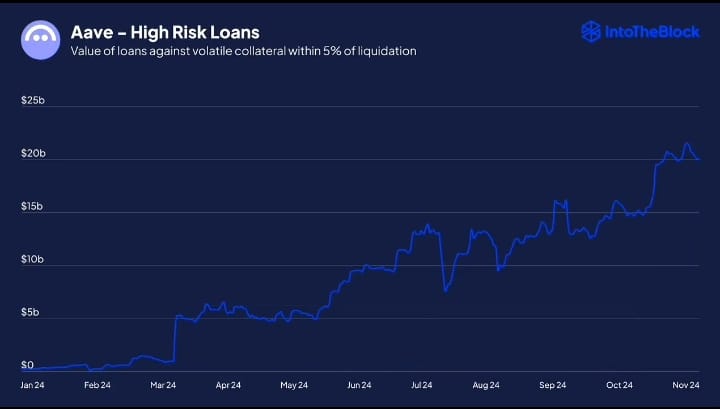

- High-risk DeFi loans surged as market sentiment drove demand for leverage.

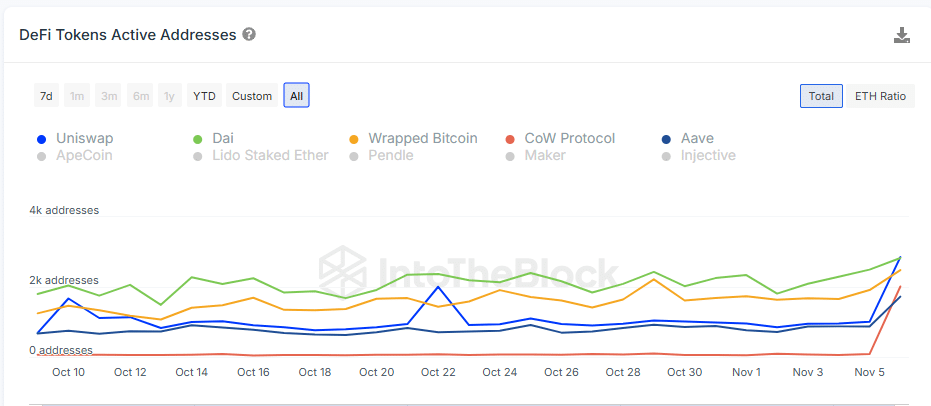

- DeFi tokens active addresses hitting new all-time highs.

High risk loans surged as Bitcoin [BTC] hit new ATH driving demand for leverage. DeFi lending platforms Aave and Moonwell showed a significant uptrend in the value of high-risk loans as per IntoTheBlock, where the collateral was within 5% of being liquidated.

The upward trend suggested an increased appetite for leverage within the crypto market as participants seek higher returns, especially during bullish phases.

Notably, the rise in high-risk loans suggested that similar behaviors were prevalent across other DeFi lending platforms. This meant that broader market sentiment was inclined towards aggressive investment strategies.

Source: IntoTheBlock

However, the recent conclusion of the U.S. elections introduced potential volatility that could affect these leveraged positions adversely.

Large-scale political events often lead to unpredictable market movements, increasing the risk of liquidations for these high-stake loans.

The scenario illustrated the precarious balance DeFi participants navigate between seeking high returns and managing significant risks in an ever-volatile market environment.

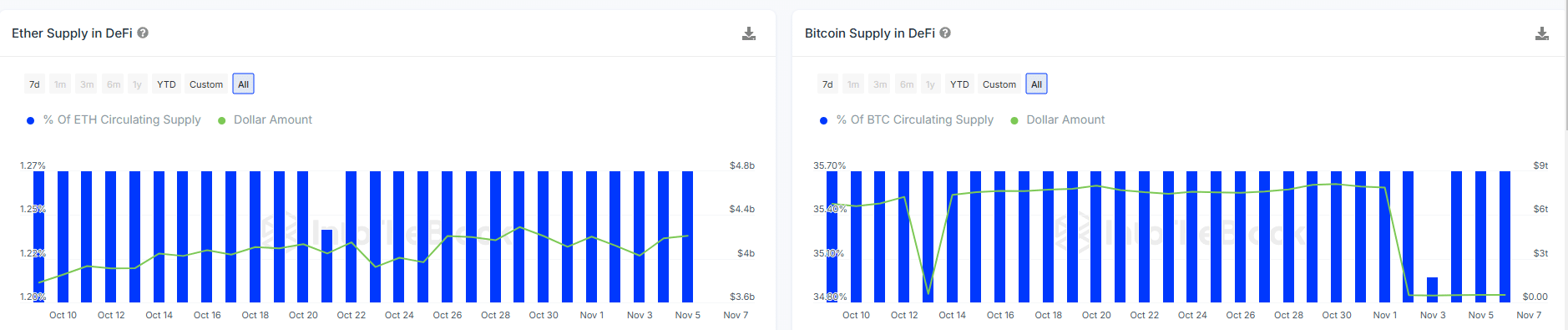

Difference in supply of ETH and BTC in DeFi

Despite slight decrease in total dollar value of Bitcoin in DeFi, it remained substantially higher than that of Ethereum. This suggested a deeper market penetration and higher stake by participants leveraging Bitcoin in DeFi platforms.

This indicated that Bitcoin could be more susceptible to the impacts of high-risk loans, especially as market sentiment pushes demand for leverage.

Source: IntoTheBlock

With Bitcoin’s larger presence in DeFi, any significant market corrections or volatility could lead to more pronounced effects on Bitcoin’s price and stability compared to Ether.

Thus, stakeholders in Bitcoin should stay particularly vigilant about potential market movements that these high-risk financial activities in the DeFi space may drive.

DeFi tokens active addresses at ATH

The chart showed a big rise in active addresses for several DeFi tokens, likely due to more users speculating and seeking high-leverage opportunities in DeFi.

The notable increase in activity, especially with Wrapped Bitcoin (WBTC), highlighted the market’s growing use of leverage and fear of missing out, which could inflate asset prices.

Source: IntoTheBlock

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Historically, increased activity often came before market peaks. A sudden awareness of overpricing or a big economic event could quickly drive down BTC prices.

Investors and traders need to be careful. The current rise in active addresses and leveraging shows higher volatility risk. This could affect Bitcoin’s movements soon and may lead to a local top that could ignite a correction.

Source: https://ambcrypto.com/high-risk-defi-loans-surge-is-bitcoin-ethereum-headed-for-volatility/