Glassnode offers insights into Ethereum and Bitcoin ETF flows for January 2025.

Despite several positives, such as President Donald Trump’s inauguration and the resulting pro-crypto regulatory shifts, January 2025 was a turbulent month for crypto, filled with several wild price swings.

Following the wild ride, prominent crypto analytics platform Glassnode has offered insight into how investors reacted with spot Bitcoin and Ethereum exchange-traded funds (ETF) data for the month.

Bitcoin ETFs

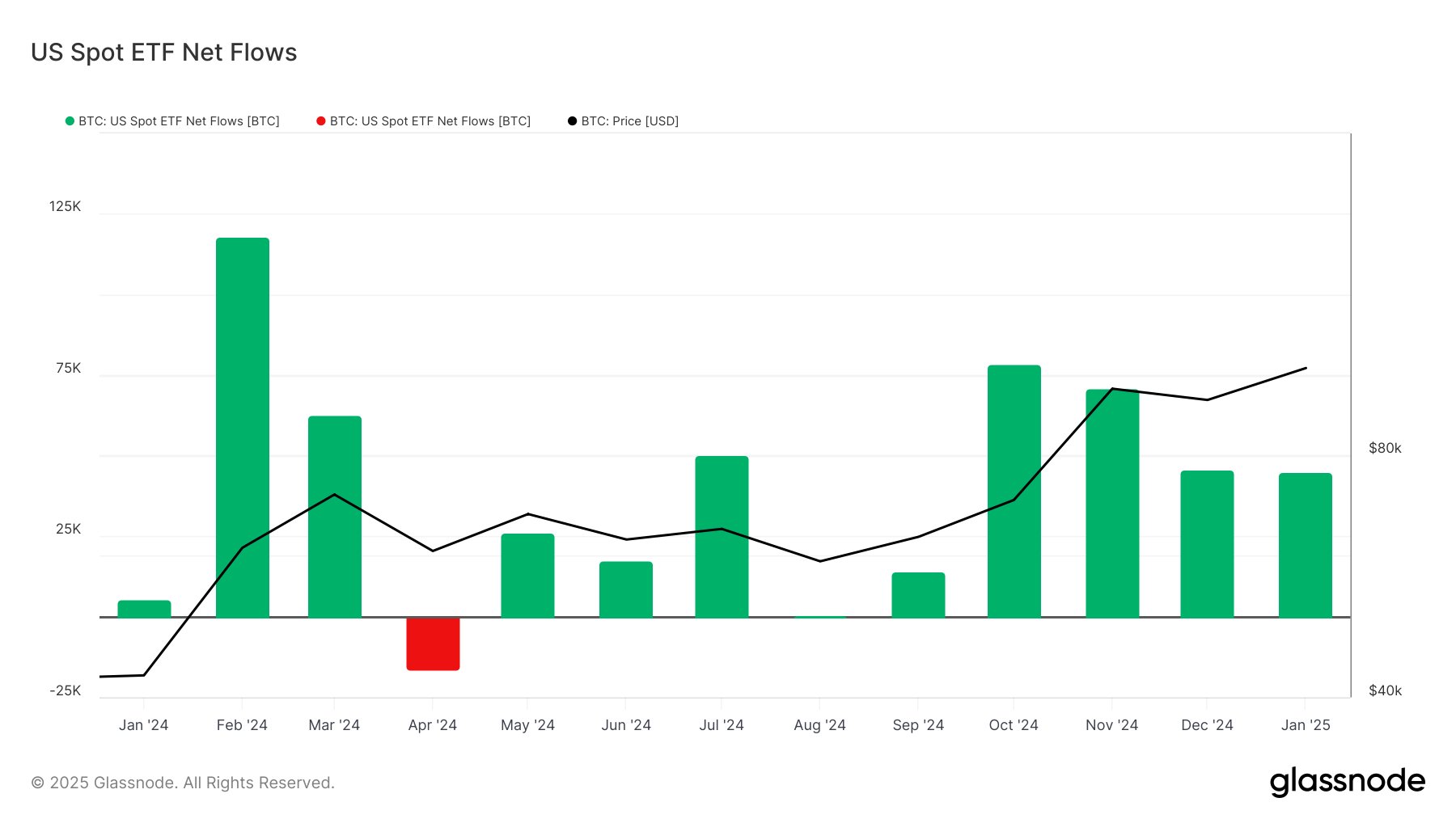

Despite January’s turbulence, there appears to have been no significant shift in Bitcoin investor sentiment, at least according to ETF flows for the month.

Per Glassnode data shared on Monday, February 3, these investment products saw net inflows totaling about 45,100 BTC worth about $4.26 billion at current prices in January 2025, only slightly less than the 45,600 BTC worth roughly $4.3 billion in December 2024.

As highlighted by the firm, BlackRock maintained its record of seeing the most inflows with about 26,100 BTC worth about $2.5 billion, followed by Fidelity with 12,400 BTC worth roughly $1.2 billion. Meanwhile, Grayscale saw outflows totaling 4,000 BTC, about $378 million.

Ethereum ETFs

Unlike their Bitcoin counterparts, interest in Ethereum ETF products took a massive dive in January 2025.

Specifically, net inflows to spot Ethereum ETFs dropped from over 544,000 ETH worth roughly $1.4 billion to below 11,000 ETH worth about $27 million.

The dive followed significant outflows from products issued by Grayscale, Fidelity, and Bitwise. The products issued by these firms saw outflows of 73,000 ETH worth over $187 million, 43,000 ETH worth over $110 million, and 17,000 ETH worth about $43.6 million, respectively.

This wave of outflows was only offset by over 145,000 ETH worth nearly $372 million in inflows recorded by BlackRock.

Meanwhile, the crypto market is off to another rocky start in February 2025 amid Trump’s tariff decision.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2025/02/03/heres-how-ethereum-and-bitcoin-etf-products-fared-in-january-2025/?utm_source=rss&utm_medium=rss&utm_campaign=heres-how-ethereum-and-bitcoin-etf-products-fared-in-january-2025