- Gensler compares Bitcoin to gold, highlighting its global appeal.

- Regulatory clarity boosts market sentiment for Bitcoin.

- Bitcoin maintains its non-security status, strengthening institutional confidence.

Former SEC Chair Gary Gensler emphasized Bitcoin’s global interest in a CNBC interview released on April 17, 2025, likening it to gold due to worldwide appeal. He noted Bitcoin might persist because of its global intrigue.

Gensler’s comments offer clarity on Bitcoin’s regulatory status and come amid his transition out of the SEC role, affecting market sentiment. Trading volumes increased as Bitcoin maintains non-security status due to clarified regulations.

Regulatory Shifts Encourage Positive Bitcoin Market Sentiment

Gensler’s recent remarks drew parallels between Bitcoin and gold, citing its international popularity. This comparison stemmed from his interviews suggesting Bitcoin’s enduring presence as a “digital gold”. Gensler’s opinions echoed widespread interest, potentially influenced by Bitcoin’s standing among international assets.

Regulatory shifts are afoot, marked by the SEC pivoting from stringent enforcement under Gensler to enhanced engagement. This change aligns with the exit of Gensler and potential nominations indicating potential regulatory flexibility. Market participants interpret these changes as welcomed reliefs against prior uncertainties.

Strong market responses followed Gensler’s statements, as Bitcoin’s status received reinforcement, echoing as a boon for institutional investment confidence. Bitcoin ETF approvals previously catalyzed similar surges, amplifying market optimism. Observers suggest continued adherence to commodity classification fosters stability and limits regulatory ambiguities.

Market Data and Future Insights

Did you know? Bitcoin’s comparison to gold, as highlighted by Gensler, underscores its status as a “digital gold,” drawing parallels between the two as enduring assets within investor portfolios historically characterized by long-term value potential.

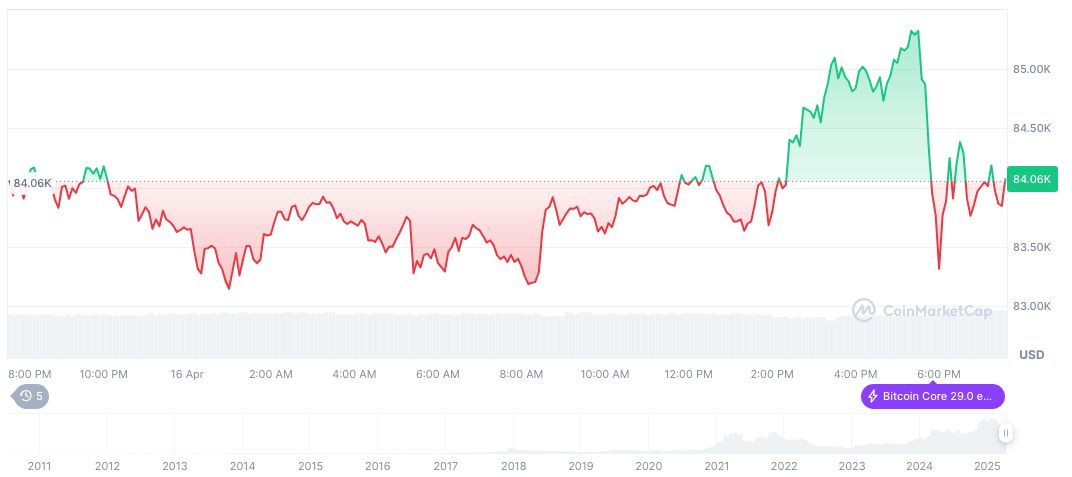

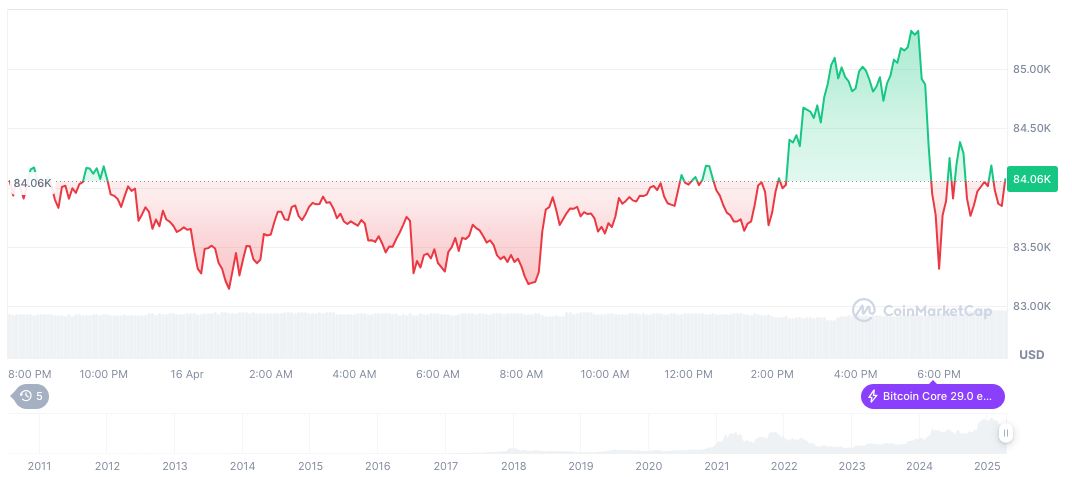

According to CoinMarketCap data, Bitcoin currently trades at $84,604.81 with a market cap of $1.68 trillion. Its dominance stands at 62.93%, with a circulating supply of nearly 19.85 million BTC and a max supply cap of 21 million. The token’s recent 24-hour trading volume reached $27.66 billion, reflecting a 2.68% change, amidst a nuanced price trajectory, adjusting by 1.25% over the last day, and exhibiting varied trends over longer time frames.

Coincu’s team notes that regulatory clarity signifies reduced market volatility, positioning Bitcoin advantageously against securities designations. An evolving SEC stance, bolstered by leadership transitions, supports a conducive environment for Bitcoin investment, potentially influencing future ETF approvals and sustained market involvement.

Source: https://coincu.com/332658-gary-gensler-bitcoin-global-appeal/