- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Square launches native Bitcoin payment services for select merchants today.

- Merchants can convert Bitcoin to fiat instantly, enhancing payment options.

Jack Dorsey announced on X that Square has started offering native Bitcoin payment services to a select group of merchants as of July 23.

The move marks a significant step in Square’s ongoing strategy to integrate cryptocurrency into mainstream financial transactions. This initiative uses the Lightning Network to facilitate fast, low-cost transactions among merchants. Merchants are empowered with options to hold Bitcoin or convert it to fiat currency instantly, adding flexibility to their payment systems.

Square’s Bitcoin Payment Rollout: Lightning Network and Merchant Flexibility

Square’s introduction of Bitcoin payments involves the deployment of the Lightning Network, aiming to enhance transactional efficiency and cost-effectiveness. Jack Dorsey, CEO of Block, Inc., confirmed that merchants have autonomy over whether to retain Bitcoin or switch it to fiat. Such flexibility supports economic empowerment for businesses, according to Miles Suter, Block’s Bitcoin Product Lead.

Market implications of this move include potential increased adoption of Bitcoin for everyday transactions. The integration could encourage both small and large businesses to reconsider cryptocurrencies as a viable payment method, strengthening their presence in digital commerce. This engagement aligns with Block’s push for BTC’s acceptance akin to foreign currency.

Merchants can choose to hold the Bitcoin, or auto-convert it to fiat in real-time.” — Jack Dorsey, CEO, Block, Inc.

Historical Context, Price Data, and Expert Analysis

Did you know? Square’s BTC payment integration builds upon its 2021 conversion feature, where merchants first had the option to convert sales directly into Bitcoin. This latest move deepens their commitment to crypto integration.

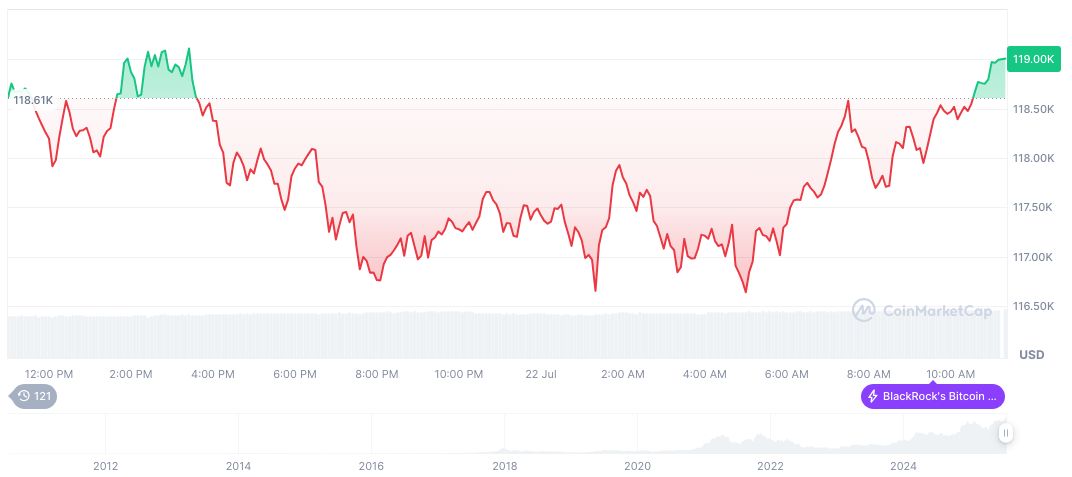

According to CoinMarketCap, Bitcoin (BTC) is currently valued at $120,036.86, with a market cap of $2.39 trillion and market dominance of 60.07%. Over 24 hours, its trading volume reached $79.12 billion, with a 2.22% price increase. Recent data suggests significant growth, with gains of 19.03% over 30 days and a 28.23% increase over 90 days.

The Coincu research team suggested that by promoting Bitcoin as a day-to-day financial tool, Square could influence broader regulatory frameworks favorably towards cryptocurrencies. This strategy might offer a catalyst for similar integration across other platforms, provided regulatory environments adapt accordingly.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/350222-jack-dorsey-bitcoin-square-payments/