- Analysts predict Trump could drive Bitcoin towards $100,000, while Harris may alter the crypto landscape.

- Historical trends show Bitcoin’s resilience after the elections.

This year’s election cycle has sparked considerable discussion around cryptocurrency, fueling intense debates within the crypto community.

Some analysts believe a Trump victory could push Bitcoin [BTC] toward $100,000. Others think a Harris win could bring significant changes to the digital asset ecosystem.

Tom Lee sees Bitcoin’s growth irrespective of…

Fundstrat Global Advisors’ Tom Lee anticipated a strong market trajectory as we approach 2025, regardless of the U.S. presidential election outcome.

Lee envisions a broad market rally across various sectors.

Discussing these insights on CNBC, Lee emphasized that solid economic fundamentals and a dovish Federal Reserve support the potential for a year-end market surge.

He noted that once election uncertainties dissipate, significant cash reserves on the sidelines may re-enter the market.

He noted that once the uncertainties surrounding the election dissipate, significant cash reserves that have been on the sidelines may re-enter the market.

Furthermore, he added,

“I’m bullish only in the sense that election uncertainty has caused people to derisk and cash to sit on the sidelines, but the fundamentals have been good.”

Other analysts share similar sentiments

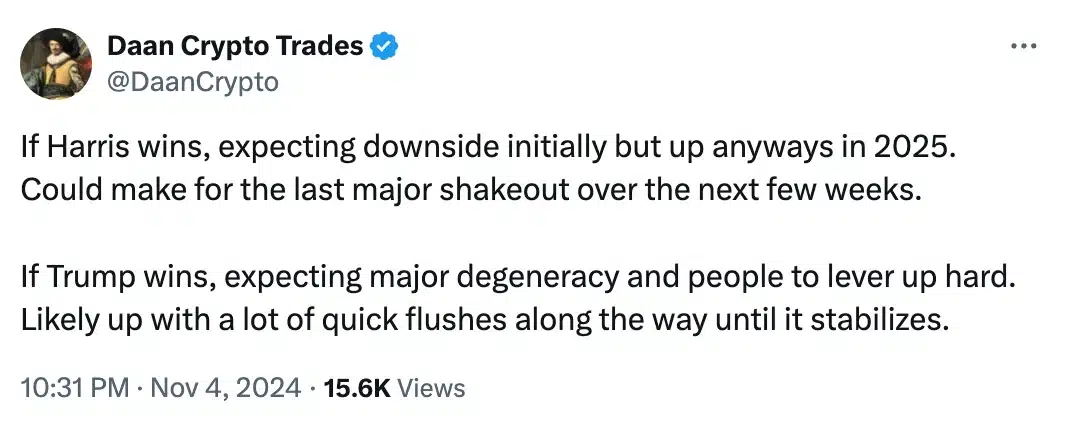

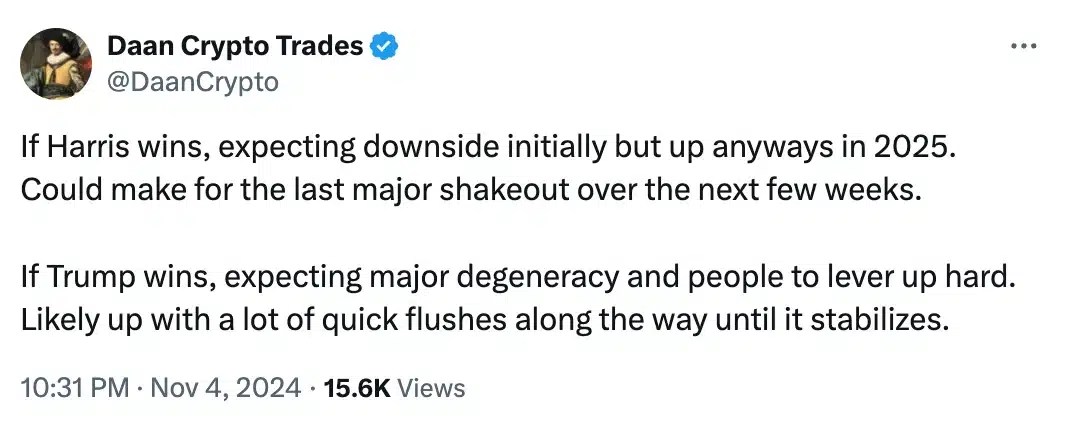

As expected, Lee was not the only one to have such an opinion, Daan Crypto Trades also joined the fray and took to X (formerly Twitter) and noted,

“I think there is a good probability that price will see at least a 10% move to either direction depending on who ends op winning the election this week.”

In a follow-up tweet, Daan emphasized how different presidential candidates could lead to differing outcomes for the cryptocurrency market.

Source: Dann Crypto Trades/X

Additionally, in a note published on the 4th of November, analysts at Bernstein emphasized that,

“Bitcoin remains the most resilient within crypto.”

By this, Bernstein underscored BTC’s ability to withstand political turbulence.

They acknowledged that the election results could trigger distinct price movements.

A Trump victory might propel Bitcoin to new heights, potentially reaching $80,000 to $90,000.

However, they cautioned that a Harris win could lead to an initial drop, possibly bringing BTC’s price down to around $50,000.

What lessons can we learn from Bitcoin’s history?

That being said, historical trends indicate that Bitcoin has shown resilience following the U.S. presidential elections.

After the 2012 election, BTC surged nearly 12,000% from $11 to over $1,100 by November 2013.

In 2016, it started at around $700 and peaked at approximately $18,000 in December 2017, pointing to a rise of 3,600%.

Following the 2020 election, Bitcoin rallied 478%, reaching around $69,000 within a year and hitting over $73,000 in March 2024.

While post-election price increases have diminished to 70% and 87% in the last two cycles, a projected 90% decrease could imply a rally of about 47.8%. This could bring BTC to around $103,500 by late 2025.

At press time, Bitcoin was priced at $68,804.11, reflecting a modest increase of 0.43% over the last 24 hours.

However, it has experienced a decline of 3.18% this past week following its recent peak near $73,000.

Source: https://ambcrypto.com/could-trumps-victory-send-bitcoin-soaring-to-100000-analysts-weigh-in/