- The flight to safety benefits gold over Bitcoin.

- Gold prices reach record highs amid uncertainty.

- Bitcoin ETFs face declining speculative interest.

JPMorgan Chase reports investors favoring gold over Bitcoin amid economic uncertainty, with gold prices hitting record highs, per The Block on April 17, 2025. This trend highlights investor preference for traditional havens, impacting Bitcoin futures and ETF market flows.

Anthony Pompliano of Professional Capital Management states, “Bitcoin’s returns will eventually surpass gold, historically proving resilient.” However, the investor community remains divided on Bitcoin’s short-term performance.

Investors Favor Gold with Record Price Highs

JPMorgan Chase’s analyst team led by Nikolaos Panigirtzoglou reported a surge in gold investments due to economic uncertainty. While gold ETFs see inflows, Bitcoin faces outflows, according to their findings. With gold prices reaching record highs, Bitcoin futures’ speculative interest has decreased significantly. This divergence points to a sharper investor preference for gold amid current macroeconomic challenges.

The Coincu research team emphasizes Bitcoin’s inherent volatility and high existing allocation in portfolios, limiting its safe-haven appeal during risk-averse climates. Historically, gold remains a preferred hedge, aligning with present investor trends.

The sharp rise in gold prices highlights a stronger investor appetite for traditional safe havens. – Nikolaos Panigirtzoglou, Managing Director, JPMorgan Chase

Bitcoin’s Market Cap and Price Falling Amid Economic Challenges

Did you know? Traditionally, gold’s safe-haven status supersedes Bitcoin. Past economic turmoil has shown gold’s robust rally compared to Bitcoin’s fluctuating responses.

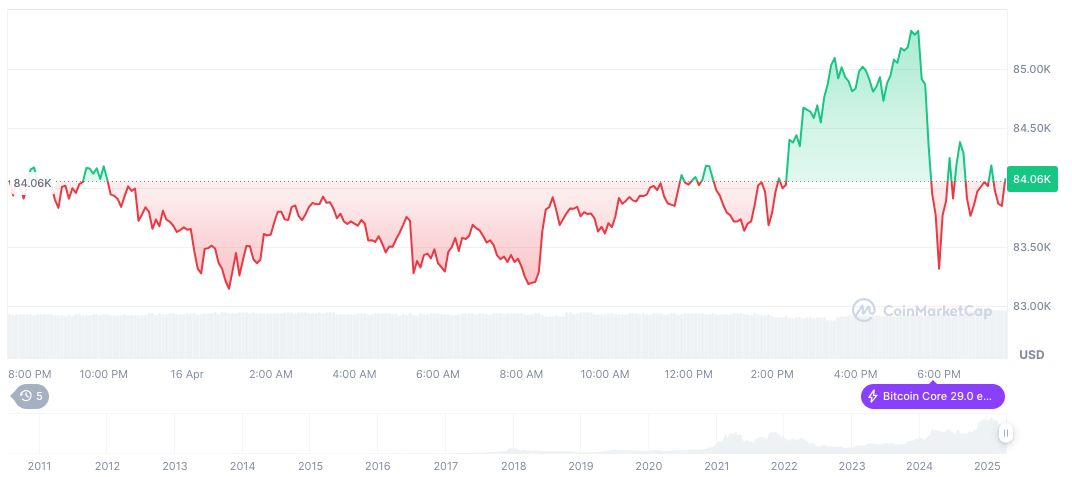

As of April 17, 2025, Bitcoin (BTC) is priced at $84,434.29, with a market cap of $1.68 trillion and a 63% market dominance. Recent trading volumes decreased by 6.89%. Over the past three months, Bitcoin’s price fell 17.46%, per CoinMarketCap.

However, the investor community remains divided on Bitcoin’s short-term performance.

Source: https://coincu.com/332713-economic-uncertainty-gold-vs-bitcoin/