin treasuries to the speculative bubble observed with SPACs in 2021. Chanos pointed out that companies like MicroStrategy, led by Michael Saylor, have amassed billions in market valuation by leveraging Bitcoin holdings. The analogy stems from firms achieving market capitalizations exceeding their core asset values. Chanos highlighted concerns over what he terms as “financial gibberish” surrounding valuation logic.

Comparing it to the 2021 SPAC boom, Chanos raised the potential for a similar abrupt downturn due to unsustainable valuations. He indicated that this premium disconnected from actual Bitcoin holdings could subject investors to unexpected market fluctuations. Such comparisons draw parallels with previous market frenzies, underlining vulnerabilities in speculative bubbles.

“There’s a wonderful sales job that’s being done about the fact that this is an economic engine in and of itself. And so therefore, terms like ‘Bitcoin yield’ are used and I’ve called them financial gibberish because they are.” — Jim Chanos, Legendary Short Seller

Market Concerns Overvaluations and Potential for Abrupt Downturns

Did you know? In 2021, SPACs raised over $90 billion in just three months, leading to valuation issues reminiscent of corporate Bitcoin strategies today.

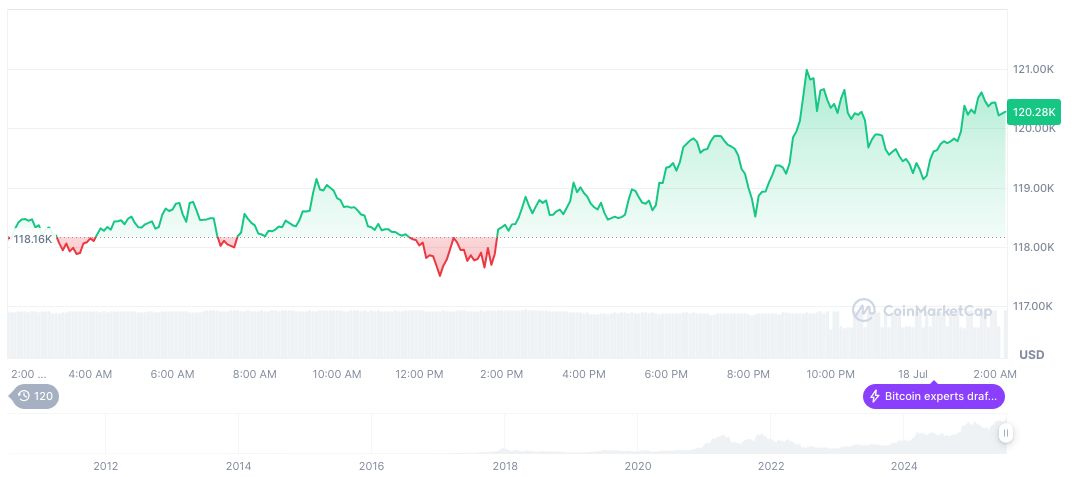

Bitcoin (BTC) valuation remains robust, with a market cap reaching $2.394 trillion and dominance at 61.03%, according to CoinMarketCap. It marks a moderate price rise of 1.74% in the past 24 hours and 3.30% over the past week. The trading volume of $49.37 billion fell by -30.65%.

The Coincu research team emphasizes that institutional adoption may accelerate regulatory frameworks and market corrections. The current trend could evoke a focus on ensuring transparency and reflecting real asset values, mirroring shifts observed in similar conditions historically.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349302-chanos-corporate-bitcoin-warning/