Bitcoin’s price action failed to attract fresh interest. Instead, it printed a lower low and kept sentiment fragile.

As BTC slipped toward the $86,000 region, on-chain data pointed to weakening momentum and potential downside continuation.

Fear dominated positioning, and further declines remained possible.

Bitcoin has not reached a market bottom

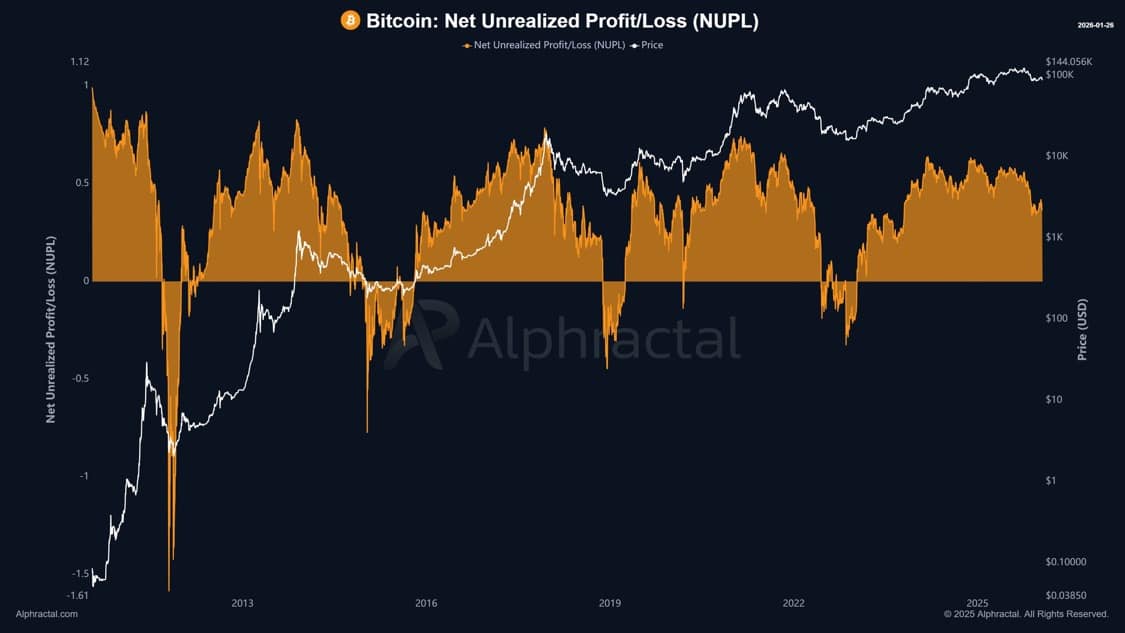

Bitcoin’s [BTC] Net Unrealized Profit/Loss (NUPL) continued to trend lower at press time, indicating that a growing number of investors are panic-selling, either to lock in profits or cut losses.

This behavior aligned with broader sentiment. The Fear and Greed Index stayed in the “fear” zone at 29, based on CoinMarketCap data.

Historically, NUPL tracked cycle structure well when measured against zero.

Source: Alphractal

When NUPL dips into negative territory, it often marks a market bottom—a phase characterized by rising accumulation, a market reset, and the early stages of a rally that expands Bitcoin’s market capitalization.

Over the past five cycles, every move into this negative zone preceded a sharp rebound, each time pushing Bitcoin to fresh price highs.

At press time, NUPL remained positive. That structure suggested downside pressure could persist while the metric trended lower.

Even so, a momentum shift, marked by rising NUPL, could stabilize conditions and support a recovery attempt.

Accumulation builds, but conviction remains uneven

A negative NUPL would likely benefit BTC over the long term, potentially laying the groundwork for a move beyond its $126,000 all-time high. However, investors have yet to fully align behind that scenario.

Despite the uncertain price structure, investors continue to accumulate Bitcoin, signaling that many may view current levels as discounted entry points.

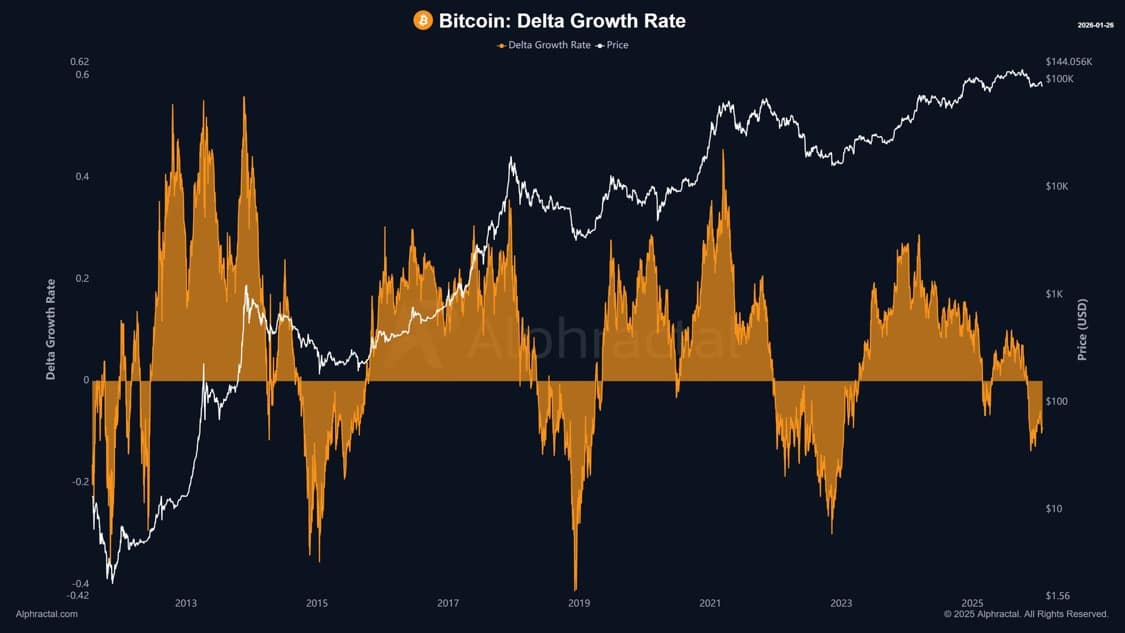

Accumulation still appeared in the Delta Growth Rate, which compared Market Cap against Realized Cap.

The Delta Growth Rate had already turned negative, signaling a shift from speculation toward fundamental accumulation. Historically, this phase reduced capitulation risk unless driven by macro shocks or systemic risk events.

However, Spot demand remained weak.

Source: Alphractal

Centralized exchanges recorded roughly $213 million in net Spot selling over the past week.

By contrast, the week ending the 19th of January saw $943.7 million in Spot buying, which supported price stability during that period.

That shift left BTC dependent on renewed spot inflows to regain upside traction.

Chart structure highlights rebound potential

From a technical perspective, the chart suggested that Bitcoin may attempt a rebound.

BTC has entered a key demand zone, highlighted in blue, which previously acted as a launchpad for rallies on three separate occasions. This zone could once again support higher prices.

However, any recovery is unlikely to be smooth. Bitcoin must first overcome a resistance band between $89,228 and $90,180.

A decisive break above this range could open the door to filling the fair value gap (FVG) between $93,673 and $94,977. Fair value gaps often attract price action, as markets tend to revisit these zones over time.

Despite lingering uncertainty, Bitcoin remains at a pivotal level, where shifts in sentiment, spot demand, or on-chain momentum could define its next major move.

Final Thoughts

- Bitcoin’s NUPL remains above negative territory, which suggests many investors are still selling out of fear rather than accumulating with conviction.

- Stronger spot buying and a rise in NUPL, combined with a move above $90k, could improve market confidence.

Source: https://ambcrypto.com/has-bitcoin-found-a-floor-near-86k-one-btc-indicator-says/