- Genius Group splits lawsuit proceeds with shareholders and Bitcoin reserves.

- Bitcoin treasury growth tied to legal outcomes.

- Potential market impact from large BTC purchases.

Genius Group Limited announced a plan to allocate future net legal win proceeds by distributing to shareholders and purchasing Bitcoin, showcasing a new corporate strategy.

The integration of litigation proceeds into Bitcoin reserves could significantly impact corporate finance, linking legal outcomes with financial markets.

Genius Group Strategizes Bitcoin Reserves with Legal Wins

Genius Group Limited recently revealed a strategic plan to allocate profits from anticipated litigation successes directly to shareholders and Bitcoin purchases. This decision, unanimously supported by the board of directors, emphasizes the company’s forward-thinking approach to enhancing shareholder value via strategic crypto investments.

The company’s CEO, Roger Hamilton, confirmed ongoing legal actions worth over $1 billion. He stated:

“Since both lawsuits aim to recover direct losses caused to our shareholders by third parties, the board believes that once the cases are won, 100% of all profits should be directly allocated to shareholder distribution or reinvestment to maximize shareholder interests.” – Press Release

Market analysts are keenly observing the potential impact on Bitcoin prices, as purchases are contingent upon the successful outcome of litigation efforts. Significant statements from Hamilton and the board underline their confidence in this combined approach to tackle financial challenges.

Bitcoin Purchase Prospects Amidst Ongoing Legal Efforts

Did you know?

The strategy of linking lawsuit proceeds to Bitcoin purchases is unprecedented for a NYSE-listed company, potentially paving the way for similar strategies across the financial sector.

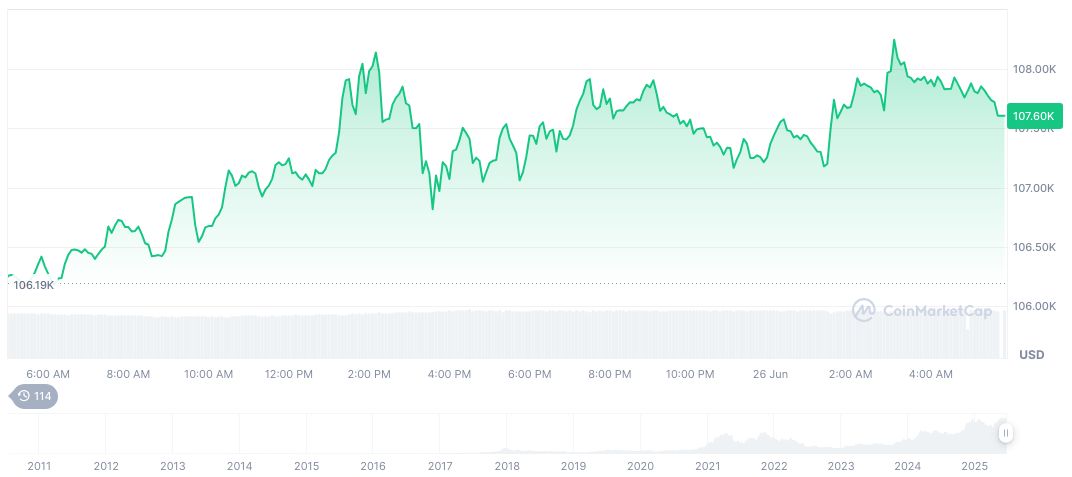

According to CoinMarketCap, Bitcoin (BTC) currently trades at $107,625.25 with a market cap of approximately 2.14 trillion. Despite a slight 0.19% decline in the last 24 hours, Bitcoin’s dominance sits at 65.09%. The 60-day and 90-day price movements show gains of 13.97% and 28.64% respectively.

Insights from the Coincu research team suggest that Genius Group’s potential financial impact could encourage other corporates to adopt similar practices. The integration of digital assets in treasury strategies might change regulatory landscapes and provide new avenues for corporate financial management.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345354-genius-group-bitcoin-reserve-strategy/