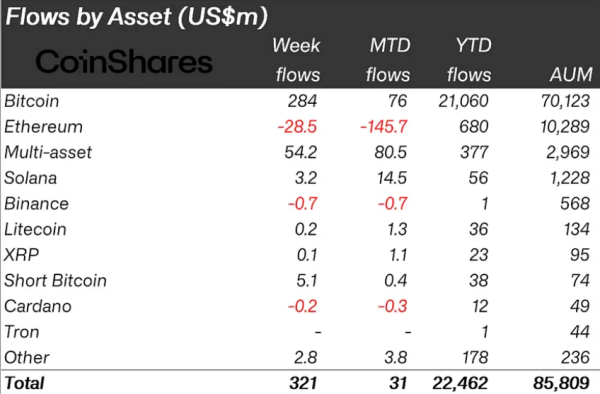

For the second week in a row, crypto asset investment products have seen a significant net influx of capital, with a total of $321 million pouring in.

According to CoinShares’ latest weekly report on the crypto ETP market, this sustained growth is likely due to the Federal Open Market Committee’s surprisingly dovish tone last Wednesday, which included a 50 basis point interest rate cut.

Consequently, total assets under management (AuM) for crypto investment products have increased 9% over the past week. Moreover, the total volumes reached $9.5 billion, also a 9% rise from the previous week.

Bitcoin Leads The Way

The report highlighted that Bitcoin was the main driver of the inflows, attracting $284 million in investments last week. This influx is also reflected in the spot market, where Bitcoin hit $64,000 and later closed above $63,000 for the first time in four weeks.

Bitcoin has continued to maintain its gains, trading at $63,230 at press time, having briefly reached $64,600 earlier today.

However, CoinShares observed that recent price volatility led to a surge in interest in short-Bitcoin investment products, which saw inflows of $5.1 million. Notably, this trend suggests some investors are cautious, hedging their bets against potential downward price movements in the cryptocurrency.

Solana Investments Performing Better than Ethereum

In contrast to Bitcoin’s strong performance, Ethereum-based products continue to struggle, with outflows reaching $29 million last week. This marks the fifth consecutive week of declines, bringing the total outflows for the month to a significant $145.7 million.

According to CoinShares, the persistent outflows from the Grayscale Trust and limited inflows from newly launched ETFs contribute to Ethereum’s woes.

On a more positive note, Solana investment products have seen steady, albeit modest, inflows, with $3.2 million entering the market last week.

Other cryptocurrencies, such as XRP and Litecoin, also experienced positive inflows at much smaller scales, with $200,000 and $100,000, respectively. Investment products for BNB and Cardano also registered a notable capital drain last week.

Inflows Per Region

From a regional perspective, the inflows into crypto assets were unevenly distributed. The United States led the way, with substantial inflows of $277 million. Switzerland followed closely, with its second-largest weekly inflows this year, totaling $63 million.

However, Sweden, Germany, and Canada experienced outflows, with a combined total of $19.6 million.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/09/23/crypto-investment-products-attract-321m-in-new-capital-as-bitcoin-soars-to-64k/?utm_source=rss&utm_medium=rss&utm_campaign=crypto-investment-products-attract-321m-in-new-capital-as-bitcoin-soars-to-64k