- Harvard University massively increases Bitcoin ETF holdings, reaching $442.9 million.

- Bitcoin ETF shares grew by 257.48% this quarter.

- Significant institutional confidence in cryptocurrency investment.

Harvard University significantly expanded its holdings in BlackRock’s iShares Bitcoin Trust, reaching 6.81 million shares by September 30, as disclosed in a recent 13F filing with the SEC.

This increased allocation signals institutional confidence in Bitcoin and aligns with broader trends of endowments investing in cryptocurrency-related assets, potentially impacting market perceptions and liquidity.

Harvard’s Bitcoin ETF Surge: 257% Growth in One Quarter

Harvard University’s increase in IBIT holdings marks a significant shift in its investment strategy. The university now holds 6,813,612 shares, a considerable jump from 1,906,000 shares in the previous quarter. This sharp rise underscores Bitcoin’s strengthening role in institutional portfolios and Harvard is positioning this as its largest equity investment. The endorsement of a Bitcoin ETF by a major endowment signals enhanced interest in digital assets. Harvard’s step mirrors similar strategies by other universities, illustrating a wider institutional embrace of these assets. The lack of direct commentary from Harvard Management Company officials leaves room for speculation, although BlackRock’s CEO Larry Fink has cited Bitcoin’s appeal as a “digital gold” in recent months.

Did you know? In 2019, university endowments first began dabbling in cryptocurrency, although on much smaller scales trying to hedge against traditional market instabilities. The recent large-scale IBIT allocation marks a significant evolution in strategy.

Larry Fink, CEO, BlackRock – “As institutional interest in Bitcoin and digital assets continues to grow, we see the digitalization of gold as a significant opportunity.”

From Small Bets to Major Stakes: Harvard’s Crypto Journey

Did you know? In 2019, university endowments first began dabbling in cryptocurrency, although on much smaller scales trying to hedge against traditional market instabilities. The recent large-scale IBIT allocation marks a significant evolution in strategy.

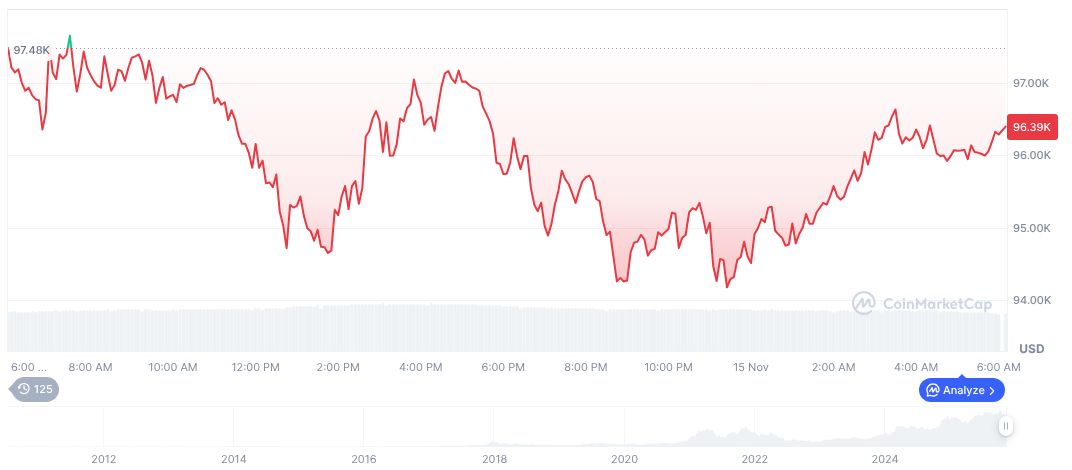

As of November 16, 2025, Bitcoin (BTC) is valued at $95,819.93 with a market cap of 1.91 trillion and a market dominance of 58.78%, according to CoinMarketCap. It saw a price decline of 17.23% over the past 90 days amid notable trading activity. Despite recent price volatility, BTC remains a pivotal asset, with a 24-hour trading volume of 49.22 billion, indicating sustained interest and engagement from both amateur and institutional investors.

According to Coincu’s research, the changing landscape of financial regulations and increasing technological advancements may lead to amplified institutional adoption of cryptocurrencies like Bitcoin. This could foster innovations in asset management and ETFs that enhance market liquidity.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/harvard-endowment-bitcoin-etf/