Bitcoin [BTC] may be on the brink of a critical turning point, with recent market signals suggesting a potential shift in momentum.

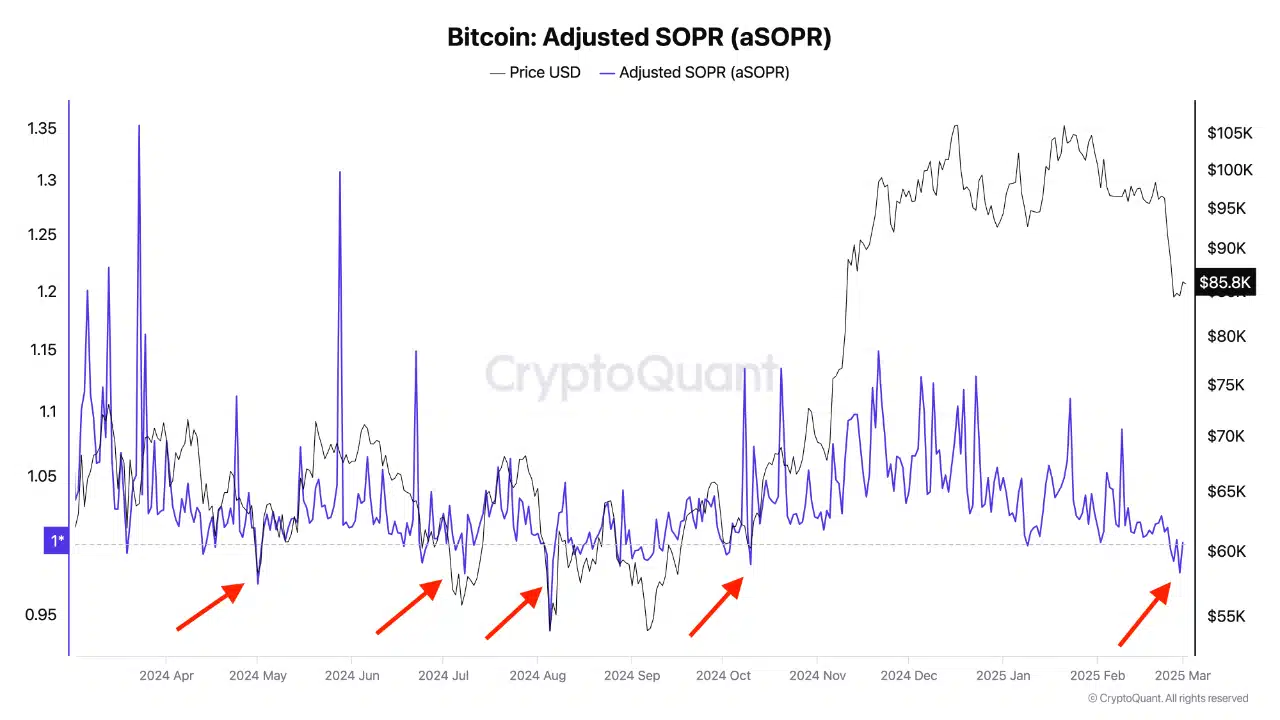

The Adjusted Spent Output Profit Ratio (aSOPR) has remained persistently below 1, signaling that many investors are selling at a loss — an indicator often linked to market capitulation.

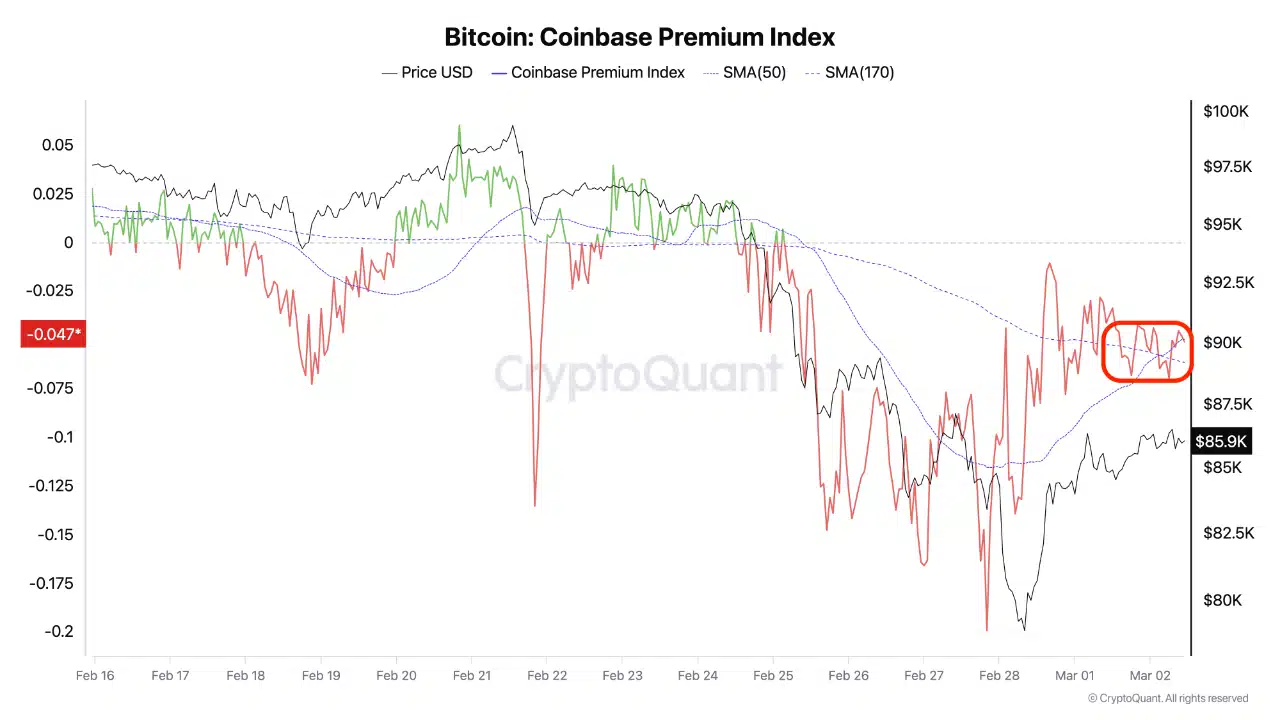

At the same time, the Coinbase Premium Index is showing signs of recovery, pointing to a potential easing of selling pressure despite recent outflows and typical weekend slowdowns.

Is Bitcoin nearing a market bottom, or is there more volatility ahead?

aSOPR and market bottom signals

aSOPR measures whether Bitcoin investors are selling at a profit or a loss. A reading below 1 indicates that the average seller is exiting at a loss, often aligning with capitulation phases and market bottoms.

Historically, when aSOPR dips below 1 for an extended period and then recovers, it has signaled a shift in trend.

Source: CryptoQuant

In the chart, red arrows highlight previous instances where aSOPR fell below 1, aligning with local price bottoms before Bitcoin rebounded.

The most recent drop in early 2025 suggests a similar pattern, raising the question whether Bitcoin is nearing another turning point.

If selling pressure eases and demand strengthens, history may repeat with another recovery.

Source: https://ambcrypto.com/is-bitcoin-price-bottom-in-asopr-suggests-btc-is-about-to/