- Defiance seeks SEC approval for Bitcoin and Ethereum ETFs.

- Aims for market-neutral returns via spot-futures arbitrage.

- No public statements from Defiance leadership on the filing.

Defiance ETFs has applied to the U.S. SEC to introduce market-neutral Bitcoin and Ethereum ‘Basis Trading’ ETFs, aiming to balance returns and crypto volatility, as recorded on September 16, 2025.

This marks the first U.S.-regulated ETF focusing purely on ‘basis arbitrage’ in Bitcoin and Ethereum, signaling potential shifts in crypto investment strategies.

Defiance Eyes SEC Approval for Bitcoin, Ethereum ETFs

Defiance, a U.S.-based ETF issuer, has initiated a regulatory process by filing with the SEC for ETFs pegged to Bitcoin and Ethereum. These funds will focus on profiting from the spread between spot and futures markets, thereby mitigating direct price volatility. If approved, Defiance’s ETFs could be among the first to operate on a basis trading strategy within the U.S.-regulated market. Their application with the SEC represents another move to bridge traditional finance with cryptocurrency assets, potentially influencing ETF market diversity. Stakeholders involve CME-listed futures for implementing the funds’ strategy.

Implications of these filings suggest broadened financial products in crypto markets and potentially greater stability through reduced exposure to outright volatility. While the funds aim at leveraging basis trades, the extent of uptake and impact will be contingent on approval. Although the SEC has acknowledged receipt of the application, there are no additional comments. Industry watchers await the SEC’s future stance on such approvals, with varying reactions among market participants. Without direct statements from Defiance, community reactions remain speculative.

Currently, the only information stems from the SEC registration documents and official announcements with no commentary from industry leaders or community figures.

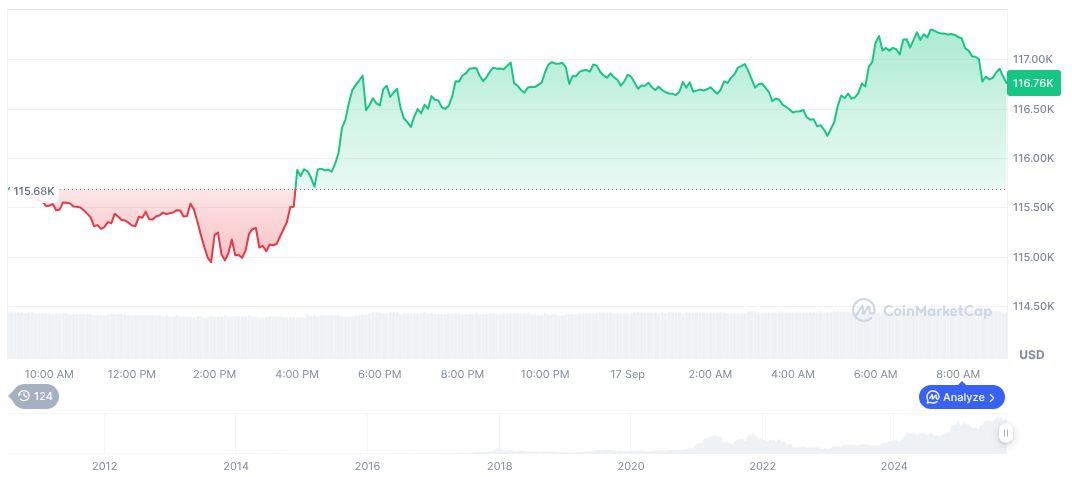

Bitcoin at $115K: Analyzing Market Impact of Potential ETFs

Did you know? Basis trading ETFs like Defiance’s proposal could transform the crypto ETF landscape, fostering more stability by hedging against outright price drops, reminiscent of traditional financial market maturity processes.

Bitcoin (BTC) is currently priced at $115,632.80, Defiance ETF QTUM Strategy Overview with a market cap of $2.30 trillion and dominance at 57.43%, according to CoinMarketCap. It shows a recent 1.77% gain over seven days but a slight drop of 0.20% in the past 24 hours.

Insights from Coincu’s research indicate these ETFs might offer novel investment avenues by tapping into basis arbitrage, balancing potential gains against reduced volatility risk. Historical precedent highlights the shift towards integrating complex financial strategies in crypto markets. Recent trends suggest growing institutional interest, key in further legitimizing the crypto asset class. With no immediate statements, responses from industry leaders are pending further market developments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/defiance-sec-etfs-bitcoin-ethereum/