- El Salvador receives IMF approval for loan amidst Bitcoin acquisition.

- IMF acknowledges strong economic reforms.

- Loan amount is $120 million, reflecting continued support.

El Salvador has secured approval from the International Monetary Fund (IMF) for the next tranche of its financial program. The nation will receive a $120 million loan as part of its ongoing economic reforms.

The IMF’s decision underscores El Salvador’s commitment to meeting its program goals, despite its controversial purchases of Bitcoin. This approval indicates continued financial support for the country’s initiatives.

IMF Backs El Salvador’s $120 Million Loan Despite Bitcoin Concerns

The IMF confirmed El Salvador’s compliance with loan conditions, noting the country’s effective economic reform implementation, as stated by Luis Cubeddu, IMF Deputy Director. Despite ongoing concerns regarding Bitcoin purchases, the financial assistance plan remains on track.

The $120 million loan will support continued economic reform efforts, even as El Salvador maintains its controversial cryptocurrency strategy. The IMF emphasizes that program targets have been easily met and structural benchmarks are advancing well.

“I advocate for an approach that fosters innovation while ensuring investor protections, which is why I’m looking forward to the dialogues at this roundtable.” – Hester M. Peirce, Commissioner, U.S. Securities and Exchange Commission ChainCatcher

Bitcoin Adoption Fuels Debate on Economic Stability and Reform

Did you know? El Salvador became the first country to adopt Bitcoin as legal tender in 2021, marking a historical shift in national fiscal policy.

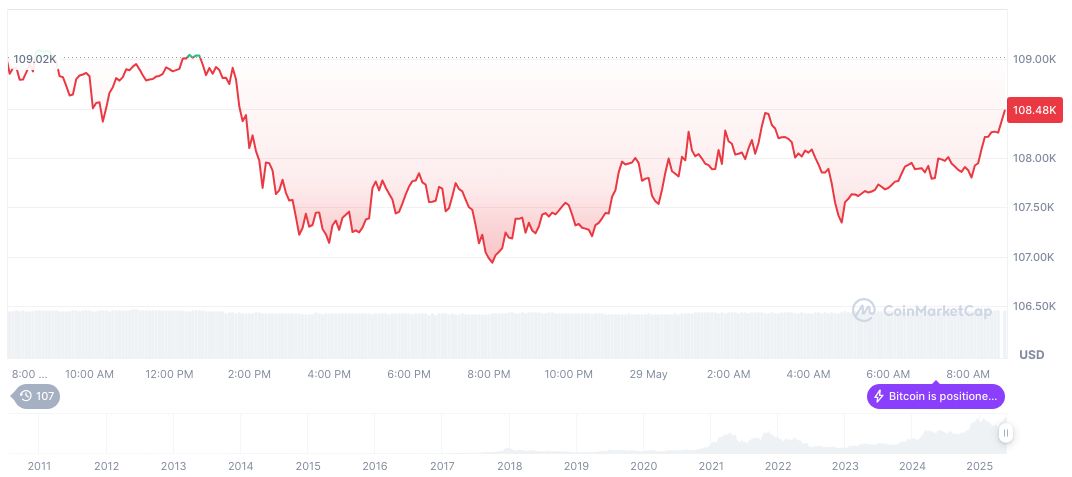

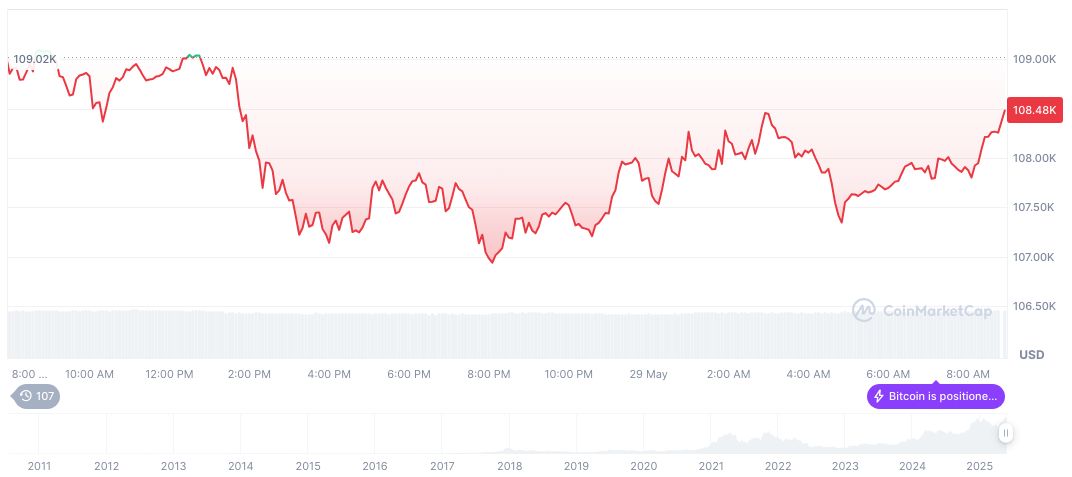

According to CoinMarketCap, Bitcoin (BTC) currently trades at $106,640.40, maintaining a market cap of $2.12 trillion with a 62.75% market dominance. In recent weeks, Bitcoin saw a 4.35% decline over 7 days despite a 29.48% increase over 60 days. These figures illustrate ongoing volatility within cryptocurrency markets.

Coincu’s research team highlights that El Salvador’s persistent acquisition of Bitcoin could face regulatory scrutiny, especially if the cryptocurrency’s volatility impacts national economic stability. Nevertheless, the IMF’s approval suggests room for sustained crypto-innovation within an economic reform framework.

Source: https://coincu.com/340552-imf-el-salvador-loan-bitcoin/