- Ståle Rodahl leads Green Minerals’ $25M Bitcoin financing initiative.

- Structured deal aims to expand company Bitcoin holdings.

- Bold move highlights Bitcoin’s role in corporate treasury management.

Green Minerals has announced its entry into a significant financial agreement, securing 250 million NOK ($25 million) for Bitcoin purchasing.

The financing marks a strategic shift in its treasury policy, emphasizing Bitcoin’s potential for long-term value and its anti-inflationary benefits.

Norwegian Firm Allocates $25M to Bitcoin Holdings

Green Minerals, a Norwegian mining company, has inked a NOK 250 million ($25 million) financing agreement to expand its Bitcoin holdings. Ståle Rodahl, the Executive Chairman, is central to this shift, underscoring the company’s commitment to financial innovation and sustainability. The move aligns with Green Minerals’ broader blockchain adoption strategy.

By acquiring Bitcoin, the company aims to mitigate risks associated with fiat currency depreciations, positioning Bitcoin as a key asset in its treasury. This step adds cryptocurrency as a novel component in its mineral extraction operations, potentially altering the financial landscape for similar enterprises.

Market stakeholders have noted Green Minerals’ commitment to Bitcoin as a bold shift in treasury management strategies. Ståle Rodahl stated:

“With significant future capital expenses, the program robustly hedges against financial instabilities.”

His remarks emphasize Bitcoin’s role as a non-inflationary asset, appealing to financial strategists in various sectors.

Bitcoin Adoption Strategies and Market Dynamics

Did you know? Green Minerals’ effort mirrors MicroStrategy’s previous strategy, impacting Bitcoin market confidence. The latter saw a notable surge in cryptocurrency adoption and price volatility after their substantial treasury introduction.

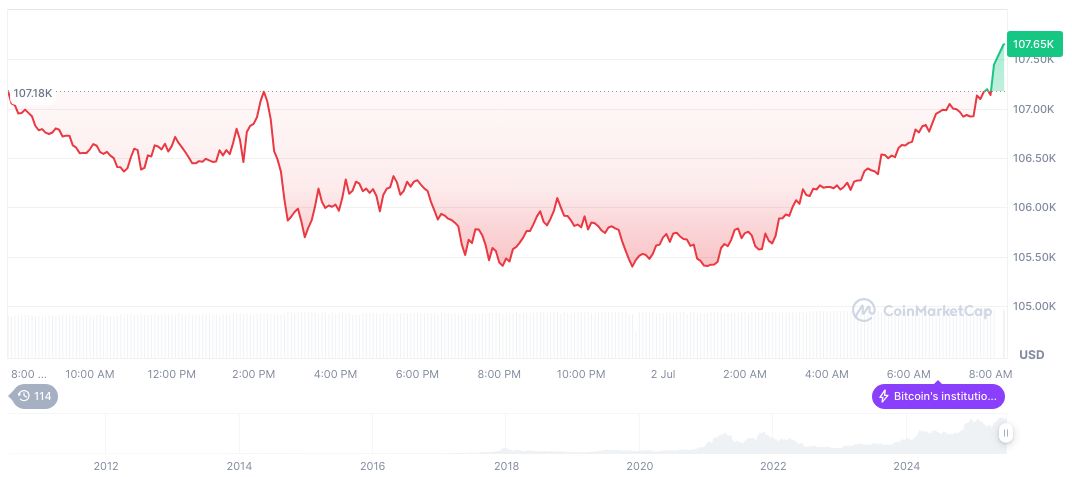

According to CoinMarketCap, Bitcoin (BTC) is presently valued at $107,527.20, boasting a market cap of $2.14 trillion. With a market dominance of 64.80% and a trading volume of $46.44 billion within the last 24 hours, Bitcoin’s price has seen marginal changes across various timeframes.

Coincu research team suggests that such treasury management moves may spur more corporations to incorporate Bitcoin into their holdings. This trend is expected to influence both market dynamics and regulatory attention. Historically, similar investments have increased Bitcoin’s adoption and liquidity, presenting a mixed landscape of financial and technological outcomes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346392-green-minerals-bitcoin-financing/