Bitcoin may be set for lower price targets as data points to declining demand for the firstborn crypto asset and an aggressive bear dominance.

Bitcoin has been in a pronounced downtrend in recent weeks, falling over 5% over the past seven days. According to Head of Research at CryptoQuant, Julio Moreno, the sideways price movement is a product of simple economics.

The CryptoQuant analyst stated in a recent tweet that the largest crypto asset is trending downwards because demand is drastically reducing. The lack of notable inflow into Bitcoin has given bears full command of the market, driving prices lower.

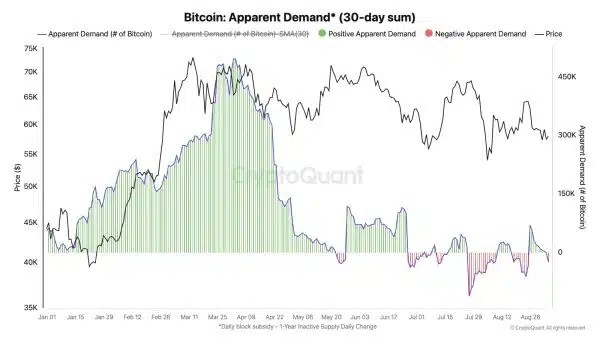

Per an accompanying chart, the 30-day sum of Bitcoin’s apparent demand has been in massive decline from the levels seen at the start of the year. The positive apparent demand has kept reducing, while the negative apparent demands are beginning to emerge considerably.

Bitcoin’s demand peaked during the incessant inflows from the US Bitcoin spot ETFs, launched on January 11. The Bitcoin products pulled billions of dollars from institutional and retail investors. However, the ETFs seem to be running out of steam, having recorded their seventh consecutive outflow on Thursday.

Bears Dominate Market

Moreno also pointed to the bull-bear market indicator, which showed that bears are becoming predominant. According to the 30-day moving average (MA) chart, bears have outpowered bulls in market sentiments.

This indicates that investors are more inclined to sell than buy Bitcoin. It also meant that traders betting on the asset to continue the downtrend have outgrown those in long positions.

Veteran trader Peter Brandt made a similar market analysis yesterday, stating that the bull cycle might be in jeopardy if not rescued soon. He also noted that sellers are higher than buyers, signaling further market decline.

Targets to Watch

The steady decline might not end soon, as analysts have speculated that the asset would see lower prices. Market veteran Michael Van De Poppe noted that Bitcoin could see $54,300.

He noted that the liquidity around that target could hedge Bitcoin’s further price decline and see a brief pump to $57,300. According to his chart, Bitcoin might fall further to $53,450 if the asset fails to hold $57,300.

His downward trajectory call correlates with BitMEX co-founder Arthur Hayes’ $50,000 price speculation. Hayes based his predictions on the rising reverse repurchase agreement (RRP) in the United States.

At press time, Bitcoin trades at $56,031, with a market cap of $1.1 trillion.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/09/06/cryptoquant-analyst-says-all-bitcoin-evaluation-metrics-in-bearish-territory-target-to-watch/?utm_source=rss&utm_medium=rss&utm_campaign=cryptoquant-analyst-says-all-bitcoin-evaluation-metrics-in-bearish-territory-target-to-watch