Notable industry leaders have noted that Bitcoin is bound to trade above $100,000 by 2025 despite increased tension around the outcome of the November US election.

Amid the growing tension over the short and long-term implications of the November election on Bitcoin, key crypto players have maintained a bullish stance.

According to a CNBC report, notable investors have stated that the largest cryptocurrency by market cap would hit six figures regardless of the outcome of the November US election.

Steve Lubka, the head of private clients and family offices at Swan Bitcoin, told CNBC that he was well assured of Bitcoin’s bullish push to at least $100,000 by 2025. He noted that the impending 42% surge from the asset’s current market price would not be deterred even if Democrat nominee Kamala Harris becomes the next US president.

Lubka asserted that Bitcoin is not an investment vehicle tied to the US but an asset with global recognition and adoption. He noted that the fiscal and monetary policies of the US and other countries influence Bitcoin’s price, not the US election.

James Davies, the co-founder of the Crypto Valley Exchange, shared a similar thought with Lubka, saying that Bitcoin would make waves regardless. He cited a possible struggle among crypto start-ups or a short-term sideways wave but noted that Bitcoin would get along quickly.

Davies noted that the approval and trading of the US Bitcoin spot exchange-traded funds (ETFs) in January has raised the asset’s pedigree beyond a petty currency to a vehicle for institutional adoption. Hence, Bitcoin would trend upward regardless of who the president is.

Six Figures Bitcoin Programmed

Notably, Lubka revealed that he will not entirely overrule a short-term correction if Harris wins. However, a six-figure Bitcoin would emerge in the medium to long term. He sees an immediate Bitcoin pump if Trump wins and maybe a slight market panic if Harris wins.

Furthermore, the Swan Bitcoin investment executive noted that Harris’ possible negative impact on cryptocurrency has been hyperbolic, and he feels the vice president would outperform Joe Biden in handling digital assets.

In an earlier report, The Crypto Basic highlighted Harris’ attempt to fraternize with the crypto industry through consultancy and acceptance of several assets as donations.

Meanwhile, Tonwallet’s chief strategy officer, Daniel Cawrey, emphasized that the months leading up to the November election have been good for crypto. Cawrey stated that crypto has been at the forefront of the election, attracting positive attention to the sector.

Bitcoin’s Historical Performance

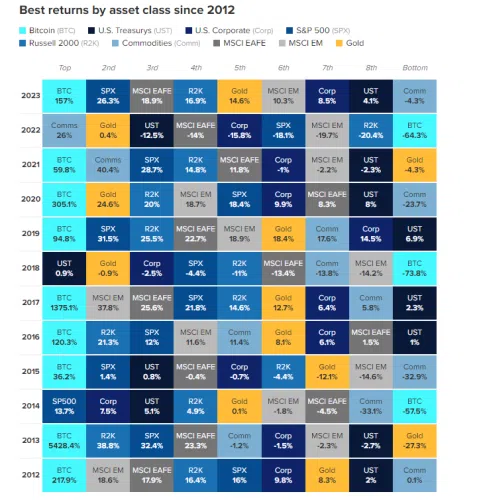

The largest crypto asset has shown its inherent overperforming prowess over time. Data shows that Bitcoin has been the best-performing global asset nine times in the past twelve years.

Bitcoin missed being at the summit in 2014, 2018, and 2022 during its historical bear markets. Hence, the asset has a track record of posting a 9,560% increment in the last 12 years and an average of 796%.

At the time of writing, Bitcoin traded at $58,055, up 2.4% in the past 24 hours.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/09/12/industry-leaders-say-bitcoin-would-hit-six-digits-regardless-of-us-election-outcome-cnbc/?utm_source=rss&utm_medium=rss&utm_campaign=industry-leaders-say-bitcoin-would-hit-six-digits-regardless-of-us-election-outcome-cnbc