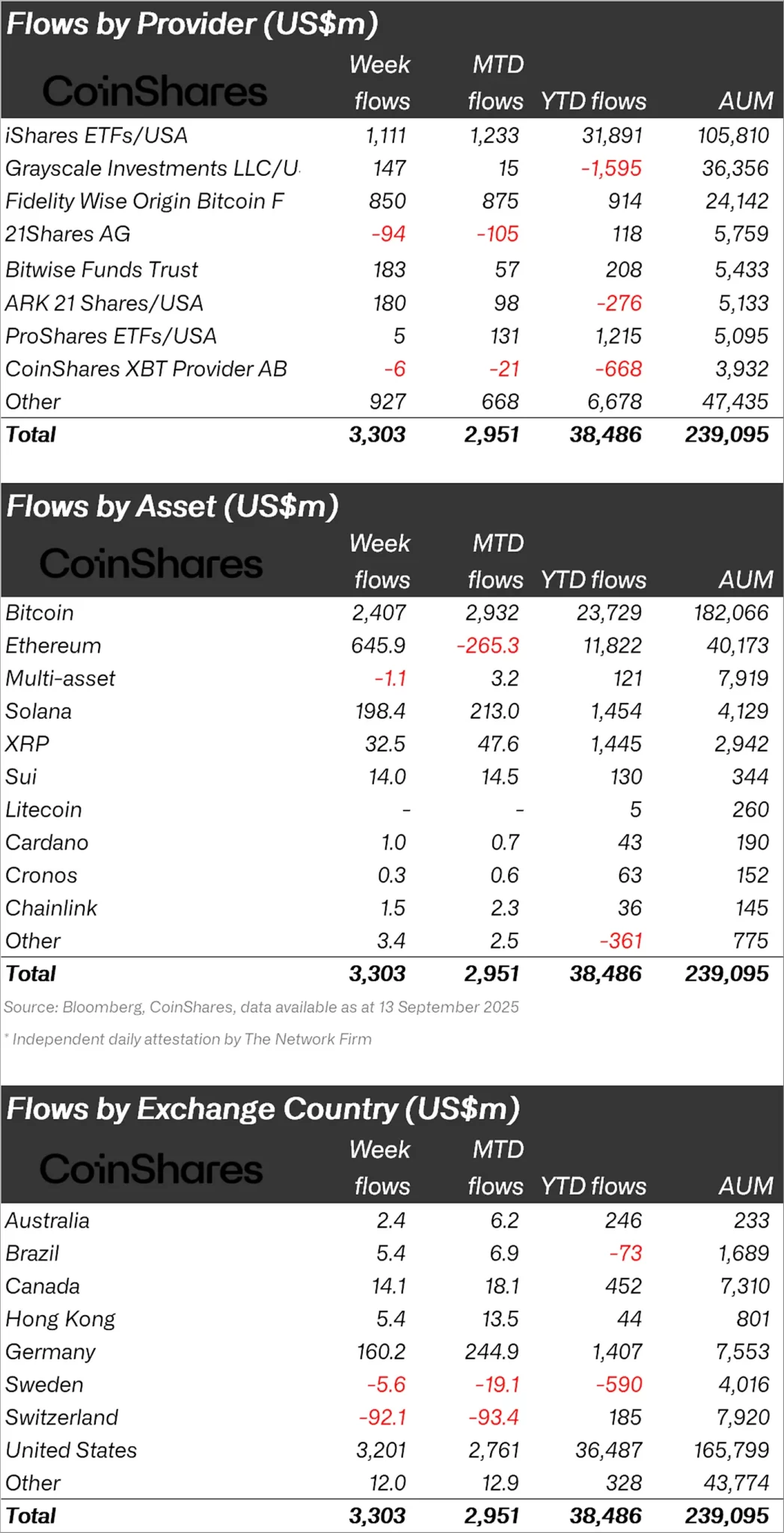

While the FED’s critical September interest rate decision is awaited this week for Bitcoin (BTC), Ethereum (ETH) and altcoins, CoinShares released its weekly cryptocurrency report and said that there was an inflow of $3.3 billion last week.

“Cryptocurrency investment products saw $3.3 billion inflows, while asset management assets rose to $239 billion, close to a record high in August.”

Bitcoin Saw the Most Inflow!

When looking at individual crypto funds, it was seen that the majority of inflows were in Bitcoin.

While Bitcoin experienced an inflow of $2.4 billion, Ethereum (ETH) experienced an inflow of $645.9 million.

Looking at other altcoins, XRP saw an inflow of $32.5 million, Solana (SOL) $198.4 million, Sui (SUI) $14 million, and Chainlink (LINK) $1.5 million.

“Bitcoin experienced the strongest recovery in market sentiment, attracting inflows of $2.4 billion, the largest weekly inflow since July.

Ethereum, which has seen eight consecutive trading days of gains, has also seen a reversal in market sentiment. Last week, it recorded a total of $646 million in inflows over four consecutive days.

Solana posted its biggest single-day entry ever with $145 million on Friday, bringing its weekly total to $198 million.

Aave and Avalanche saw small outflows of $1.08 million and $0.66 million, respectively.

When looking at regional fund inflows and outflows, the USA ranked first with an inflow of $3.2 billion.

Following the USA, Germany had an inflow of $160.2 million and Canada $14.1 million.

In the face of these inflows, Switzerland experienced an outflow of $92.1 million and Sweden $5.6 million.

*This is not investment advice.