- Garantex delays BTC, ETH disposal announcement amid ongoing sanctions.

- Over $28 million remains frozen due to sanctions.

- Market liquidity and user withdrawals significantly impacted.

Garantex, a major Russian cryptocurrency exchange, has delayed its decision on BTC and ETH asset disposal originally planned for this month, announcing this will now occur next month.

The delay affects more than $28 million in frozen assets due to sanctions, impacting user withdrawals and liquidity.

Garantex Faces Sanctions-Caused Freezes of $28 Million

Garantex recently announced a delay in asset disposal procedures for its BTC and ETH holdings. Initially expected this month, the final decision is deferred to next month. This decision aligns with ongoing sanction-related challenges facing the exchange.

Sanctions and asset freezes by Tether have immobilized over 2.5 billion rubles. This has prompted operational suspensions, influencing BTC, ETH, and USDT on the platform.

“This package continues targeting actors responsible for circumventing EU sanctions, including through third countries. The European Union remains ready to step up pressure on Russia.” — EU Council, Official Statement, European Union

User concern grows as liquidity issues impede withdrawals. No official leadership comments on this have been issued on verified channels as users await updates via Telegram.

Regulatory Pressures Trigger Crypto Exchange Crisis

Did you know? Garantex’s ongoing issues echo previous exchange seizures, such as BTC-e, which faced extensive regulatory delays impacting users’ access to funds.

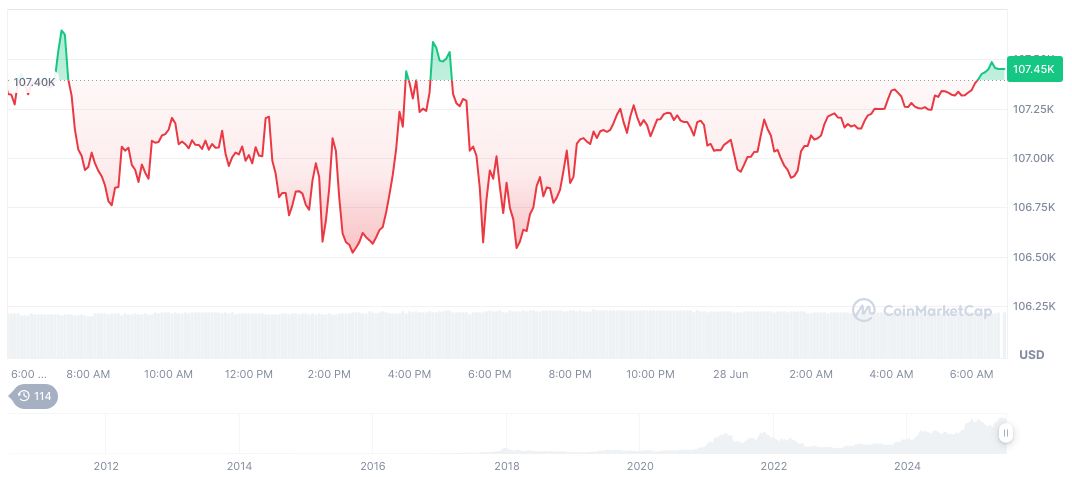

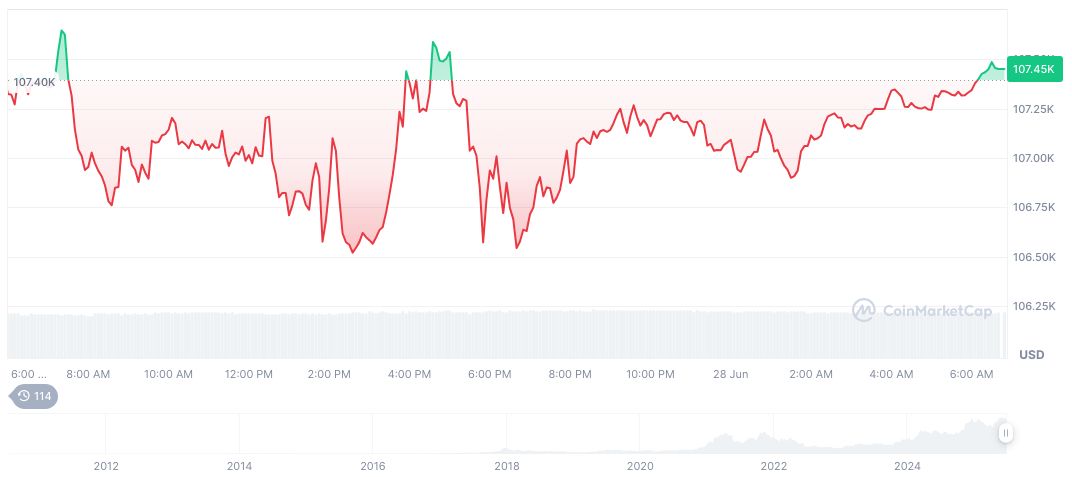

Bitcoin (BTC) holds a market cap of X.XX trillion as reported by CoinMarketCap, with a current price of $107,380.61. Over the past 90 days, BTC saw an increase of 30.14%. A 24-hour trading volume stood at $30.29 billion, indicating changes driven by evolving market conditions.

Insights from the Coincu research team suggest that the current regulatory challenges in crypto markets could lead to stricter asset management strategies and potentially slower recovery timelines for affected funds. As regulatory frameworks evolve, user access and exchange operations may face enhanced oversight.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345767-garantex-delays-crypto-asset-decision/