Standard Chartered suggests that institutional inflows could double Bitcoin price by the end of 2025, with altcoins only benefiting mildly from the rally.

Geoff Kendrick, the company’s global head of digital asset research, conveyed this perspective in a recent statement. Kendrick asserted that consistent inflows from Bitcoin and Ethereum ETFs would support their expected price ascent throughout this year.

For Ethereum, Standard Chartered has projected unprecedented heights at $10,000 by year-end.

Notably, Kendrick predicts that institutional capital, particularly from long-only funds like pension funds, will surpass 2024 levels. However, while altcoins could see some capital flow in 2025, Kendrick believes the dominant focus on Bitcoin and Ethereum will limit their potential.

“The market will see an altcoin light season,” he explained, suggesting that institutional interest will temper the usual intensity of altcoin rallies.

Interestingly, this perspective aligns with that of Ki Young Ju, founder of CryptoQuant, regarding the much-anticipated altcoin season. Young Ju noted that institutional investors and ETFs are driving demand this cycle, unlike previous retail-driven cycles.

These institutions typically do not rotate their Bitcoin holdings into altcoins, which affects liquidity and hinders altcoin growth.

Potential for an Altcoin Revival Amid Institutional Influence

Despite the expected dominance of Bitcoin, analysts believe that the recent launch of the TRUMP meme coin could spark a new wave of interest in altcoins. Specifically, QCP Capital analysts have pointed to the dramatic surge in the TRUMP meme coin’s popularity as a sign of a shift in the crypto market.

“The speed at which TRUMP surged signals a paradigm shift in capital formation as crypto assets become increasingly mainstream,” they noted.

For context, the TRUMP meme coin attracted nearly 930,000 new traders in its first four days. It saw new trader activity peak at 42,208 per hour on January 18. This coincided with the coin’s extreme price volatility, which spiked 43,759% to $80 on January 18 before crashing to $30 amid a sell-off.

This surge could catalyze an altcoin season, though it may be more subdued compared to previous cycles due to the ongoing institutional focus on Bitcoin and Ethereum.

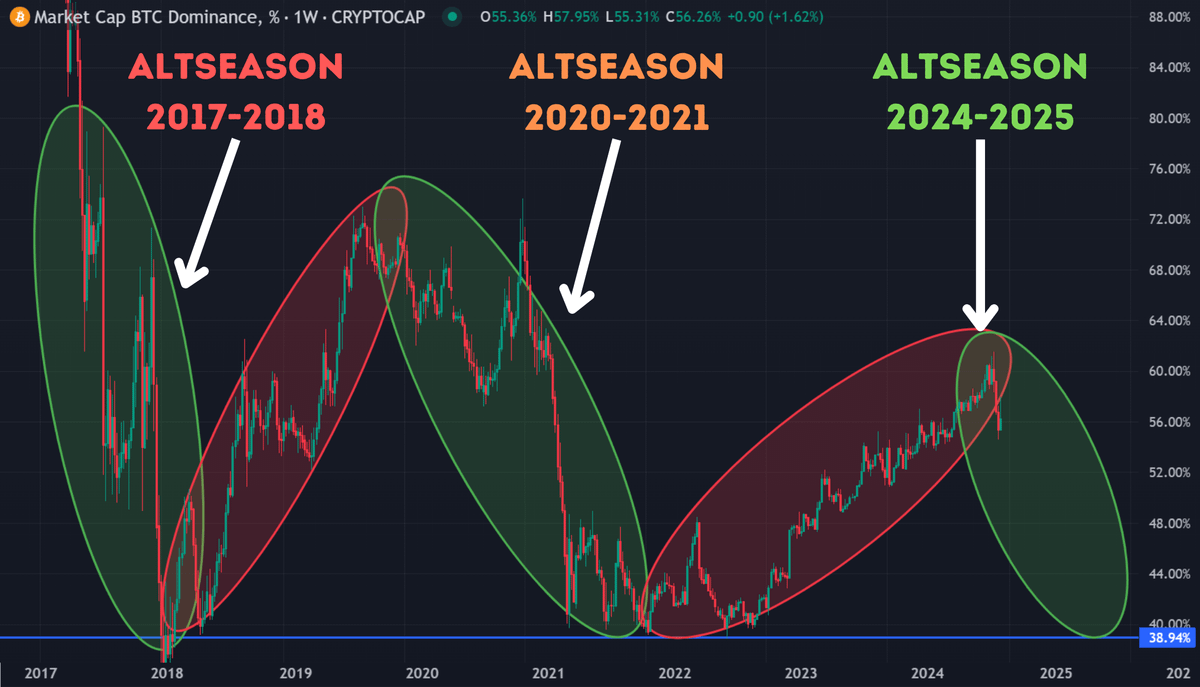

Altcoin Season Potential with Bitcoin Dominance Drop

Nonetheless, independent market analysts believe the ongoing cycle is mirroring historical trends. As a result, they still project that a full-blown altcoin season will emerge once Bitcoin’s dominance drops. However, this is taking longer than anticipated.

Bitcoin’s dominance stands at 58.9% at press time, up 2.3% over the past week and month. According to the CoinMarketCap Altcoin Season Index, it is at 45, suggesting that Bitcoin still outperforms most top-ranking altcoins.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2025/01/23/institutional-inflows-could-push-bitcoin-to-200k-while-altcoins-lag-standard-chartered/?utm_source=rss&utm_medium=rss&utm_campaign=institutional-inflows-could-push-bitcoin-to-200k-while-altcoins-lag-standard-chartered