In Brief

- Binance sees $1.96M average BTC spot order size, indicating increased whale participation.

- Large holders now control 68.6% of BTC supply, despite recent profit-taking actions.

- Retail volume drops to 0.48%, showing rising institutional dominance in Bitcoin trading.

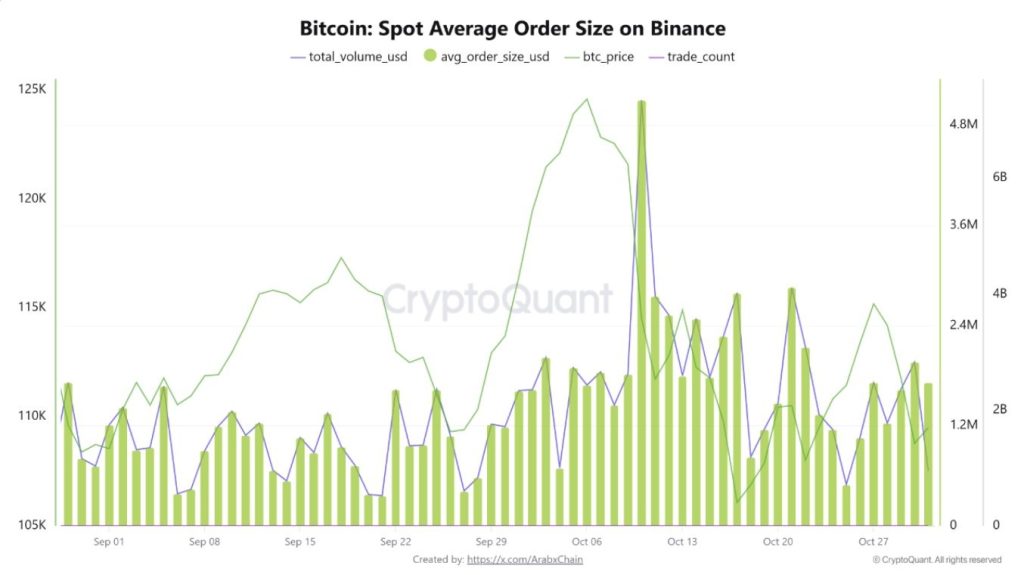

Bitcoin spot trading on Binance has seen a sharp increase in both total volume and average order size since September. The average spot order size surged to $1.96 million, while total daily volume peaked above $4.8 billion around October 10–12.

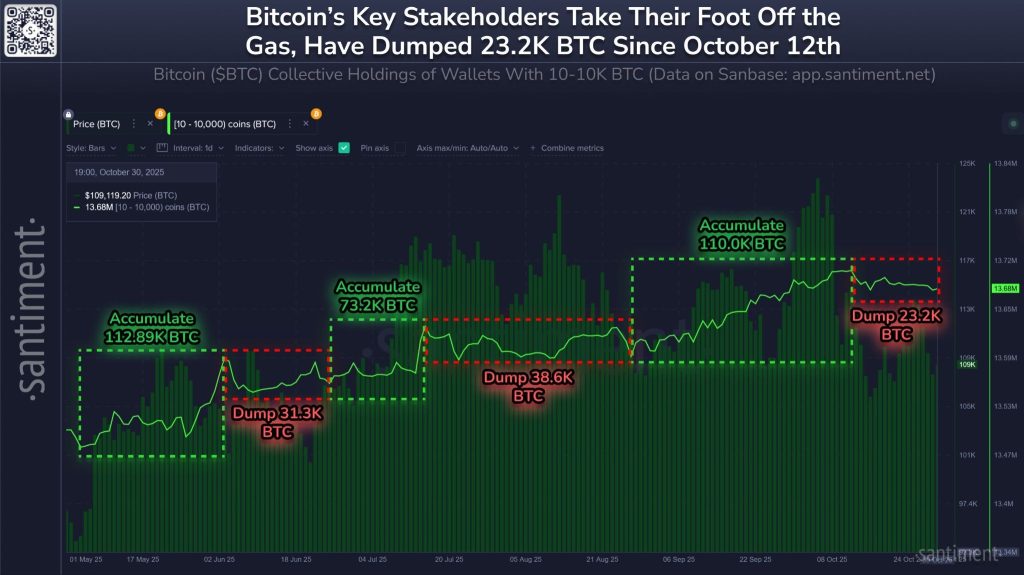

This trend coincides with sustained accumulation by large holders, indicating renewed interest from institutional and professional traders. Between August 22 and October 12, wallets holding 10 to 10,000 BTC accumulated approximately 110,000 BTC.

Although large holders control 68.6% of the circulating supply, they have reduced holdings by 23,200 BTC since October 12. This suggests profit-taking activity, yet the overall share held by whales remains historically high.

Meanwhile, CryptoQuant data shows the Coinbase Premium Gap dropped to –$80, implying stronger selling pressure from U.S.-based investors. As a result, Bitcoin’s price fell from $116,000 to $110,000 over the past week.

The negative premium highlights waning demand from U.S. institutions, despite broader accumulation elsewhere. This shift could explain the short-term slowdown in price momentum following the early October surge.

Retail Participation Declines as Market Matures

The structure of the Bitcoin market continues to evolve as retail activity steadily declines in proportion to total trading volume. Retail share in transaction volume dropped from 1.8% in 2021 to just 0.48% currently.

At the same time, daily retail transaction value stabilized at $108 million, well below historical peaks of $132–$150 million. Though transaction count remains near 700,000 per day, the average size has decreased significantly.

This trend confirms a more cautious approach among small investors compared to previous cycles marked by speculative trading behavior. The decline in average order size among retail users supports this view.

Larger entities increasingly dominate the market, shifting control away from retail participants toward institutions and long-term holders. This transition reflects a maturing market with more strategic accumulation patterns.

Overall, rising whale activity and declining retail influence point to stronger institutional control and changing market dynamics in Bitcoin.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/institutional-buyers-are-back-can-bitcoin/