When most people think of Bitcoin, they think of BTC—the version trading at around $45,000 per coin on exchanges. It’s widely assumed that this BTC is the same Bitcoin renowned in the Bitcoin white paper: a vision of a digital cash system characterized by low-cost, speedy, and efficient transactions. However, the reality, as this article will reveal, is strikingly different.

Since its inception in 2009, Bitcoin’s journey has been tumultuous. Initially hailed as a revolutionary financial and monetary technology, it was poised to disrupt traditional financial institutions and empower individuals with a digital cash system. Yet, as we delve into Bitcoin’s history, a narrative of hijacking unfolds—a story of how BTC, commonly mistaken as the real Bitcoin, has been co-opted by the industries it sought to challenge. This article chronicles how BTC, passing off as Bitcoin, has strayed far from the original path charted in the Bitcoin white paper.

2024 is a pivotal year in the saga of Bitcoin, as one man, Dr. Craig Wright, confronts those who have endeavored to take over the Bitcoin project. His legal battle is not just a fight for recognition that he is Satoshi Nakamoto but a crusade to preserve the foundational vision and mission of Bitcoin. This mission, as Wright asserts, is to facilitate legal, global e-commerce transactions that are swift, cost-effective, reliable, and true to Bitcoin’s original intent. Through this lens, we explore the depths of Bitcoin’s evolution, the forces that have shaped it, and the ongoing struggle to keep its original dream alive.

The Bitcoin white paper was distributed on October 31, 2008, by Satoshi. The Bitcoin protocol was formally initiated on January 3, 2009, by mining the first block, known as the Genesis Block, by Satoshi Nakamoto. This event marked the start of Bitcoin’s operation. Satoshi released the original version of the Bitcoin protocol, Bitcoin 0.1.0, on January 9, 2009. It is essential to point out that no block-size limit was explicitly made in this version. The 1MB limit was introduced later by Satoshi as a temporary measure against spam transactions. He explicitly provided an instruction as to how it could be expanded before the Bitcoin network became congested.

Since the release, Satoshi has sought assistance from developers like Gavin Andresen and engaged in online discussions with other developers. Notably, Satoshi Nakamoto never appeared in person and maintained his privacy. It didn’t take long for people with various interests to start using Bitcoin because they thought it would provide them anonymity.

Wikileaks

On June 15, 2011, Wikileaks, a whistleblowing platform, began accepting BTC donations. On December 5, 2010, Satoshi posted on a forum, expressing the view that the Bitcoin project should grow gradually to strengthen its software. He appealed to WikiLeaks, discouraging them from using Bitcoin at that early stage.

Satoshi characterized Bitcoin as a small beta community in its infancy and cautioned that the potential attention WikiLeaks might attract could be detrimental, as they would not gain more than modest sums of money. Additionally, the increased scrutiny could jeopardize Bitcoin’s development at that early phase.

Why Satoshi left Bitcoin in 2010

In his court testimony in 2019, Dr. Wright explained his decision in 2010 to distance himself from his pseudonym, Satoshi Nakamoto, and Bitcoin. Apart from Wikileaks, he cited the emergence of early Bitcoin users engaging in the funding of terrorism and the creation of darknet markets like Silk Road and Hydra as a significant factor in this decision:

“Silk Road was designed to sell heroin, MDMA, Fentanyl, weapons, et cetera. Martti also started working on a reputation system to allow assassination markets.”

“They started actually working on a system designed to allow people to fund terrorism, and others who were involved, such as Amir, went to Syria to promote the idea of Bitcoin as a funding mechanism. Hydra was worse than Silk Road. The nature of Hydra that Theymos wanted was as a mechanism to have children exchange hard drugs for pornographic photographs. They sought to alter Bitcoin to allow the distribution of encrypted child pornography that would be exchanged in schools for Fentanyl and other such drugs. I stopped mining because of that reason completely in August 2010.”

Dr. Wright then continues to say that he proceeded to remove anything that would link him to being Satoshi, the inventor of Bitcoin:

“At that point, I brought in Dave [Kleiman] because he was a friend, and he knew who I was, and he was a forensic expert, and I wanted to wipe everything I had to do with Bitcoin from the public record. I had money put aside from operations concerning casinos that I was involved with and had a large amount of money overseas, and I spent that buying other assets in Bitcoin to work on fixing the problems that I’d created.”

BTC Core developers take over Bitcoin source code and binaries

Satoshi entrusted Bitcoin to Andresen, granting him access to the Bitcoin repository, which contained the code for the Bitcoin protocol.

Bitcoin Core serves as the implementation of the Bitcoin Protocol used in BTC. Over time, Andresen recruited additional contributors to join those who could contribute to Bitcoin Core development. These individuals became known as Bitcoin Core Developers and were responsible for overseeing the evolution of Bitcoin Core.

Subsequently, control over Bitcoin.org, which was initially overseen by Satoshi, transitioned to other members of the Bitcoin community. Andresen was eventually locked out of the Bitcoin repository after an event where he expressed belief after meeting Dr. Wright in person that he is the inventor of Bitcoin, Satoshi Nakamoto.

The Bitcoin repository underwent a significant shift in its hosting platform, moving from SourceForge to GitHub. During this transition, the copyright designation was altered, changing from Satoshi to the Bitcoin Core Developers. It’s important to note that this change occurred without any payments made to Satoshi, nor was there ever an explicit permission granted by Satoshi for the Bitcoin Core Developers to take over ownership over the Bitcoin project.

If we check Satoshi’s last forum post, there’s a link showing where he released the Bitcoin source code and binaries.

When we go to that link, we can indeed confirm that the Bitcoin files had been relocated at least on or before June 5, 2015.

The campaign for anonymity and small blocks begins

Around 2013, a mysterious individual named John Dillon emerged on Bitcoin forums. He engaged in private communications with Bitcoin developers. A forum post by Peter Todd, the Bitcoin Developer who had contact with Dillon, shared that the latter wrote he works for an intelligence agency and held a high position but wanted to remain anonymous.

One of Dillon’s primary advocacies was limiting the block size to 1MB. He demonstrated his commitment to this cause by offering financial support to Bitcoin Developer Peter Todd to create a video titled “Why the block size limit keeps Bitcoin free and decentralized.” This video was subsequently published on YouTube on May 17, 2013.

It’s worth examining the purpose behind this video because even a decade later, individuals who advocate for Bitcoin to maintain a small 1MB block size continue to present similar arguments.

Starting at the 50-second mark in the video, it acknowledges that when the block size is small, transaction fees will become more expensive. The most logical thing to do is to increase the block size of Bitcoin. However, the narrator says that if we did that, the miners who process transactions would need to become bigger, making it more difficult for them to operate anonymously.

“Mining pools will be forced to close due to rising costs of regulations. What’s left would be large, powerful, regulated pools, controlling what transactions happen at all.”

The underlying rationale behind this argument is that larger blocks could lead to larger miners, which, in turn, might attract regulatory attention. While the video portrays this as a negative outcome, it’s important to note that regulation often aims to prevent significant corporations from abusing their power. Dillon’s focus appears to be on preserving transaction anonymity rather than reducing transaction costs.

In response to this argument, Dr. Wright (Satoshi Nakamoto) clarified he designed Bitcoin to have large blocks processed by mining operations that could not maintain anonymity. The importance lies in ensuring that miners are identifiable so that legal action can be taken against them in case of cheating or malicious attacks on the system. Governments and courts can seize their assets and shut them down if they fail to comply. This system ensures that miners remain honest and protect their substantial capital investments required to set up their mining operations.1

Dr. Wright believes that anonymity is an environment where crime and evil thrive. In his article titled, ‘The false lure of anonymity‘2, Dr. Wright wrote:

“An anonymous system will never be scaled to the world. At best, an anonymous system forms a methodology for black markets and illicit and illegal trade. I was never interested in creating a dark-web money. Bitcoin needed to be private and yet easy to stop or control such that illegal and illicit activity could be stopped at scale…

“Bitcoin was designed to ensure privacy and utterly destroy anonymity. It is an important distinction. Anonymity is the realm of cowards and those without courage. It is utterly different to privacy. Private transactions involve individuals and leave traceable records. People can engage in private communications, and yet have no other party know who they are; different to anonymous transactions, each party in a private communication can trace the other one.”

In a series of interviews, Dr. Wright mentioned that before he stopped posting as Satoshi in 2010, he engaged in discussions with individuals like Eric Vorhees (of Shapeshift), who wanted a coin impervious to government interference. However, Bitcoin’s chain of digital signatures posed a challenge as it allowed transactions to be traced back to an identity3. Dr. Wright believes this was the real reason why BTC developers implemented Segregated Witness (SegWit) in 2017, separating digital signatures from the main transaction layer. With SegWit and the Lightning Network, they aim to add layers of obfuscation to enable anonymous transactions.

We have discussed how the BTC Developers removed digital signatures from the base transaction layer in a previous article4. The problem in 2017 was figuring out how to scale Bitcoin. After SegWit’s implementation which was sold to the network users as a scaling solution, Bitcoin could still barely process beyond seven transactions per second. So, the only thing that does make sense is that the people behind the development of BTC are working towards making BTC more anonymous.

The narrative that Bitcoin is not for small transactions begin

Starting from 1:23 in the video funded by Dillon and produced by BTC developer Todd, the video says, “we have an alternative to increasing the block size—off-chain transaction. You’ll still use the blockchain for large transactions, but small exchanges will be handled by payment processors, which means small purchases like your morning coffee don’t clog the whole system.”

The same narrative is echoed loudly by Small Blockers like Samson Mow, a former Chief Strategy Officer at a company called Blockstream, who said in 2016, “Bitcoin isn’t for people that live on less than $2 a day.”

Let’s clarify the terms “on-chain” and “off-chain” transactions. On-chain transactions are those conducted and recorded on the Bitcoin Blockchain. Conversely, off-chain transactions imply that transactions will NOT occur on the Bitcoin blockchain. However, this concept raises a critical question: does this approach align with the original vision of Bitcoin?

Referring to the Bitcoin white paper, Satoshi defined the purpose Bitcoin:

Clearly, the inventor of Bitcoin envisioned it to enable people to engage in small, casual transactions akin to purchasing a cup of coffee. Interestingly, the propaganda video produced by small blocker Peter Todd suggests that such small transactions should not take place on the Blockchain.

It is of interest to note that, as early as 2013, some people were already trying to make Bitcoin anonymous and were trying to subvert its mission of being able to facilitate commerce for the internet and small casual transactions.

The corruptibility of Bitcoin developers

Who is John Dillon? Is it true that he is from the Central Intelligence Agency (CIA)? Why would he be prioritizing anonymity, though? From what we see about Todd’s information about Dillon, the latter did not say he was operating under the authority of any intelligence agency. It is possible that he presented himself as having connections to the CIA to pique the interest of Bitcoin Core Developers and make them more receptive to his requests.

It is also plausible that Dillon represented the interest of organized criminals who first started using Bitcoin for illegal drugs, weapons, counterfeit goods, and human trafficking because they thought Bitcoin allowed them to be anonymous. They have the motivation to change Bitcoin to make it more useful for crime. After all, law enforcement closed the Silk Road website in 2013 using the data from the blockchain to track the movement of Bitcoin between Silk Road users and identify the website’s operators. Perhaps then, Dillon represented criminals who wanted to use Bitcoin for crime. This aligns with the desire to convert Bitcoin into an anonymous cash system.

One significant development associated with Dillon is the implementation of the Replace-By-Fee (RBF) feature in the Bitcoin Core protocol.

Here is Todd announcing that someone wanted to implement RBF for a reward.

Here is John Dillon saying that he paid Peter Todd to have it implemented.

In the simplest terms, RBF is a feature that allows a sender of Bitcoin to replace an already sent transaction with a new one that includes a higher fee. This is useful if the original transaction takes too long to get confirmed because the fee offered to the miner was too low and the block size is artificially small. Increasing the fee makes the new transaction more likely to be picked up and processed by miners faster. As a consumer, I consider this too ridiculous even to consider.

Can you imagine if Visa (NASDAQ: V) or Mastercard (NASDAQ: MA) asked you to negotiate your processing fee for most transactions you do daily? That is tiresome! Instead of miners competing to keep transaction costs down for their users, this feature makes consumers compete by bidding higher transaction fees. Further, RBF is again trying to solve a problem that would not exist if the block size were enlarged so that transactions would not get stuck, waiting to get processed in the first place.

Setting aside the merits and drawbacks of RBF, it’s crucial to highlight that an unverified individual settled such a contentious and significant issue by paying a Bitcoin Developer $500 to implement the feature, regardless of the needs of Bitcoin users. This sum seems modest for altering a system designed to serve as a global cash system. The fact that an anonymous person on an online forum could sway Bitcoin’s trajectory is alarming. It opens the possibility of Bitcoin Developers being susceptible to corruption.

The Bitcoin Developers are entrusted as the primary guardians of the Bitcoin protocol, expected to shield it from harmful changes. Ideally, determining what is detrimental to Bitcoin should be guided by the Bitcoin white paper and Satoshi’s writings, where the inventor writes about Bitcoin’s mission and guiding principles. This should raise significant concerns now that we know the susceptibility of Bitcoin developers to accepting relatively small bribes. If developers were receptive to a $500 offer from an anonymous person to modify the Bitcoin protocol, imagine the influence that wealthy individuals and corporations could exert with substantially more significant sums of money!

Conflict of interest in BTC magnified

Let’s fast forward over the years and see how wealthy and powerful companies have now come to dominate and control the BTC ecosystem by looking at the money they have invested in the BTC Core Developers through a chain of companies.

It is essential to understand what the chart tells us so that we can gain insights into the mix of influence, power, and motivations that are at play in BTC.

- The Bitcoin Genesis Block was established in 2009.

- By 2013, Bitcoin Core, the protocol used in BTC, was managed by the Bitcoin Core Developers.

- In 2014, some Bitcoin Core Developers founded Blockstream. The original members included Adam Back, Wladimir Van der Laan, Pieter Wuille, Greg Maxwell, and Austin Hill.

- SegWit was implemented in the Bitcoin Core Protocol in 2017. But it is imperative to know, that SegWit was already proposed in 2015 as the GitHub commit of SegWit shows below

- In 2017, the Big Blockers, among them Dr. Wright, saved the legacy Bitcoin protocol from being altered by SegWit forever by working with it under a different name called Bitcoin Cash. After having saved the legacy Bitcoin protocol from SegWit, some Big Block developers wanted to make further protocol changes, one of which was called CTOR, which tried to reorganize the order of transactions. Again, for the second time, there was a group of people led by Dr. Wright who saved the legacy Bitcoin protocol from being altered forever to a change they deemed had no basis in the Bitcoin white paper nor from the writings of Satoshi. Having avoided SegWit and changes like CTOR, the legacy Bitcoin protocol continued under a new name: Bitcoin Satoshi Vision, with its ticker symbol: BSV.

- Since 2018, Dr. Wright, along with allies like Calvin Ayre and Stefan Matthews, worked with likeminded individuals and companies to have Bitcoin Satoshi Vision restore the Bitcoin protocol on which it runs to as close as they could to the original version, Bitcoin 0.1.0, released by Satoshi, the one without the block size limit. It is also paramount to mention that, at this stage, the Bitcoin Core Developers removed OPCODES from the BTC protocol. This prevented Bitcoin from being able to perform smart contracts, which are self-executing agreements that run on a blockchain. Without this, Vitalik Buterin felt that he needed to start another blockchain — Ethereum — to be able to provide smart contract solutions. The BSV developers restored the OPCODES, and today, the BSV blockchain can perform a variety of tasks, including smart contracts that can automate various tasks, such as escrow payments, voting mechanisms, and token issuance.

- Early investors in Blockstream included:

- Major tech companies like Microsoft (NASDAQ: MSFT), PayPal (NASDAQ: PYPL), LinkedIn, Facebook (NASDAQ: META), Apple (NASDAQ: AAPL), and Google (NASDAQ: GOOGL).

- Financial institutions such as AXA (NASDAQ: AXAHY), Tether, and Bitfinex.

- Digital Garage (linked to Jack Dorsey‘s Block and Fidelity).

- MIT Media Labs received funding from Jeffrey Epstein. Given what we know about Epstein, it makes sense that he has an incentive to fund the development of BTC to make it more anonymous.

- Other notable investors include Facebook, Meta, Skype, and Spotify (NASDAQ: SPOT).

- In May 2016, Digital Currency Group (DCG) acquired a majority stake in Blockstream. Confirmation of this can be found on DCG’s website.

- DCG’s portfolio includes:

- Digital currency exchanges like BitFlyer and Coinbase (NASDAQ: COIN).

- Services like BitGo (institutional staking, custody, and trading), BitPay (crypto payments), and Brave browser.

- Financial institutions like Circle (USDC creator), Grayscale (Asset Management), and Kraken (crypto exchange).

- Other notable entities like Ledger (hardware wallet), Lightning Labs (Lightning Network solutions), Ripple (XRP token), Shapeshift (Erik Vorhees), Worldcoin (Sam Altman), and ZCash (anonymous coin).

- Funding for DCG come from entities like:

- iFinex, the owner of Bitfinex and Tether, who was accused of inflating the market with USDT, also contributed to the funding.

- It is backed by companies like Mastercard as this confirms:

The involvement of these diverse investors suggests that Bitcoin Developers face a ‘Conflict of Interest.’ Being the stewards of the Bitcoin protocol, the influx of millions of dollars from sources with varying agendas could potentially compromise their objectivity. Many investor companies benefit from maintaining the status quo. For example, Bitcoin’s potential to disrupt Mastercard and American Express’ (NASDAQ: AXP) profits could incentivize these companies to prevent Bitcoin from becoming an effective payment system. The DCG also owns and invests in companies like Lightning Network and Liquid, which are purportedly necessary to enhance Bitcoin’s transaction capacity.

It becomes abundantly clear that many of these companies, primarily under the same parent company, DCG, have strong incentives and investments in technologies and business models that are not aligned with Bitcoin’s core principles. Their investments in these technologies began as early as 2014. This is why they took measures to ensure the Bitcoin blocks remained small and incapable of handling millions of transactions as Bitcoin should. Keeping the block size small justifies their entire rationale for investing in these technologies. They recognized profit potential, and for that potential to materialize, Bitcoin must appear reliant on these solutions to function adequately.

Blockstream blocks the stream

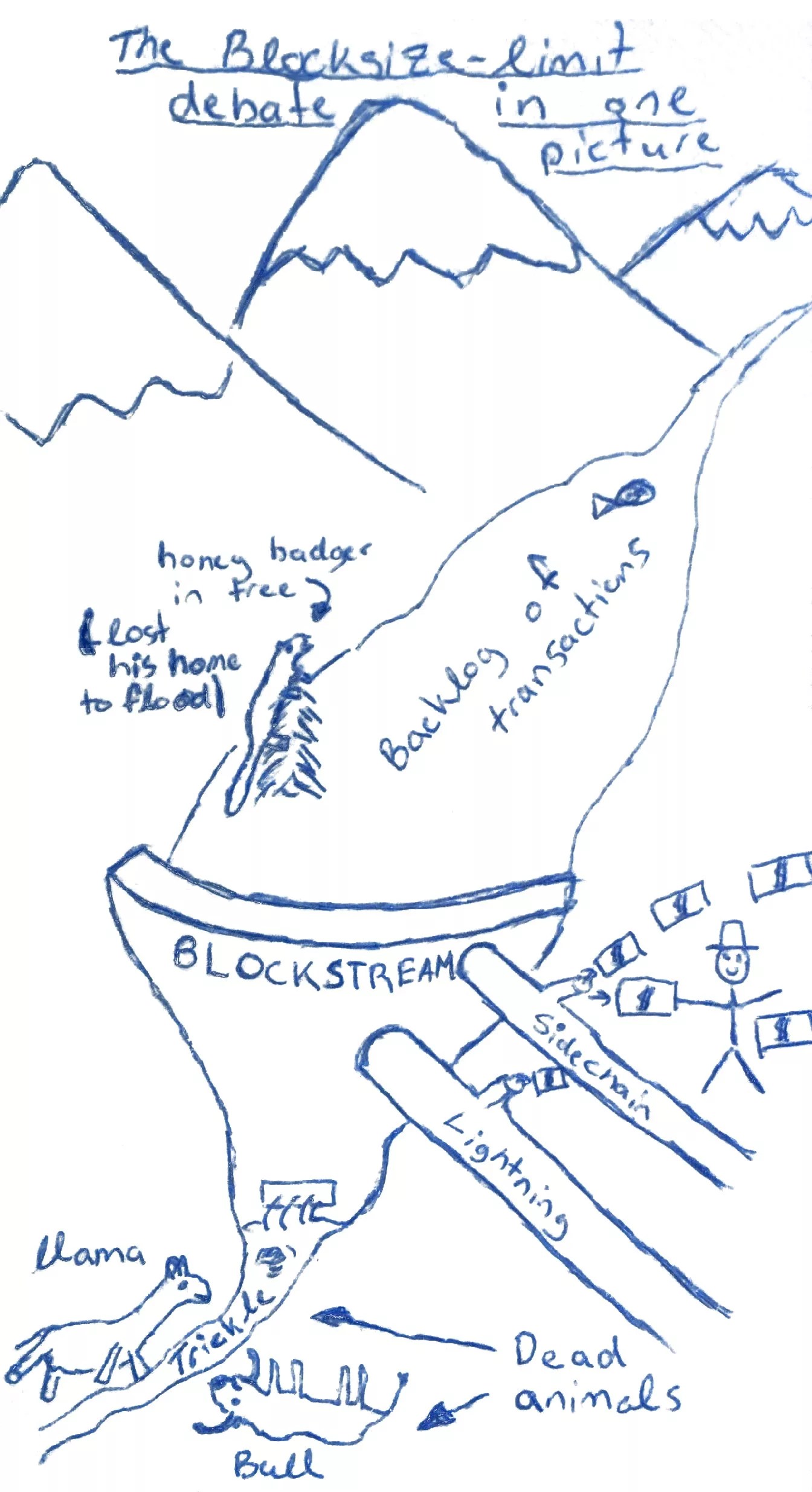

In July 2015, someone posted a picture of a sketch drawn on a paper towel. It was titled, “The Blockstream-Limit Debate: In One Picture“5. I cleaned up the photo for better visibility below:

Considering our discussion on Bitcoin’s history, this simple-looking diagram helps illustrate why BTC has been constrained, effectively preventing it from functioning as Bitcoin. This constraint serves the interests of Small Blockers and those who benefit from limited block sizes, aiming to extract value from users who simply want to use Bitcoin as intended.

To explain the meaning of the drawing:

- The upper part of the diagram represents satoshis, the smallest units of Bitcoin, being transacted, flowing down a river from people worldwide, like water from mountains.

- By maintaining the 1MB block size limit, the BTC Core Developers, Blockstream, and their owners and investors have essentially constructed a dam on the Bitcoin BTC network. This dam severely restricts the flow of transactions or satoshis from passing through the network easily.

- The presence of this dam results in Bitcoin becoming costly to use, causing transactions to slow to a trickle. At the bottom of the dam are animals that have died of thirst. They symbolize many Bitcoin users who suffer from being deprived of Bitcoin’s economic benefits.

- By restricting the size of Bitcoin’s blocks, Blockstream and its investors are knowingly causing congestion. However, they obscure the truth that they are the ones perpetuating this congestion problem. Claiming that Bitcoin is unable to scale, they present alternative blockchain solutions such as the Lightning Network and various ‘sidechain’ or ‘off-chain’ systems. In this diagram, Blockstream and its investors are represented by the figure on the right, profiting significantly at the cost of everyone else’s expense.

Craig Wright (Satoshi Nakamoto) saves Bitcoin and it is named Bitcoin SV

Consistent with what we expect Satoshi to do, Dr. Wright has been a prominent figure in advocating for Big Blocks, aiming to maintain the original vision of Bitcoin. Since 2017, he has spearheaded a coalition of individuals and companies focused on utilizing the legacy Bitcoin blockchain and reverting the protocol to its initial design. This endeavor involved eliminating the block size limit and reinstating the OPCODES removed by BTC developers. Currently, Bitcoin Satoshi Vision (BSV) stands as the sole implementation operating on the original protocol and design of Bitcoin.

Dr. Wright has announced his intention to pursue legal action against those who misused Bitcoin in its BTC phase and continue to promote BTC as if it represents the original Bitcoin. In 2020, Wright authored a blog article titled “Forking and Passing Off“6 in which he discussed this matter:

“As the sole creator of Bitcoin, I own full rights to the Bitcoin registry. People can fork my software and make alternative versions. But, they have no rights to change the protocol using the underlying database. I was explicit when I said so by putting forward reasons not to fork the database. Yet, both Bitcoin Core (Core) and Bitcoin ABC (ABC), global partnerships under law, have sought to use my database without authority. Rather than seeking licences, they have sought to attack my character and impugned me. This year, I am taking charge and control of my system. Those involved with the copied systems that are passing themselves off as Bitcoin, namely BTC or CoreCoin and BCH or BCash, are hereby put on notice.”

Dr. Wright maintains that while forking the Bitcoin software to develop alternative versions is permissible, it should be done under a distinct project name and not as Bitcoin. He argues that the BTC developers and Blockstream, by forking the Bitcoin protocol and continuing to represent it as the original Bitcoin, have strayed from its foundational vision. They have appropriated its blockchain, essentially a record of Bitcoin’s transaction history, treating it as their own creation despite lacking explicit authorization from Satoshi Nakamoto for such use.

COPA: The hijackers of Bitcoin, passing off BTC as Bitcoin

Following Dr. Wright’s assertion of his rights as the alleged creator and inventor of Bitcoin, the Crypto Open Patent Alliance (COPA) was established. COPA aims to forge a union of individuals and corporations, amalgamating resources from powerful and affluent groups. These members advocate for BTC as the legitimate Bitcoin, although some may be unaware that BTC’s evolution contradicts the vision and principles Satoshi Nakamoto outlined in the Bitcoin white paper.

COPA’s roster includes BTC developers who have enacted modifications in alignment with Blockstream, as well as its parent entity, DCG. This network extends to several affiliated companies, such as Kraken (Jessie Powell), Coinbase (Brian Armstrong), OKCoin, Worldcoin (Sam Altman), Meta (previously Facebook), and MicroStrategy (Michael Saylor).

Conclusion

The insights shared in this article illuminate a critical truth: Bitcoin, as represented by BTC today, starkly contrasts with the original vision outlined by Satoshi Nakamoto. This divergence extends beyond technicalities, embodying a departure from the fundamental principles and mission detailed in the Bitcoin white paper. Key to this transformation is the role of BTC developers, who have accepted funding to implement changes that veer BTC away from Satoshi’s blueprint, favoring a direction towards anonymous transactions and higher fees. This shift, influenced by the very industries Bitcoin aimed to disrupt, raises serious questions about its future trajectory.

As the COPA v Wright court case looms in London this February 2024, the direction of Bitcoin’s evolution hangs in the balance. This case is not just a legal battle; it’s a clash of ideologies about Bitcoin’s true essence. My intention in writing this article is to equip readers who care about the direction of Bitcoin with crucial information ahead of this landmark event.

This article seeks to stimulate reflection on the two principal Bitcoin implementations: BTC, characterized by its emphasis on anonymity, high fees, and ongoing modifications to the Bitcoin protocol; and BSV, which aims to maintain Satoshi’s original concept of a practical, affordable global cash system, offering a balance of privacy and accountability on a stable protocol that undergoes minimal changes, providing a solid foundation for future developments. As readers weigh this information, the hope is to inspire a considered evaluation of which version—BTC or BSV—truly embodies what Satoshi Nakamoto, envisioned for Bitcoin, irrespective of the debate over Craig Wright’s identity.

This decision transcends mere technical aspects; it’s about the direction of our economy, property, finance, and money. Should our future be shaped by a select group of wealthy individuals and corporations, making Bitcoin dependent on their products and services for any significant utility, or should it be a Bitcoin that empowers everyone with access to a nearly free, rapid money transfer system, accessible even to the poorest in the world? If you align with the latter, you grasp Satoshi’s Vision for Bitcoin, embodied in the Bitcoin SV (BSV) implementation. This article aims to demonstrate that despite the conflicting narratives about Craig Wright, he is arguably the most fervent advocate for Bitcoin’s original mission and purpose.

***

[1] “Bitcoin: The electronic cash system | Title, Author, Abstract | Theory of Bitcoin: White Paper”, https://youtu.be/vQ6iWJnTd-g?si=vAtXd-54lo-qFokw&t=4123, starts at around: 1:08:43. This belongs to a series of interviews originally recorded between 2019 to 2021, that have been republished by CoinGeek.

[2] “The false lure of anonymity”, https://craigwright.net/blog/bitcoin-blockchain-tech/the-false-lure-of-anonymity/, Feb 12, 2019

[3] “Why aren’t we anarchists? | Section 2: Transactions | Theory of Bitcoin: White Paper”, https://youtu.be/UCpRsEYCmb0?si=nOVFO6ewvqgwya3Y&t=1564 (Republished from an earlier post Jun 13, 2023)

[4] “SegWit, Forks, and COPA: Why BSV blockchain, not BTC, is the true Bitcoin”, by Marquez Comelab, published by CoinGeek on 5 Dec 2023

[5] “Blocking the stream: the blocksize limit debate in one (awful) picture”, published on Imgur.com on 1 July, 2015, https://imgur.com/DF17gFE, last accessed Jan 2, 2024

[6] “Forking and Passing Off…” by Craig Wright, 13 Feb 2020, https://craigwright.net/blog/law-regulation/forking-and-passing-off/ (last accessed 2Jan 2, 2024).

Watch: Bitcoin has become Orwellian but it’s now being restored to the original vision

New to blockchain? Check out CoinGeek’s Blockchain for Beginners section, the ultimate resource guide to learn more about blockchain technology.

Source: https://coingeek.com/how-bitcoin-was-hijacked-the-hidden-shift-from-satoshi-vision/