Fabio Panetta, a member of the executive board of the European Central Bank (ECB), has stated that companies increasing their profit margins could be helping to fuel inflation. In an interview with the New York Times, Panetta warned about the effect that companies increasing such margins could have on inflation levels in the long term.

ECB’s Panetta Links Profit Margins With Inflation

Fabio Panetta, a member of the executive board of the European Central Bank (ECB) and former deputy governor of the Bank of Italy, has brought attention to the effect that the rising profit margins of various companies could have over inflation levels. In an interview given to the New York Times on March 31, Panetta talked about these profits and price-setting practices, and their possible link with the high inflationary levels in Europe.

The current headwinds the world economy is facing could lead companies to raise their profit margins if they are expecting a rise in their costs, which can come from different sources, according to Panetta. He stated:

“We are probably paying insufficient attention to the other component of income — that is, profits. The situation which prevails in the economy, there could be ideal conditions for firms to increase their prices and profits.”

However, Panetta explained that his statements did not imply that the European bloc would act to control these prices. Instead, he clarified that he wanted to examine all the factors that were affecting the inflation levels.

Inflation Levels Falling, but Far From the Goal

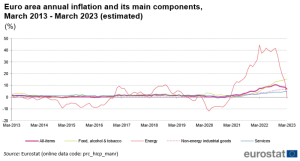

Preliminary numbers issued by the European Union indicate that March finished with a 6.9% inflation rate, cooling down from the 8.5% reached in February. This is due to the sharp decline in energy prices across Europe. However, the prices of the core elements of European inflation, which exclude energy and food, have continued to surge, reaching an all-time high of 5.7% during March.

This means that the ECB will likely keep raising interest rates in the foreseeable future, as it embraces its data-dependent approach. This is the opinion of Jack Allen-Reynolds, deputy chief eurozone economist at Capital Economics, who stated:

Policymakers at the ECB won’t read too much into the drop in headline inflation in March and will be more concerned that the core rate hit a new record high.

On March 16, the ECB raised interest rates by 0.5%, with President Christine Lagarde stating that inflation was “projected to remain too high for too long,” with levels being still very far from the 2% goal proposed by the institution.

What do you think about Fabio Panetta’s take on the rise of profit margins and its effect on inflation? Tell us in the comment section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Alexandros Michailidis / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Source: https://news.bitcoin.com/ecb-member-fabio-panetta-claims-rising-profit-margins-could-be-fueling-inflation/