Bitcoin price has rebounded by 13% from its November lows, helped by dip buying and falling fear in the market. Still, a bull run remains elusive, and these gains may become undone as the coin formed a risky pattern and as institutional demand wanes.

Bitcoin Price Technicals Point to a Deep Reversal

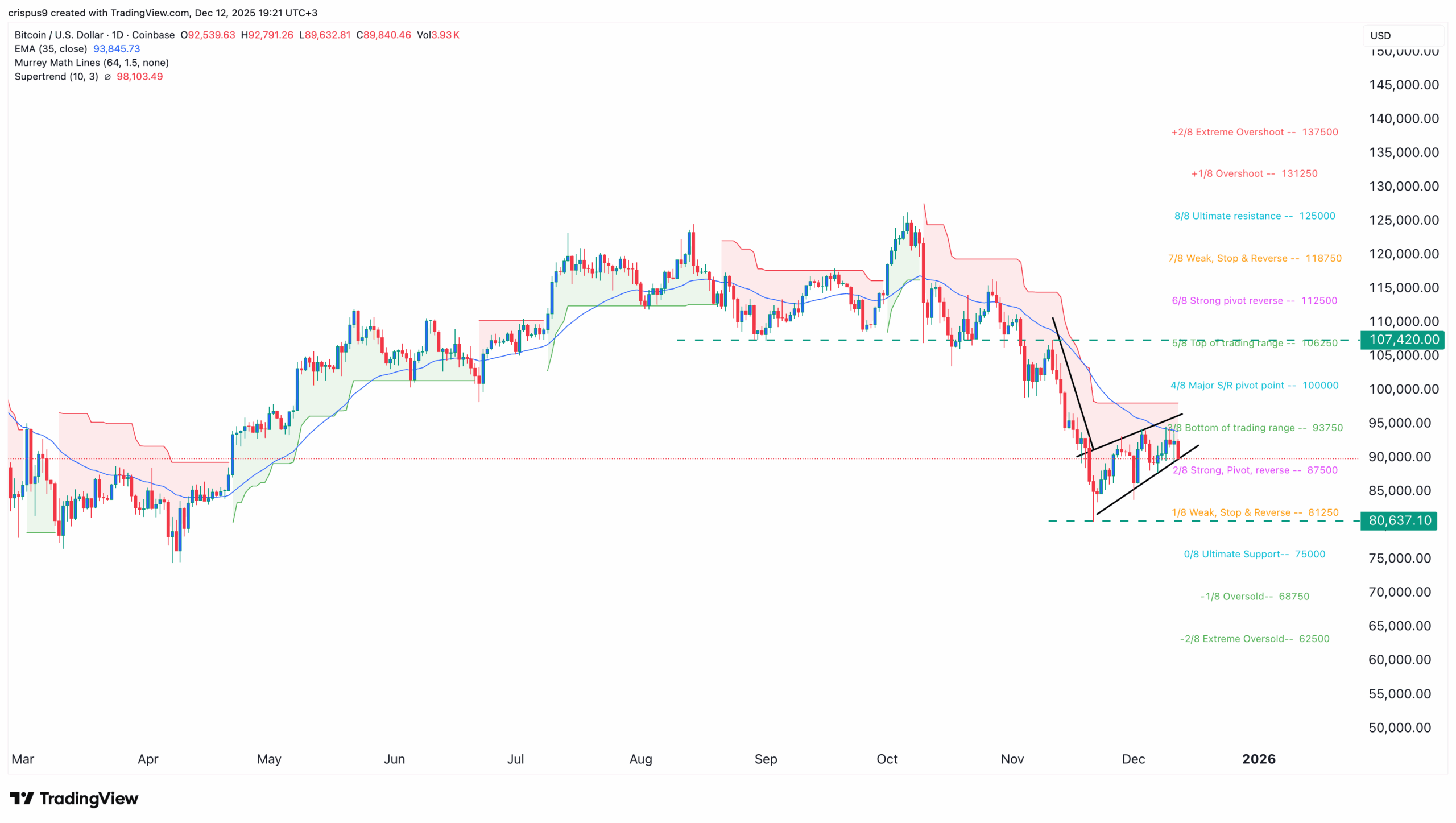

BTC price has rallied in the past few weeks after bottoming at $80,637 in November. This rebound, however, could be a sign of a dead-cat bounce, which is a temporary rebound that happens during a bear market.

The daily chart shows that the coin has faced rejection at the 50-day Exponential Moving Average (EMA). It has also remained below the Supertrend indicator, which it needs to move above to confirm a rebound.

Worse, the BTC value has formed a bearish flag pattern, which often leads to a strong breakdown. It has already completed forming the inverted flagpole and is now in the flag section.

There are signs that the flag section is about to end, which may trigger a bearish breakdown. The first target to watch will be the strong, pivot, and reverse level of the Murrey Math Lines tool at $87,500.

A drop below that target will point to further downside to last month’s low of $80,637, which is -11% below the current level. This drop will lead to more downside to the ultimate support level at $75,000. This outlook aligns with the April low as Ted Pilows, a popular analyst, predicted.

The bearish Bitcoin price prediction will become invalid if it moves above the key resistance level at $100,000, which coincides with the Major S&R pivot point.

Institutional Demand Has Largely Dried

One major risk for Bitcoin is that institutional demand has largely dried up in the past few months.

For example, Bitcoin ETFs are seeing weak demand from investors. SoSoValue data shows that all spot Bitcoin ETFs have added $237 million in inflows this year, bringing the cumulative inflows to over $57 billion.

While these inflows are encouraging, they are much lower than in the past few months. Indeed, these funds have shed over $3 billion in inflows since November this year. This is big reversal to what used to happen a few months ago when these inflows were soaring.

For example, they added $5.2 billion in May, $4.6 billion in June, and $6.02 billion in June this year.

Meanwhile, data shows that fewer companies are announcing their Bitcoin treasury strategy. According to CryptoQuant, only 9 companies have announced that they will add BTC coins in their treasury this quarter, down by 83% from the 53 that announced in Q3.

Moreso, only a few of the existing treasury companies. Strategy bought coins worth $900 million last week, while American Bitcoin bought more this week. However, these are outliers as companies like Mara and Metaplanet have paused.

Worse, there are now concerns that some of these companies will start to sell as their NAV drops. Others will sell to pay their debt and other obligations, leading to more pressure.