- Government agencies increase MicroStrategy holdings for Bitcoin exposure despite restrictions.

- MicroStrategy remains a key avenue for indirect Bitcoin investments.

- Analyst Geoffrey Kendrick notes potential for further Bitcoin price rise.

Various government agencies have increased their holdings of MicroStrategy stock in the first quarter of this year to gain indirect exposure to Bitcoin. This shift is notable in regions where direct Bitcoin holdings face regulatory hurdles.

The increased investment by sovereign funds, including the Norwegian Government Pension Fund and the Swiss National Bank, underscores growing institutional interest. Local pension funds in California, New York, and North Carolina have followed suit, marking a significant move towards Bitcoin-backed assets despite regulatory challenges.

Government Agencies Leverage MicroStrategy for Bitcoin Exposure

Standard Chartered Bank’s latest research report indicates significant growth in Bitcoin exposure through stock channels. By increasing their holdings in MicroStrategy, sovereign and pension funds circumvent regulatory constraints on direct Bitcoin holdings. MicroStrategy’s stock acts as a proxy investment for these funds, allowing them to enhance their crypto asset portfolios.

The rise in institutional investment through MicroStrategy has the potential to bolster the Bitcoin market, reflecting a broader acceptance among traditional financial systems. This position aligns with Standard Chartered’s forecast, which anticipates Bitcoin’s price reaching $500,000.

Analyst Geoffrey Kendrick commented, “Our second-quarter Bitcoin price target of $120,000 might be too conservative,” suggesting a paradigm shift in predicting Bitcoin’s future valuation. Market dynamics and regulatory landscapes continue to influence day-to-day movements in the Bitcoin market.

Bitcoin Price Analysis and Regulatory Implications

Did you know? In 2023, indirect Bitcoin exposure via stocks surged by over 300%, evidencing a growing institutional trend amidst tightening regulations against direct cryptocurrency holdings.

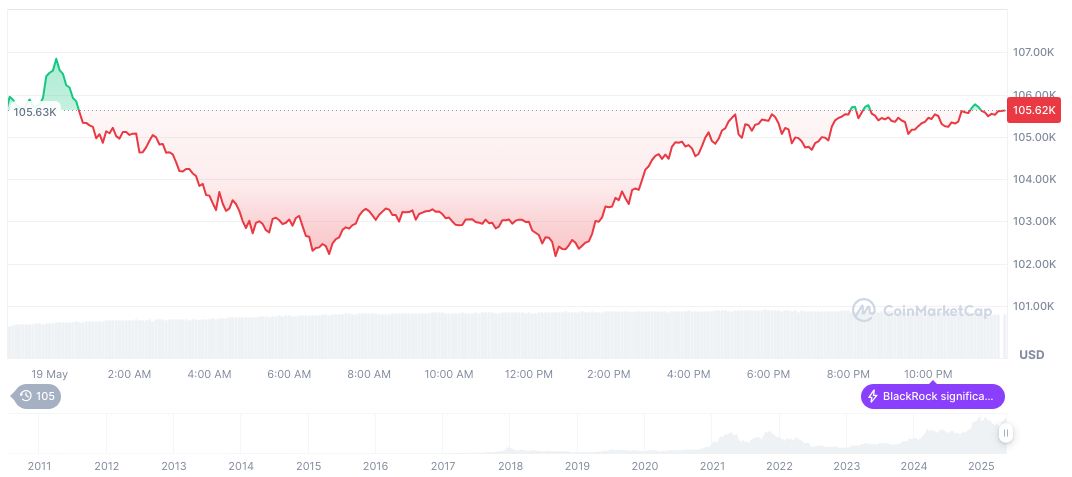

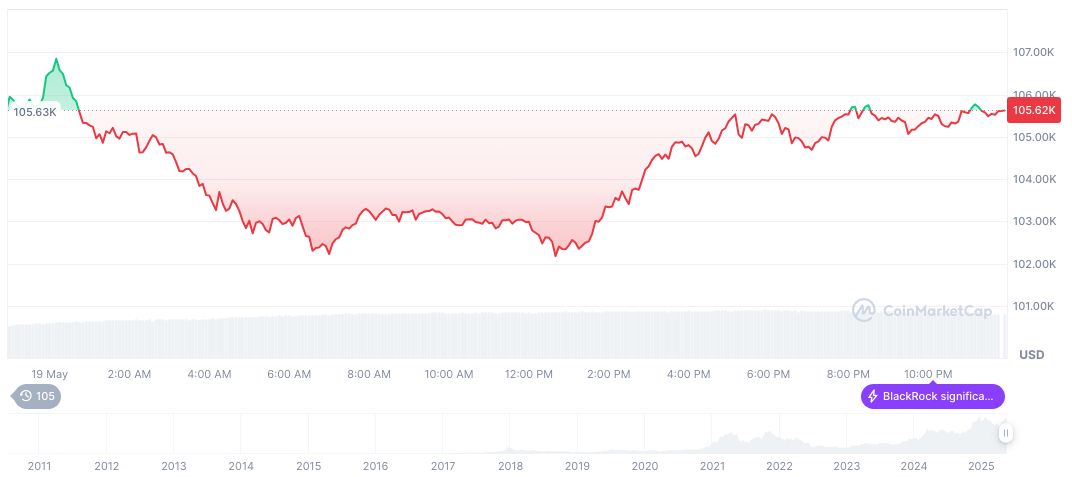

According to CoinMarketCap, Bitcoin is trading at $104,787.70 with a market cap of $2.08 trillion. The cryptocurrency experienced a 2.28% increase over the last 24 hours and a 25.29% rise over the past 60 days. Bitcoin’s current circulating supply is 19,867,337 out of a max supply of 21 million.

The Coincu research team notes that this trend of adopting stock channels for Bitcoin exposure might drive further regulatory scrutinies, but offers a resilient hedge for institutions against volatile market conditions. As traditional sectors pivot towards digital assets, Bitcoin could further solidify its standing in mainstream finance, despite regulatory anxieties.

Source: https://coincu.com/338681-government-agencies-increase-bitcoin-exposure-microstrategy/