- The crypto market retraced slightly as markets brace for Eurozone CPI and FOMC minutes to be released this week.

- The futures market shows increasing use of leverage, with more traders leaning towards short positions.

The cryptocurrency market retraced slightly on Monday, the 19th of August. The global crypto market capitalization was down by 3% at the time of writing, with the two largest cryptos, Bitcoin [BTC] and Ethereum [ETH], trading in the red.

Bitcoin failed to hold the psychological threshold at $60,000 and had dropped to around $58,000 at press time. The largest altcoin ETH was also following a similar bearish trend to trade lower at around $2,570.

With the Crypto Fear and Greed Index at 28, the market is in fear. However, the release of key economic data sets including the Eurozone Consumer Price Index (CPI) and the Federal Open Market Committee (FOMC) minutes could shift the current sentiment.

EuroStat estimates that July inflation will come to 2.6%, up from June’s 2.5%. The CPI data to be released on 20th August is expected to influence the decision of the European Central Bank on interest rates.

The ECB started trimming rates in June before pausing in July.

In the US, the FOMC minutes for the July meeting will shed light on the Federal Reserve’s dovish stance after leaving rates unchanged last month.

Short traders increase bets

After the dovish FOMC meeting last month, crypto prices failed to rally, and it appears that traders are positioning themselves for a similar move.

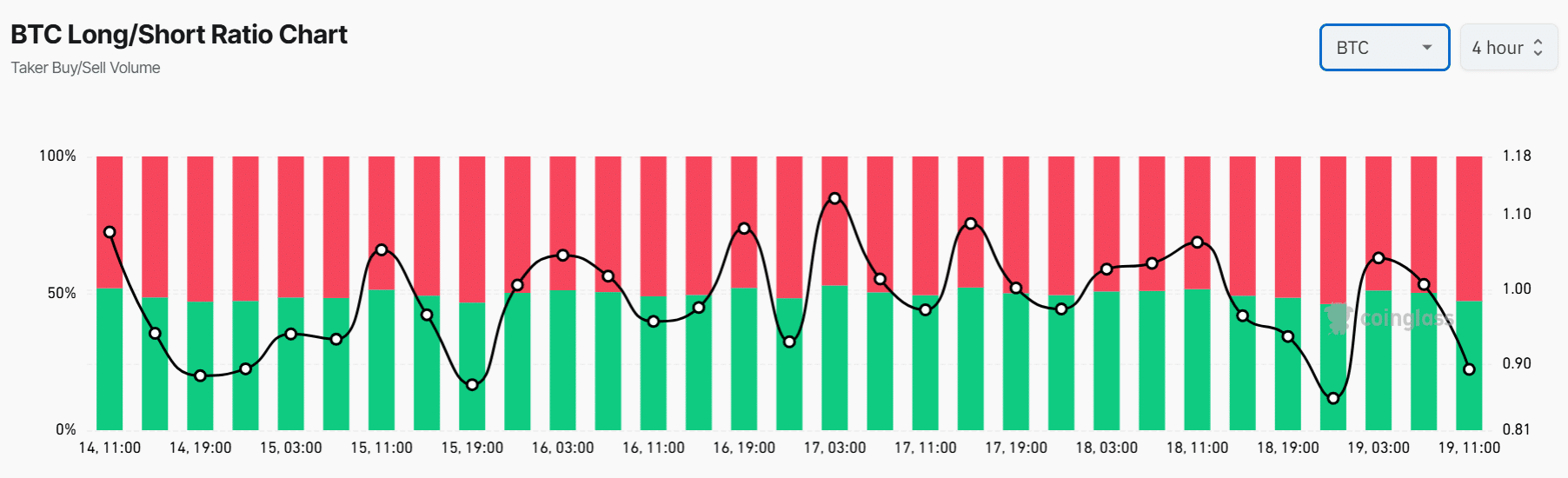

In the Bitcoin futures market, the long/short ratio has dropped from a neutral position of 1 to 0.89. This shift indicates that short positions are increasing as traders bet against Bitcoin’s price.

Source: Coinglass

Bitcoin funding rates had also flipped negative at press time as Open Interest dropped slightly to $30 billion, suggesting that long traders were abandoning their positions.

Ethereum also had the highest volume of liquidations across the crypto market at the time of writing. $30 million worth of ETH was liquidated in the last 24 hours, with $27M being long positions.

These liquidations have seen long traders choose to close their positions as short positions increase. The Ethereum long/short ratio has dropped to 0.85, with 54% of futures traders holding short positions.

According to CryptoQuant author Crypto Sunmoon, the increasing activity in the futures market shows bulls are still in play.

The analyst noted that investors are beginning to take risks, which usually happens during bull markets. “The reckless use of leverage by risk-taking investors will fuel the crypto bull market,” the analyst said.

Source: https://ambcrypto.com/crypto-market-braces-for-euro-cpi-fomc-minutes-whats-next-for-btc-eth/