Quick Take

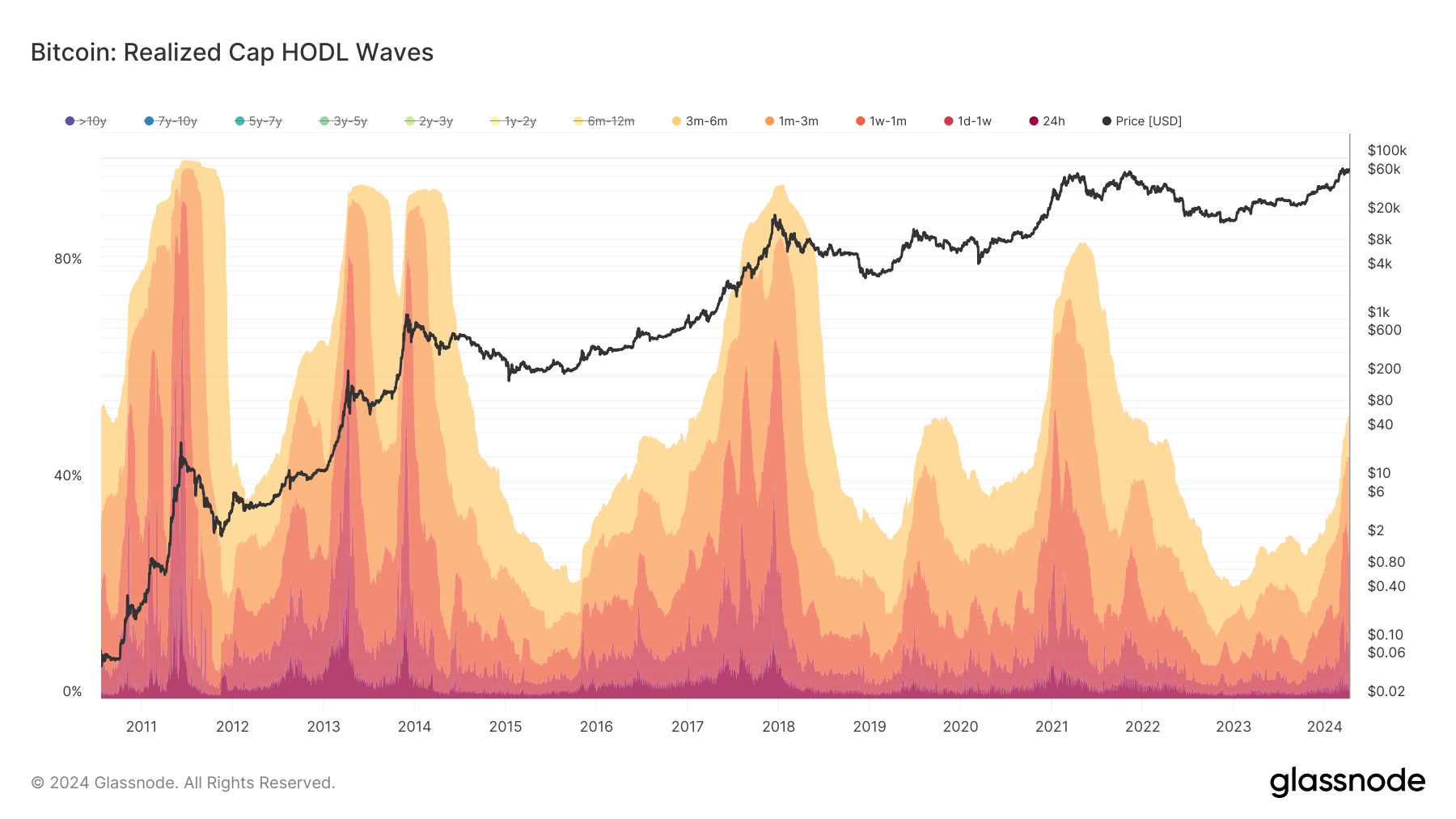

Bitcoin’s price cycles are often influenced by the behavior of short-term holders (STHs), defined as investors who have held the digital asset for less than 155 days. According to Glassnode data, during market peaks, STHs typically possess 80% or more of the Bitcoin supply, with the prevailing cohort transitioning from shorter to longer holding periods in each subsequent cycle.

Data from Glassnode shows that at the peak in 2011, STHs commanded 96% of the supply, primarily comprising holders of one-day to one-week durations. By the 2013 peak, 90% of the supply was held by STHs, predominantly those holding for one-day to one-week periods. Moving to the 2017 peak, STHs still dominated over 90% of the supply, but the principal cohort shifted to one-week to one-month holders, indicating a slightly maturing market.

In March 2021, at the peak, 85% of the supply was held by STHs, with the predominant group being holders of one-month to three-month durations, according to Glassnode.

Currently, with Bitcoin hovering near all-time highs, STHs control 54% of the supply, which suggests potential for further growth. The gradual transition in dominant STH groups from shorter to longer durations implies an evolving market maturity.

The post From days to months: How Bitcoin holder behavior predicts price peaks appeared first on CryptoSlate.

Source: https://cryptoslate.com/insights/from-days-to-months-how-bitcoin-holder-behavior-predicts-price-peaks/