- Accumulation trend reaches 1.0 as institutions wager on Bitcoin.

- Sharp increase in bullish options, showcasing market optimism.

- Whales and retail holders align—propelling bullish momentum.

Glassnode’s analysis reveals a surge in Bitcoin accumulation, with its Accumulation Trend Score hitting 1.0, indicating strong buying by both whales and small holders.

This development suggests heightened market optimism as institutional players take major stakes in bullish Bitcoin options.

Bitcoin Accumulation Hits Peak as Institutional Bets Rise

Glassnode’s report shows a surge in Bitcoin accumulation, with an Accumulation Trend Score of 1.0. This metric peaks as both whales and smaller holders ramp up buying activity, excluding miners and exchanges. The options market reflects this momentum, with $620 million allocated to bullish $300,000 Bitcoin options set to expire in June. Another $420 million focuses on bullish $200,000 strike options, emphasizing viable institutional interest. The involvement of major market makers and sophisticated funds indicates entrenched bullish sentiment. Analysis of Bitcoin market signals

Market implications are substantial. The increased allocation to bullish options points to institutional confidence and expectations of further upward volatility. This shakeup in investment patterns paves the way for potential price gains. Bitcoin’s illiquid supply now exceeds 14 million BTC, potentially tightening available stock and bolstering price dynamics.

Community and financial analysts are abuzz with interpretations. Some express speculations that the strategic alignment in Bitcoin accumulation could precede significant price advances. One notable analyst, Matthew Hyland, expressed that:

“BTC is now on the clock and probably needs to make a move to $120k-$130k in the coming weeks to make a higher high on the RSI and avoid any weekly bearish divergence from being confirmed.” — Cointelegraph

Market Optimism Driven by Bullish Options Allocation

Did you know? Bitcoin’s illiquid supply has been steadily increasing, indicating a growing confidence among long-term holders.

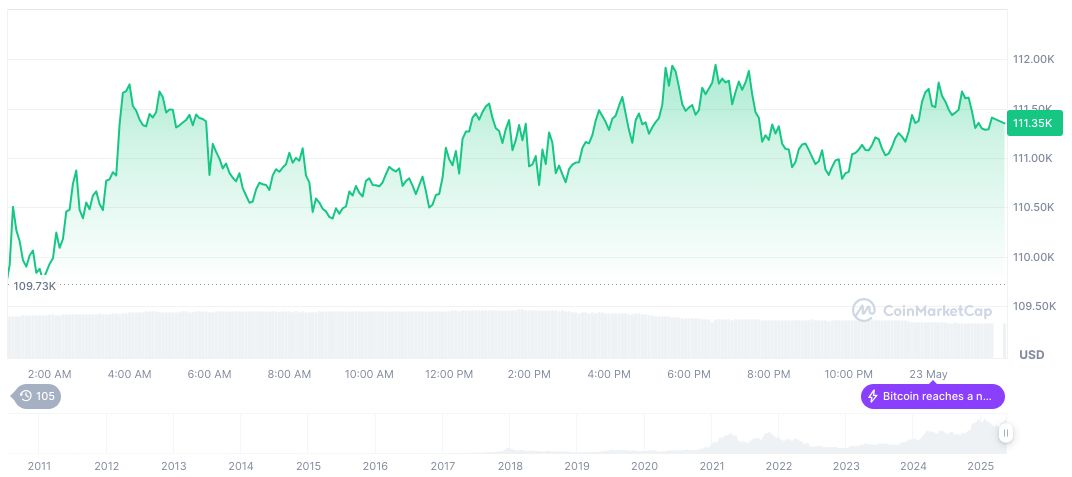

Bitcoin currently trades at $110,761.88, with a market cap of $2.20 trillion and a 24-hour trading volume of $59.41 billion, reflecting a -34.40% change. Recent 60-day performance shows a 26.93% price increase Market insights and trends from Bluntz Capital. Statistics sourced from CoinMarketCap confirm these bullish movements as Bitcoin’s dominance maintains at 62.83%.

Coincu’s research team believes that the current institutional engagement in options signals market actors’ confidence regarding Bitcoin’s trajectory. As past bullish buildups catalyzed price ascensions, current dynamics suggest potential catalysts for further gains, echoing past trends. Industry stakeholders and cautious optimists position themselves advantageously, aligning with the overall positive market narrative.

Source: https://coincu.com/339267-bitcoin-accumulation-institutional-interest/