Key Highlights:

- Bitcoin and Ethereum ETFs attract steady additions.

- Solana sees 20 days of consecutive inflows.

- XRP outpaces Solana in cumulative net inflows.

Crypto ETFs are attracting a strong institutional interest, as they see a long-term potential in the digital asset market, even though price keeps varying. In recent months, millions of dollars have accounted for inflow and outflow within the ETF space, indicating investors are becoming selective and strategic.

These products are becoming a go-to investment option for many of the big industry players. The main reason is that the investor can gain exposure to the cryptocurrency without holding on to it. Moreover, investing in a crypto ETF is a safer and more regulated option. These products have become more attractive than gold ETFs in today’s time.

Bitcoin ETF Experiences a Rebound

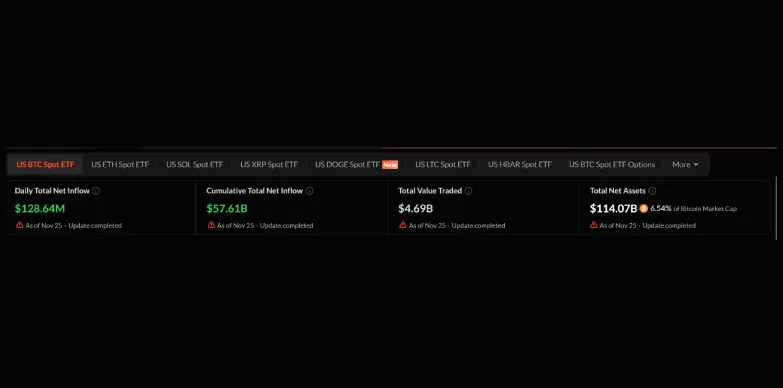

According to SoSoValue, as of November 25, 2025, the Bitcoin Spot ETF managed to gather $128.64M in total inflows, and Fidelity’s Wise Origin Bitcoin Fund (FBTC) led the way by recording $170 million inflows. There were a lot of ups and downs, and Bitcoin ETFs are finally seeing a strong bounce back.

The amounts indicate there is a clear rebound showing institutional investors are finally putting in money, and they are confident about Bitcoin’s long-term potential.

As of November 25, 2025, the net asset value for Bitcoin Spot ETF stands at $114.07 billion, which is 6.54%of Bitcoin Market Cap.

ETH ETF Sees Inflow Despite Low ETH Prices

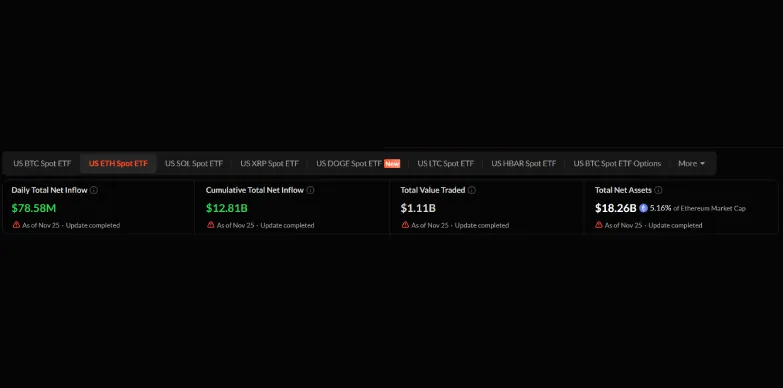

As per SoSoValue data, the Ethereum Spot ETF saw an inflow of $78.58 million on November 25, 2025. Fidelity’s Fidelity® Ethereum Fund (FETH) was leading the way with an inflow of $47.54 million. In the last seven days, the ETH Spot ETF has managed to have a steady inflow of $175.26 million.

The impressive $78.58 million indicates that the investors are continuously adding ETH to their portfolios rather than exiting during volatility. Even though the price of the token has been down by 3.0% in the last seven days, as per CoinGecko, many of the institutions see it as an opportunity to enter or add more ETH at a lower level, instead of buying when the price is high.

As of November 25, 2025, the net asset value for the Ethereum Spot ETF stands at $18.26 billion, which is 5.6% of Ethereum’s Market Cap.

Solana ETFs See 20 Days of Consecutive Inflow

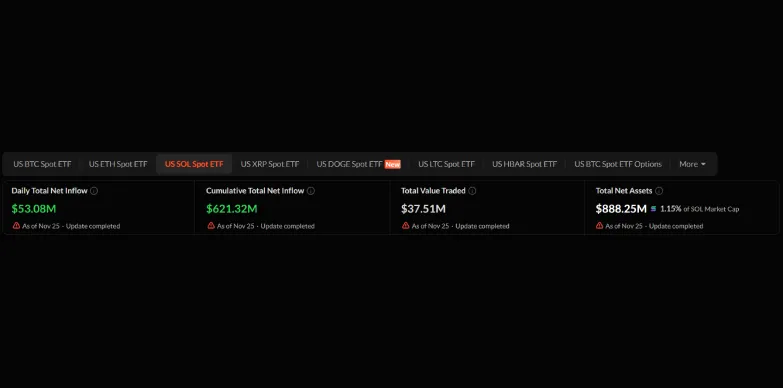

Since its launch on October 28, 2025, Solana Spot ETFs have been making headlines as they recorded 20 consecutive trading days of net inflows. The cumulative net inflow (total amount of money flowed into an ETF since its launch) has been $621.32 million.

As per SoSoValue data, Solana saw an inflow of $53.08 million yesterday, November 25, 2025. The highest inflow since the launch of Bitwise’s BSOL saw was that of $39.5 million on November 24, 2025. These steady inflows indicate that the investors are quietly accumulating Solana for the future.

As of November 25, 2025, the net asset value for Solana Spot ETF stands at $888.25 million which is 1.15% of Solana Market Cap.

XRP Spot ETFs Lead in Cumulative Net Inflows Over Solana

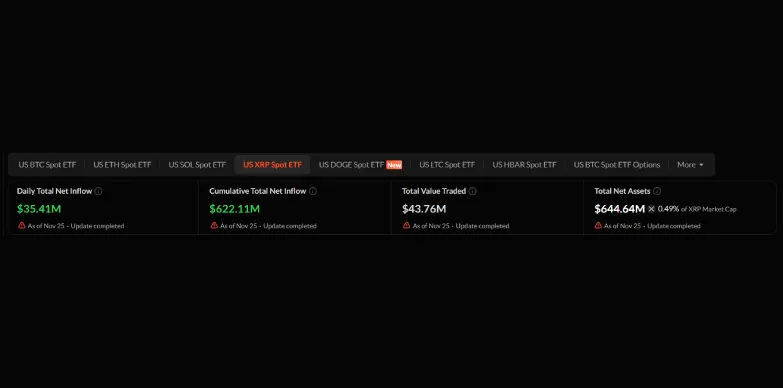

Since the launch of XRP Spot ETFs on November 13, the daily market has recorded steady inflows. As of November 25, 2025, the XRP Spot ETF saw an inflow of $35.41 million. As soon as the ETF product was launched, it managed to bring an inflow of $245 million on November 14, 2025.

The inflows show the community’s interest and support for the blockchain. The cumulative net inflow of the XRP spot ETF has been $622.11M which is more than Solana’s cumulative net inflow.

As of November 25, 2025, the net asset value for XRP Spot ETF stands at $644.64 million, which is 0.49% of XRP Market Cap.

Final Thoughts

With the analysis, Bitcoin remains the first choice for the majority of investors as it is the most established and trusted crypto as of now. Ether is still managing to attract serious interest; however, it can be seen that investors adjust their positions and move their money around, depending on the market sentiment. Solana is becoming a hit since it has only had inflows since its launch, and XRP is also attracting investors who believe in long-term utility, even if the price recently dipped.

Also Read: Metaplanet Cashes In on Bitcoin, Raises $130 Million

Source: https://www.cryptonewsz.com/etf-inflow-analysis-btc-of-eth-sol-xrp/