- Bitcoin’s rising value highlights Bulgaria’s missed opportunity.

- BTC could have covered 105% of Bulgaria’s national debt.

- Discussion on digital assets as national reserves continues.

On July 16, Binance founder Changpeng Zhao responded to an online post regarding Bulgaria’s sale of 213,500 BTC in 2018. His remarks emphasized Bitcoin’s potential for addressing national debt issues.

The commentary highlights Bitcoin’s rising value since the sale, now exceeding Bulgaria’s national debt. While some advocate for BTC’s potential, others pragmatically caution about volatility.

Key Developments, Impact, and Reactions

Binance founder Changpeng Zhao engaged public attention by retweeting news about Bulgaria’s 2018 sale of 213,500 BTC, originally acquired through law enforcement seizures. These coins would have a cumulative value of approximately $25.2 billion at present-day market prices. Zhao remarked that “Bitcoin can solve most public debt issues“, which reflects a sentiment among cryptocurrency advocates promoting BTC’s potential as a financial stabilizer.

Bulgaria’s financial outlook may have been vastly different had the BTC been retained instead of sold. The profound escalation in BTC’s value illustrates a significant missed opportunity, potentially covering 105% of the nation’s extant debt. This highlights the broader discussion on the potential and risks of digital assets as national reserves.

There is a lack of official comments from the involved parties, including the Bulgarian government. However, experts within the industry, such as Binance founder Zhao, have reiterated BTC’s supposed strengths in sovereign finance. His commentary underscores the belief in Bitcoin’s capacity for alleviating financial pressures. Conversely, skeptics highlight Bitcoin’s volatility as a risk factor.

Analyzing Bitcoin’s Role Amid National Debt Issues

Did you know? Bulgaria’s 2018 sale of its Bitcoin holdings could have offset 105% of its current national debt, illustrating the missed financial potential of long-term crypto holdings.

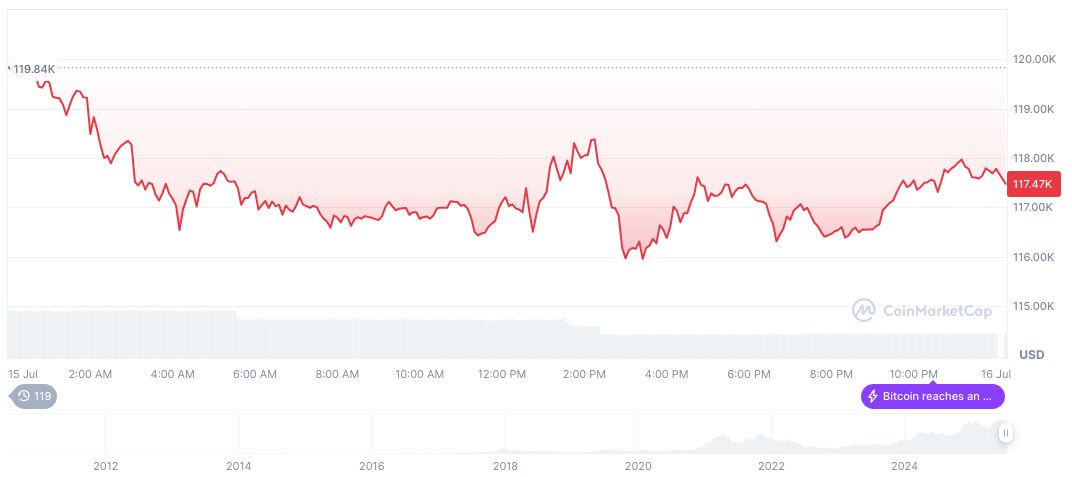

According to CoinMarketCap, Bitcoin (BTC) currently trades at $119,161.37, with a market cap of $2.37 trillion. BTC has demonstrated significant price movements, with a 40.10% increase over the past 90 days. These fluctuations continue to highlight Bitcoin’s volatile yet potentially lucrative nature.

Coincu analysts note the significant price increase of BTC over the years underscores its potential as an economic tool, although the current regulatory and financial frameworks do not fully support widespread national adoption. Experts recommend a cautious approach in national crypto asset management, emphasizing diversification and regulation to mitigate inherent risks. As Alex Obchakevich, founder of Obchakevich Research, stated, “Bitcoin’s volatility makes it difficult to use it as a stable reserve. Long-term holding of Bitcoin is a reasonable strategy, but the potential benefits would be overshadowed by the risks of a sharp drop in value. Instead of holding it as a reserve, [countries] should have diversified their holdings. Limiting the share of Bitcoin to about 10-15%, phased liquidation, hedging through derivatives, and a clear legal framework to avoid macroeconomic instability are necessary.”

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349066-bulgaria-2018-bitcoin-sale-impact/