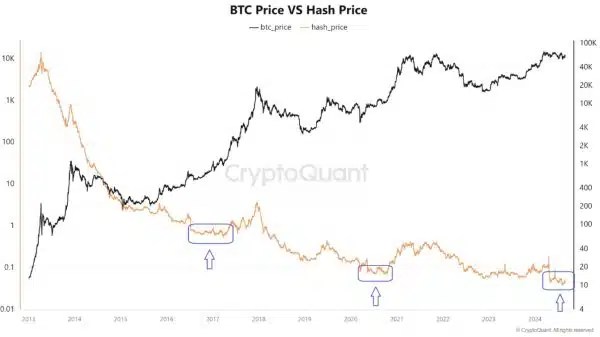

An analysis from CryptoQuant shows that Bitcoin may have bottomed, as its correlation with the hash price indicates.

This may be the last time to buy Bitcoin at a discounted price, as historical data indicates an impending rally. According to an analysis from CryptoQuants, Bitcoin may have or is close to bottoming at the current market price.

The data was based on the historical correlation between Bitcoin’s price and mining hash price. CryptoQuant indicated that the Bitcoin hash price has reached its lowest point, a signal that Bitcoin’s bottom is not far off.

The Bitcoin hash price is the revenue miners generate per-tera hash, or the expected daily worth of 1TH/s of hashing power. This hash price is a function of the Bitcoin’s market value, mining difficulty, block subsidiary, and transaction fees.

Historically, mining profitability has decreased over time. The Bitcoin network was designed to halve mining rewards every four years, thus increasing difficulty and reducing the hash price. Currently, miners only make 3.125 BTC for completing each block of Bitcoin, compared to the 50 BTC they gained in 2009.

A Buy Opportunity

The CryptoQuant analysis showed that Bitcoin’s correlation with the hash price means that investors who acquired Bitcoin on this level may have bought the bottom. Bitcoin is currently trading below $60,000, over 18% away from its all-time high.

Data from the previous bull cycles showed that Bitcon surged considerably on this indicator. In 2017, Bitcoin rallied from under $2,000 to a peak of $19,106 when the hash price bottomed. The same scenario happened late in 2020 when the largest crypto asset surged over 660% from $10,000 to the previous all-time high of $66,953.

If anything close to these scenarios reoccur, Bitcoin may have bottomed at $48,000 for this cycle and could rally past $350,000. This puts into perspective the percentage increment seen from Bitcoin at this level in the previous cycles.

However, veteran analyst Peter Brandt warned of an exponential decay in Bitcoin’s price. As The Crypto Basic earlier reported, he called for caution while Bitcoin continued to range in a triangle pattern.

At press time, Bitcoin trades for $59,524, down less than 1% in the past 24 hours. BTC is also down 2.6% in the past seven days and 10.65% in the past month.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/08/30/has-bitcoin-bottomed-this-analysis-indicates-a-bitcoin-buy-opportunity/?utm_source=rss&utm_medium=rss&utm_campaign=has-bitcoin-bottomed-this-analysis-indicates-a-bitcoin-buy-opportunity