- US Dollar Index falls below the psychological level, impacting crypto markets.

- DXY drop at multi-year lows, potential for further Bitcoin gains.

- Expert analyses highlight macroeconomic impacts on cryptocurrency trends.

The US Dollar Index (DXY) fell below the 100-mark on April 16, 2025, reaching nearly three-year lows. This situation mirrors early 2023 trends, affecting digital asset markets large and small.

The US Dollar’s dip below the psychological threshold comes amidst US-China trade tensions and recession fears, with the DXY now hovering between 99.4–99.7. According to Trader BitBull, known for macroeconomic analysis, DXY’s fastest decline since 2023 is signaling potential rebounds for digital assets, resembling the market recovery from the 2022 crypto bear market lows. “DXY is experiencing its fastest decline since 2023. At the beginning of 2023, Bitcoin and altcoins were rebounding from the 2022 bear market lows, with Bitcoin having bottomed out in the fourth quarter of 2022 and rising over 200% within a year,” said Trader BitBull. Bitcoin’s value surged over 200% within the following year from that bottom.

US Dollar Index Hits Three-Year Lows Amid Trade Tensions

The decline in the dollar suggests investors might pivot towards non-USD assets like Bitcoin. Research by Goldman Sachs supports the potential for a continued DXY decrease. Such bearish sentiment for the USD could bolster cryptocurrencies and alternative investments. In response, Andre Dragosch from Bitwise highlighted the ongoing downside potential for the DXY, correlating this to broader non-USD asset gains.

Historical Context, Price Data, and Expert Insights

Insights from the Coincu research team suggest that historical patterns often favor crypto rallies during periods of dollar weakness. Increased institutional interest and global economic shifts are likely to sustain Bitcoin’s growth trajectory, even amid regulatory challenges. Such scenarios align with previous cycles where key monetary policies influenced asset price dynamics.

Bitcoin Approaches $85K as Institutional Interest Grows

Did you know? The last major decline of the US Dollar Index in early 2023 paved the way for a significant Bitcoin price rally, demonstrating a historical correlation between dollar weakness and crypto market strength.

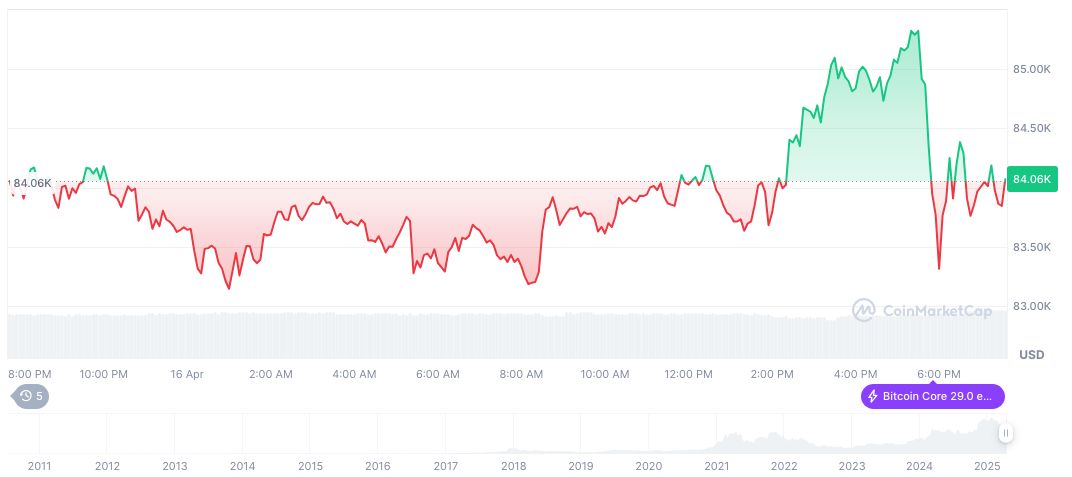

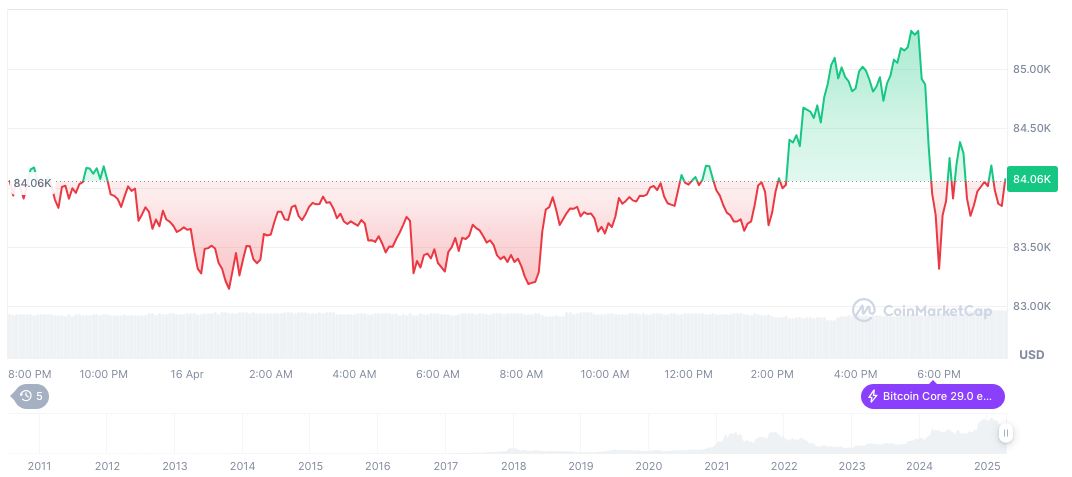

As reported by CoinMarketCap, Bitcoin’s current price stands at $84,452.87 with a market cap of $1.68 trillion, maintaining a market dominance of 63.01%. Over the past 60 days, Bitcoin’s price saw a decline of -13.57%, with its value incrementally changing by 0.49% in the last 24 hours. Trading volumes reached $29.61 billion, highlighting ongoing activity among investors despite recent volatility.

Insights from the Coincu research team suggest that historical patterns often favor crypto rallies during periods of dollar weakness. Increased institutional interest and global economic shifts are likely to sustain Bitcoin’s growth trajectory, even amid regulatory challenges. Such scenarios align with previous cycles where key monetary policies influenced asset price dynamics.

Source: https://coincu.com/332612-dollar-index-falls-bitcoin-boost/