- Federal Reserve rate decision may influence Bitcoin market trends.

- Bitcoin price holds at $105,062.13 as of June 14.

- Institutional activity suggests continued interest in Bitcoin and Ethereum.

Federal Reserve’s upcoming rate decision on June 18, coupled with Jerome Powell’s economic insights, is anticipated to impact crypto markets. The influence of these macroeconomic events is notable, particularly for Bitcoin and Ethereum.

The pending Federal Reserve interest rate decision has historically led to notable fluctuations in crypto asset values. Market movements often align with rate changes and investor sentiment, affecting major cryptocurrencies.

Federal Reserve’s Potential Rate Shift and Crypto Impact

Jerome Powell of the Federal Reserve leads discussions on interest rate changes that could shift Bitcoin and Ethereum prices. Key events include upcoming U.S. retail sales and jobless claims reports. Market participants closely monitor these releases for potential crypto asset impacts. High-impact events like Powell’s press conference are expected to influence market sentiment and volatility.

Potential changes in interest rates may affect traditional and crypto markets, especially Bitcoin and Ethereum. Macroeconomic data could spark volatility, altering DeFi yields and stablecoin flows. “The current market environment is highly favorable for Bitcoin to continue its upward momentum. He expects that it will be difficult to see a deep correction of more than 30% before Bitcoin reaches at least $140,000 to $160,000.” — Andrew Kang, Co-founder and Partner, Mechanism Capital. The outcomes of these events will address inflation concerns and monetary policy directions. Jerome Powell’s upcoming statements are closely watched for guidance on the economic outlook and policy adjustments. He asserts that long-term inflation targets remain, aimed to stabilize economic conditions.

Historical Influence of Fed Meetings on Crypto Prices

Did you know? Past Federal Reserve meetings with rate hikes often led to sharp sell-offs in Bitcoin. However, Powell’s dovish comments historically sparked rallies, posing a potential precedent for upcoming market reactions.

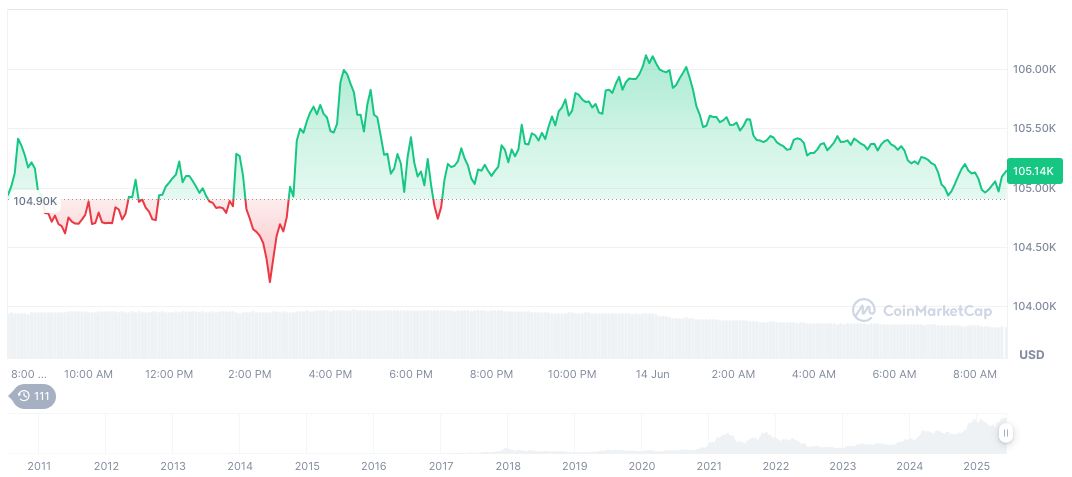

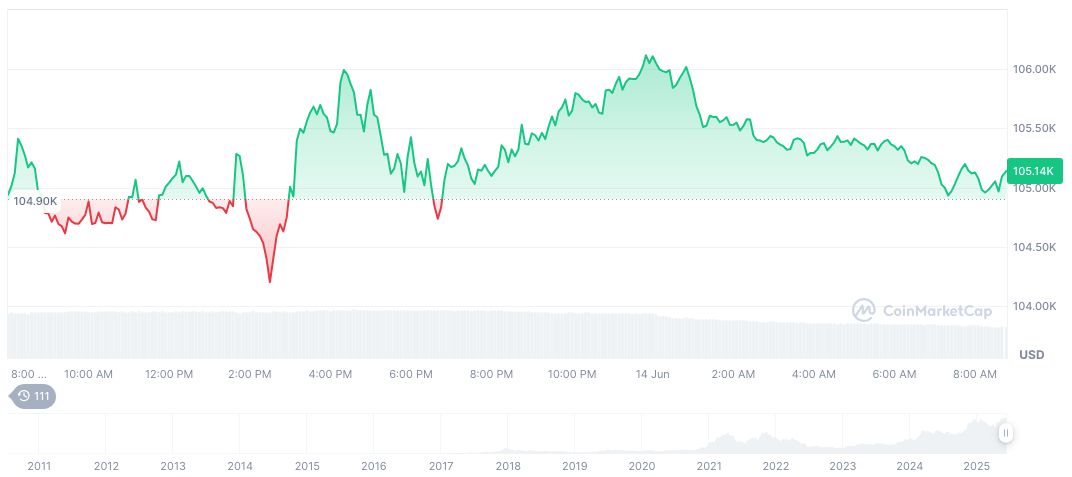

As of June 14, Bitcoin (BTC) [data via CoinMarketCap] is priced at $105,062.13, with a market cap of $2.09 trillion. Its 24-hour trading volume is $45.26 billion, a decrease of 35.35%. Over 90 days, Bitcoin’s price increased by 27.00%. The cryptocurrency’s market dominance stands at 63.78%.

Insights from Coincu research suggest that institutional activities and whale accumulation in Ethereum signal faith in BTC and ETH. Data implies potential regulatory outcomes may bolster investor strategies, while bullish sentiment may continue if rates hold or trends shift positively.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343269-fed-rate-decision-bitcoin-impact/