- Bitcoin’s “Cup & Handle” pattern pointed to a bullish run, closely following the S&P500 and Gold

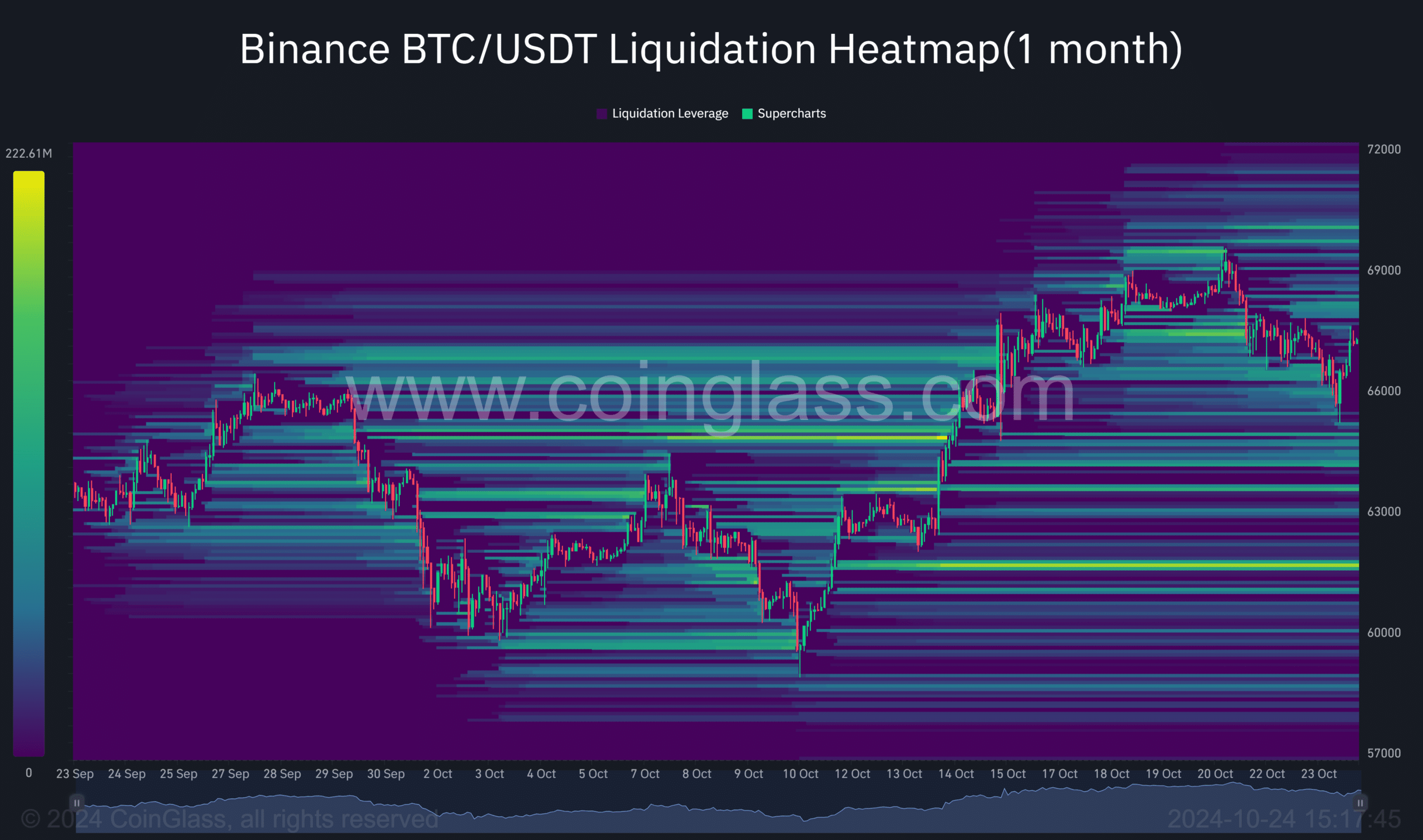

- A potential BTC rebound to $69,785 could liquidate $91.32 million in shorts

Bitcoin (BTC), at press time, appeared to be mapping out a “Cup and Handle” pattern, one quite familiar to both the S&P500 and Gold, according to an analyst’s recent tweet. Based on the setup, a bullish breakout could see the price of Bitcoin climb as high as $230k over the coming months.

Hence, the million-dollar question that investors are eager to see answered is whether or not this cryptocurrency market will follow other traditional assets in its surge to this target.

Shorts may fall…

Bitcoin’s potential rebound could trigger an extremely intense liquidation event if its price bounces back to $69,785.

Currently, $91.32 million worth of short positions are at risk, should the crypto head north. With momentum building across the market, significant volatility should be expected.

Source: Coinglass

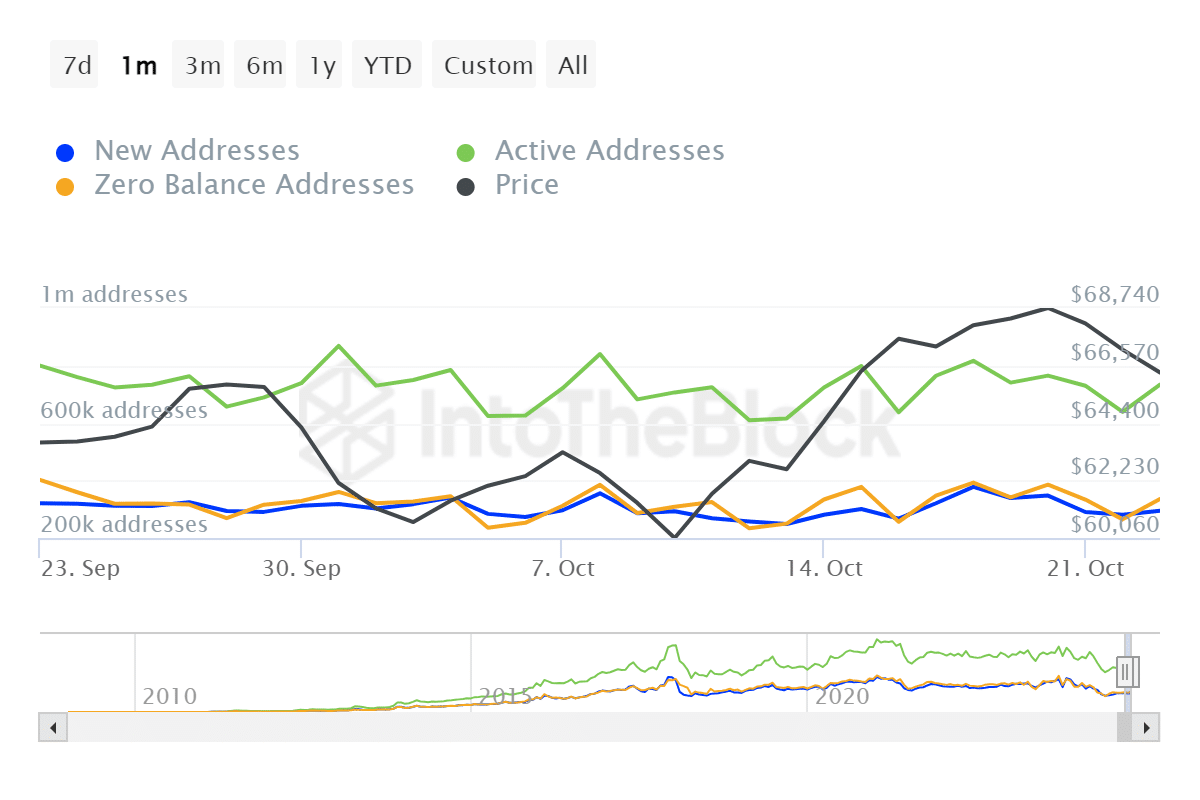

Bitcoin addresses surge on the verge

AMBCrypto further analysed IntoTheBlock’s data, with the same indicating a surge in the number of active addresses over the last 24 hours.

Bitcoin’s network has become considerably more active lately. In fact, its number of active addresses went flying 14% higher to 733k addresses. This hike in participation is a sign of greater interest and engagement, lending more fuel to the king coin’s price momentum.

Source: IntoTheBlock

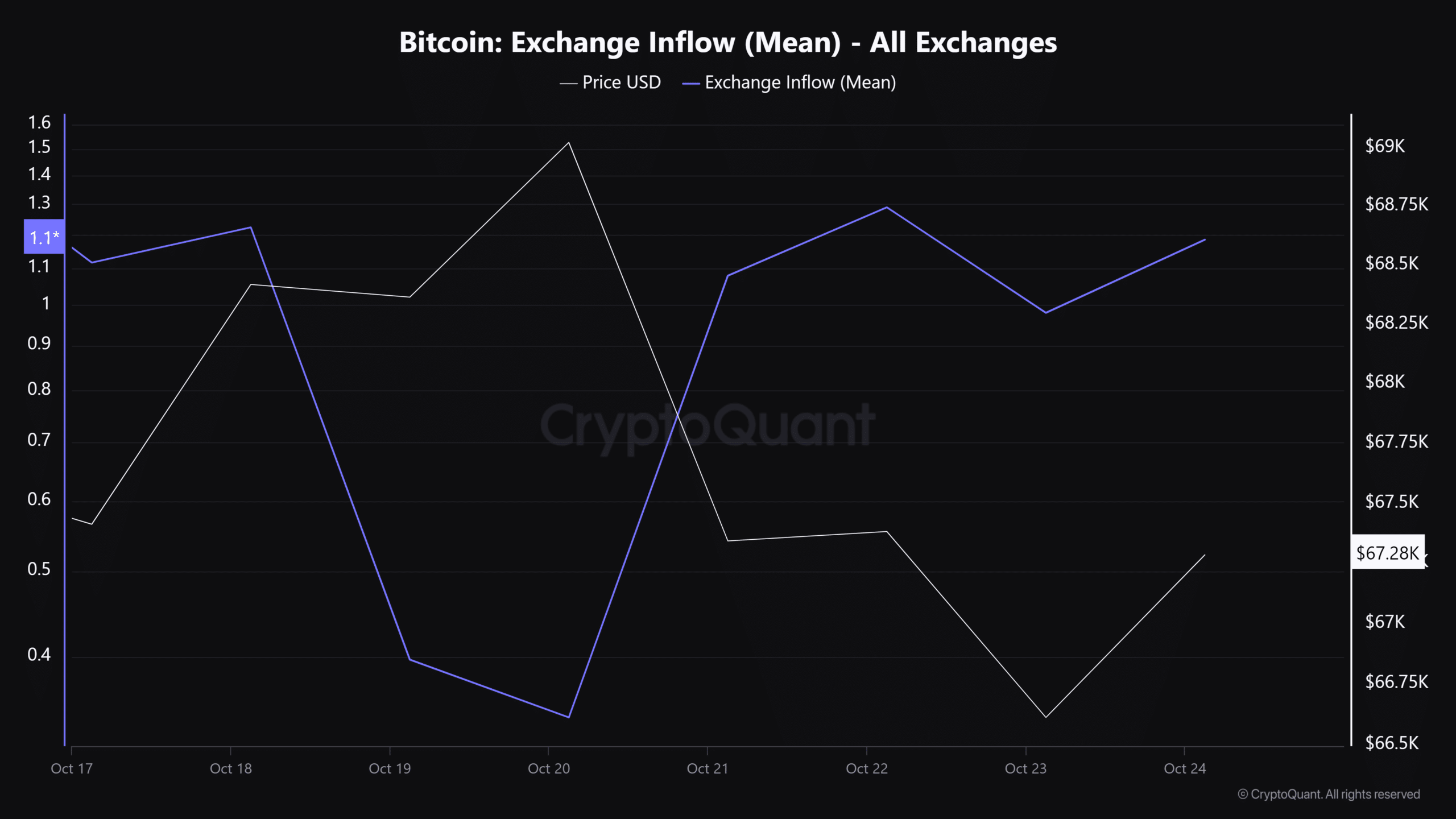

Exchange inflows add to a potential bullish rally

With most analysts now expecting BTC to rally bullishly, it’s worth noting that the asset has been recording significant inflows of late. The same was evidenced by the latest findings on CryptoQuant.

This can be interpreted to be a sign of high Open Interest and demand for Bitcoin, with all metrics alluding to the crypto possibly heading to the moon too.

Source: CryptoQuant

With Bitcoin following in the footsteps of major assets like Gold and the S&P500, the next few months could be crucial for its future.

If the asset manages to reach its projected height, many potential ripple effects on the larger economy could be on cards.

Source: https://ambcrypto.com/is-bitcoin-ready-for-the-moon-patterns-and-metrics-all-point-to/