- The Federal Reserve is expected to maintain current interest rates.

- Market participants are speculating on potential future rate cuts.

- Bitcoin’s recent price movements may be influenced by these expectations.

The Federal Reserve, led by Chairman Jerome Powell, is expected to maintain current interest rates during its policy meeting on June 16, 2025. The meeting comes as the markets speculate on potential future rate cuts following weaker-than-expected inflation data.

The Federal Reserve is anticipated to keep interest rates unchanged this week, maintaining the current federal funds rate between 4.25% to 4.50%. This decision follows recent inflation data that was softer than expected, prompting market participants to anticipate the timing of future rate reductions. Citi analysts have highlighted that the markets might be undervaluing the risk associated with these expected rate cuts.

Federal Reserve Rate Decisions and Market Expectations

The potential for market change is significant. U.S. tariff hikes and escalating tensions in Iran could impact inflation and delay rate cuts. Bitcoin and other altcoins may experience an inflow if traditional yields remain unattractive. Analysts from Allianz suggest the Federal Reserve, within the backdrop of elevated inflation, might be reluctant to ease its monetary policy prematurely.

Market reactions have been narrowly focused on the Federal Reserve’s monetary stance. In anticipation, there is a bullish sentiment surrounding key cryptocurrencies like Bitcoin and Ethereum. The crypto community, via platforms such as Twitter and Reddit, is engaging in widespread discussions relating to potential rate cuts and their implications for digital assets.

Jerome Powell, Chairman, Federal Reserve, said, “Uncertainty about the economic outlook has increased further,” with heightened risks noted on both unemployment and inflation.

Bitcoin Price Movement and Expert Insights

Did you know? Sustained periods of low interest rates in 2023 and 2019 led to major rallies in Bitcoin, often driven by traders seeking alternative assets in a low-yield environment.

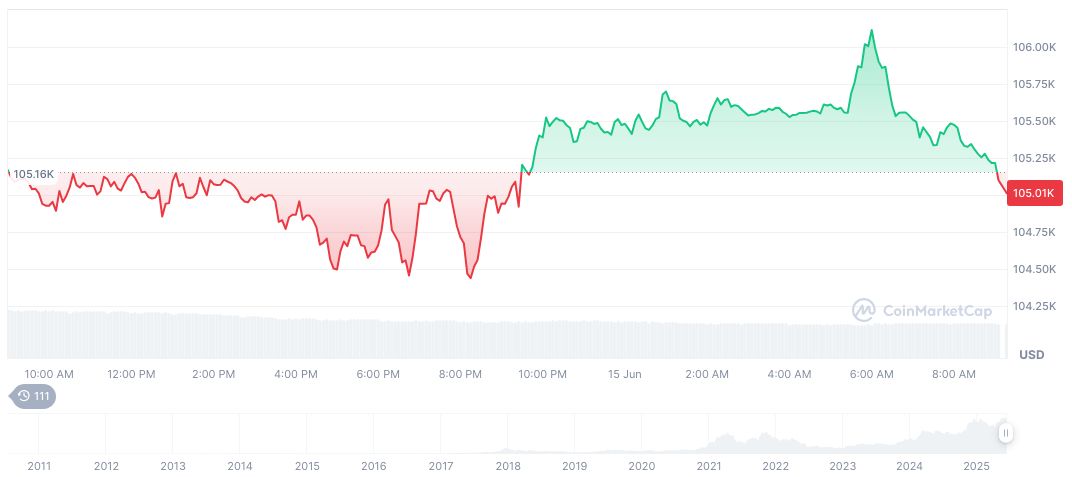

According to CoinMarketCap, Bitcoin’s current price is $107,113.76, with a market cap of $2.13 trillion and a market dominance of 63.72%. Its 24-hour trading volume has reached $41.70 billion, marking a change of 20.68%. Over the past 90 days, Bitcoin experienced a 28.86% price increase.

Insights from Coincu research teams suggest that a dovish Fed stance could renew bullish momentum within crypto markets. However, potential shifts in financial and technological regulations remain unpredictable in the face of ongoing geopolitical tensions. Singapore Exchange to launch initiatives that may impact rate change expectations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343543-federal-reserve-rate-cut-bitcoin/