- Volume spikes confirm stronger selling pressure during price declines.

- The death cross and Fibonacci levels point to more declines in store.

Bitcoin’s [BTC] price continued its downward trajectory, trading at $82,499 as of press time, after breaking below crucial support levels.

The cryptocurrency is now facing increasing bearish pressure, with technical indicators suggesting a prolonged correction.

Adding to the technical concerns, well-known analyst Ali Charts tweeted that Bitcoin has witnessed a crossover between the 50-day and 100-day moving averages on the daily chart.

Source: X

This suggests continued shifts in momentum that traders should watch closely.

Death cross confirms bearish trend

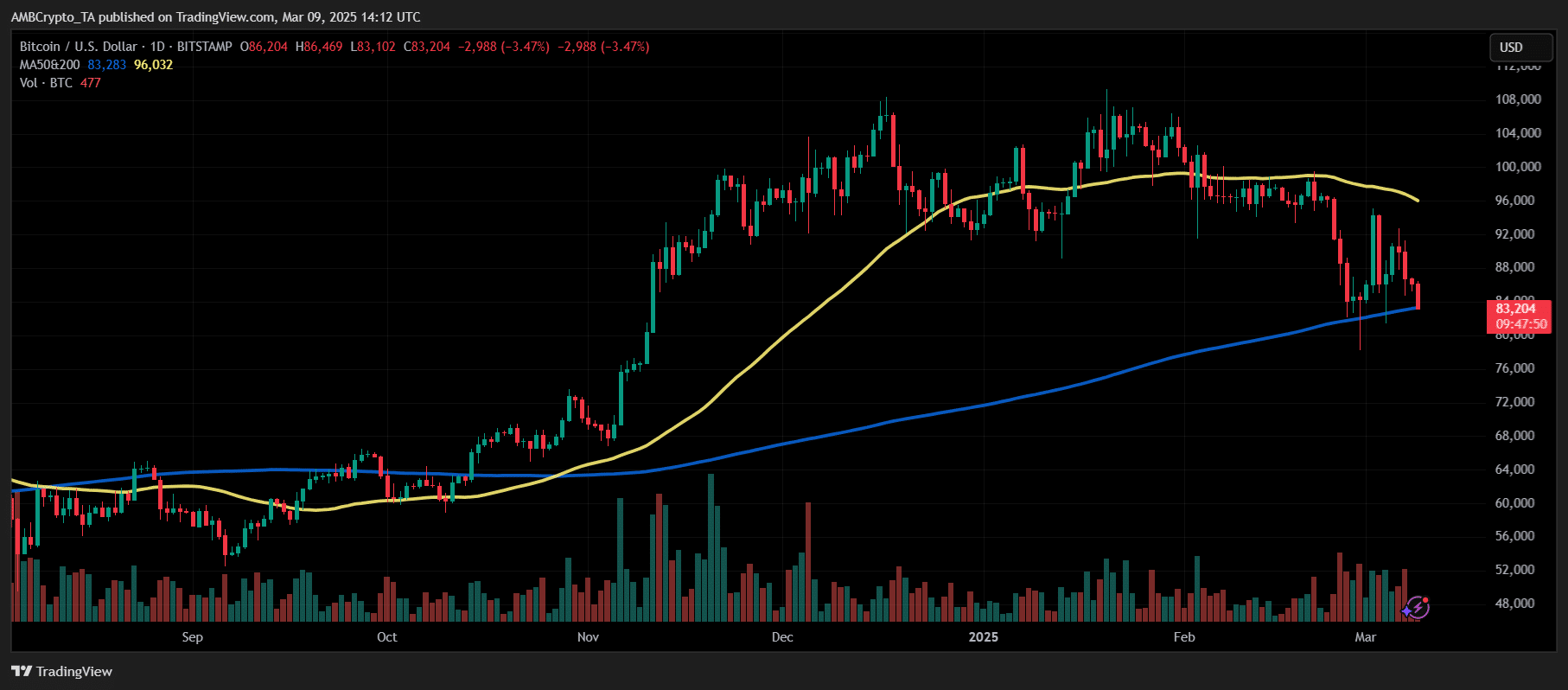

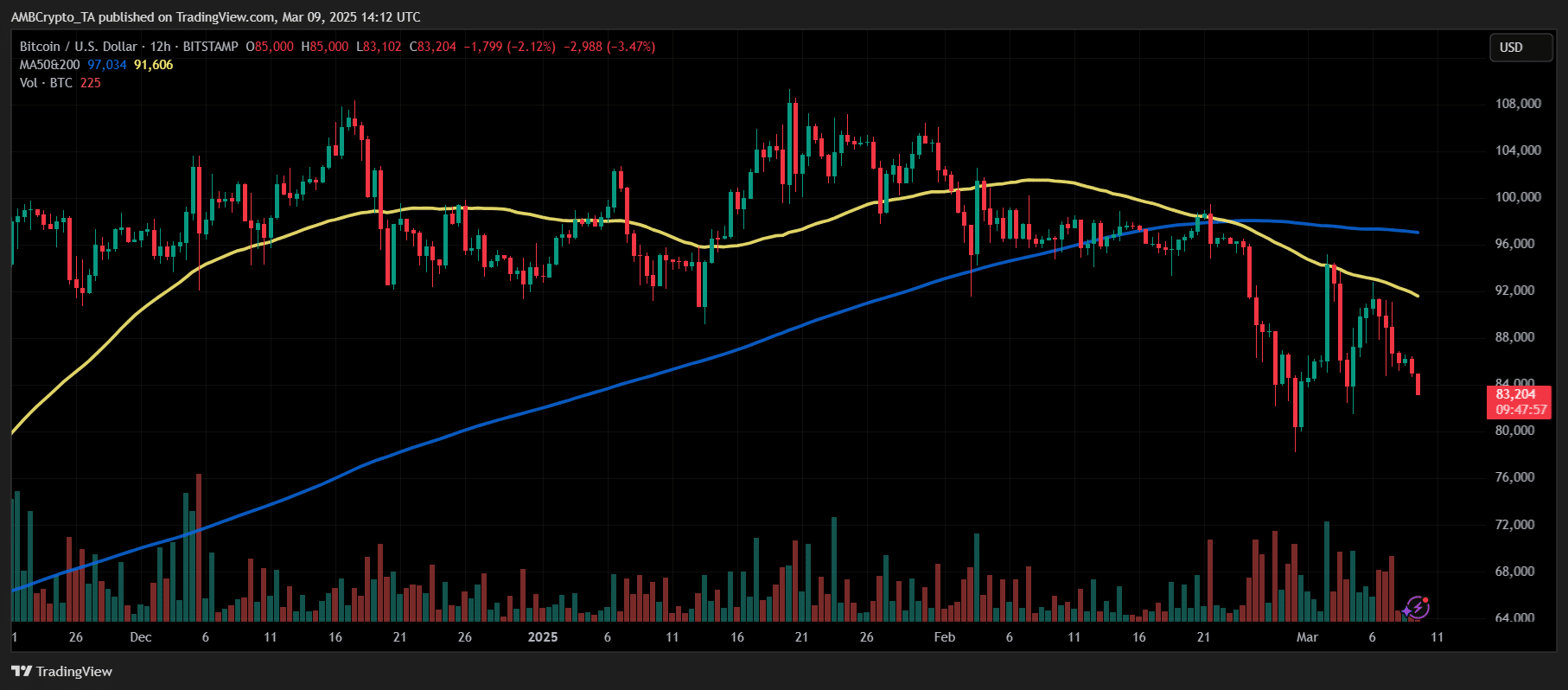

A Death Cross—a well-known bearish signal—was confirmed in February when Bitcoin’s 50-period moving average (MA) fell below the 200-period MA on both the daily and 12-hour timeframes.

Source: TradingView

Historically, this crossover has preceded extended periods of downward price action.

Source: TradingView

Bitcoin’s 50-period MA was $97,041 at press time, while the 200-period MA was at $91,631. It reinforced strong resistance levels above the price.

BTC has yet to show signs of reversing the trend, remaining below these key levels.

Fibonacci levels suggest further declines

Bitcoin previously failed to sustain a move above the 50% Fibonacci retracement level at $85,723. It was now testing the 23.6% retracement level at $82,902, a key short-term support.

A decisive break below this zone could lead to a deeper correction toward $80,380, which marks the 0% Fibonacci retracement from recent highs.

Source: TradingView

BTC’s most recent rejection near $88,181, aligning with the 61.8% Fibonacci level, suggests that bullish attempts have been weak, further validating the downward pressure.

RSI nears oversold territory

The Relative Strength Index (RSI) was 40.70 at press time, showing weak momentum but not yet entering oversold conditions (<30).

Source: TradingView

Previous RSI lows at 33.79 and 16.73 indicate that Bitcoin has historically experienced deeper corrections before significant rebounds.

A drop below 30 RSI would suggest oversold conditions, potentially signaling a short-term reversal.

Volume trends reinforce selling pressure

Volume analysis shows that selling activity spikes during downward moves, confirming a market driven by bearish sentiment.

However, if Bitcoin experiences a volume decline during further price drops, it may indicate seller exhaustion, potentially setting up for a relief bounce.

Bitcoin tested $82,902 at the time of writing, the 23.6% Fibonacci retracement level, which serves as immediate support. Holding above this level is crucial to prevent further downside.

A breakdown below $82,902 could push Bitcoin toward $80,380, the 0% Fibonacci retracement level, marking a critical support zone.

Key support and resistance levels to watch

On the upside, Bitcoin faces strong resistance at $85,723, the 50% Fibonacci level. A decisive break above this resistance could shift momentum and allow Bitcoin to test $88,181, the 61.8% Fibonacci retracement level.

However, if Bitcoin fails to reclaim $85,723, bearish pressure may persist, increasing the likelihood of further declines. Traders should watch price action closely at these levels for confirmation of trend continuation or reversal.

With the Death Cross still in play and the 50/100-day moving average crossover noted by Ali Charts, BTC remains in a medium-term downtrend unless significant buying pressure emerges.

Traders should monitor RSI levels and volume trends at key supports to gauge potential reversal signals.

Source: https://ambcrypto.com/death-cross-double-tap-why-bitcoins-downward-spiral-may-not-be-over/