- Federal Reserve Chair Jerome Powell’s speech impacts U.S. markets and cryptocurrencies.

- Investor anxiety increases amid possible monetary policy shifts.

- Volatile Bitcoin trading impacts DeFi liquidations and staking.

Jerome Powell, Chair of the U.S. Federal Reserve, delivered a speech on April 16, 2025, at the Economic Club of Chicago, highlighting challenges like rising tariffs and inflation. Soon after, U.S. stock indices experienced declines.

“The challenges posed by rising tariffs, global market volatility, and our commitment to a cautious monetary policy remain paramount in the face of persistent inflation and a steady labor market,” emphasized Jerome Powell during his speech at the Economic Club of Chicago. These remarks suggested caution in monetary policy amid inflation and a steady labor market, prompting investor anxiety and notable market reactions. The S&P 500 fell 1.6%, the Nasdaq dropped 2.5%, and the Dow decreased over 1%, reflecting concerns over potential prolonged high-interest rates.

Stock Indices Plunge Post-Powell Speech, Bitcoin Volatility Surges

Federal Reserve Chair Jerome Powell’s speech to the Economic Club of Chicago on April 16, 2025, underscored ongoing economic challenges such as rising tariffs and global market volatility. His remarks emphasized a cautious approach to monetary policy amid persistent inflation and a steady labor market. Powell’s words had immediate repercussions on the financial markets, leading to significant declines across major U.S. stock indices, reflecting investor anxiety about future interest rate trajectories.

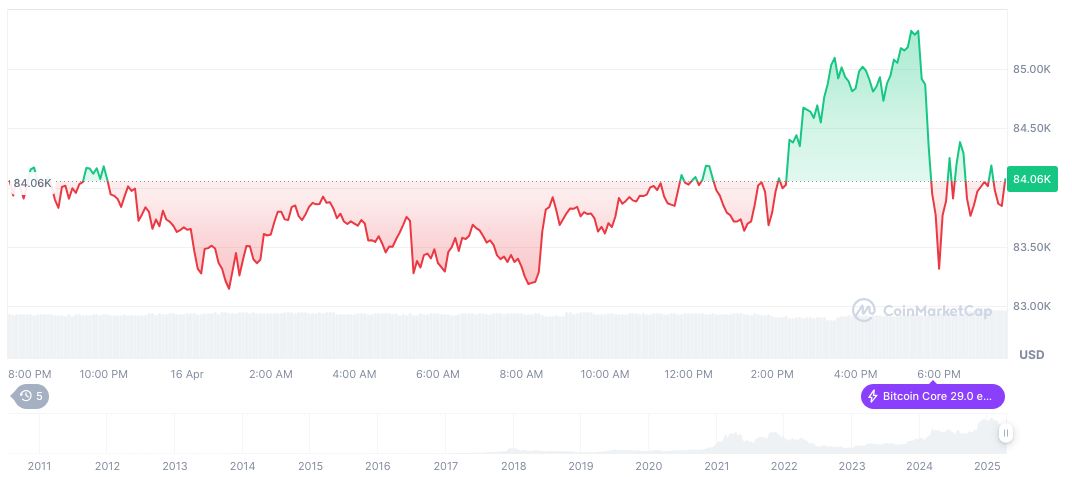

In the cryptocurrency space, the market reacted similarly, with Bitcoin experiencing increased volatility. During Powell’s address, Bitcoin’s price fluctuations were marked by strong resistance around the $80,000 level. DeFi activities underscored the stress in leveraged positions, as surges in liquidations were observed in protocols like Aave and Compound.

Notable statements came from Tether CEO Paolo Ardoino, who confirmed ongoing demand for stablecoins like USDT. Analyst James Van Straten shared insights on Bitcoin, indicating a price bottom might have been established if key support levels hold.

Historical Context, Price Data, and Expert Analysis

Did you know? Fed speeches historically impact markets, similar to Powell’s recent address, reaffirming patterns seen after major Fed announcements in 2022 and 2023.

According to CoinMarketCap, Bitcoin currently trades at $84,501.01, with a market cap of $1.68 trillion. Its market dominance stands at 63.04%, and the 24-hour trading volume has reached $29.39 billion, showing a 10.87% change. Recent price moves show BTC’s value altering by 0.40% in the past 24 hours.

Research from Coincu indicates significant financial implications tied to Federal Reserve signals, especially regarding institutional involvement in digital assets amid challenging macroeconomic conditions. Analysis of recent blockchain transactions provides further insights into these market dynamics.

Source: https://coincu.com/332608-crypto-market-reaction-powell-speech/