- Convano raises 2 billion yen for Bitcoin investment.

- Plans to hold 21,000 Bitcoins by March 2027.

- Strategic shift aligns with corporate Bitcoin adoption trend.

Convano Co., Ltd., a Japanese nail salon operator, announced on August 4th its intention to expand its Bitcoin holdings by raising an additional 2 billion yen ($13.54 million).

This move signifies Convano’s strategic pivot to cryptocurrency investment, following a similar trend among global firms embracing Bitcoin as a treasury asset, possibly influencing market dynamics.

Convano Expands Bitcoin Holdings with $13.54 Million Investment

Convano Co., Ltd. has announced a capital raise of 2 billion yen to increase its Bitcoin holdings. As a publicly traded nail salon company, Convano’s aim to hold 21,000 Bitcoins by March 2027 marks a significant move in the corporate adoption of digital assets. The decision to invest heavily in Bitcoin aligns it with notable companies like MicroStrategy and Tesla.

Convano’s strategic shift towards Bitcoin investment reflects a growing trend among corporations to adopt digital assets as part of their treasury strategies, indicating a broader acceptance of cryptocurrencies in traditional business models.

MicroStrategy’s initial Bitcoin purchase in 2020 prompted other companies worldwide to explore cryptocurrency investments, setting a precedent that’s influencing Convano’s recent decision.

Historical Context, Price Data, and Expert Insights

Did you know? Bitcoin was created in 2009 by an unknown person or group of people using the name Satoshi Nakamoto, and it has since become the first decentralized digital currency.

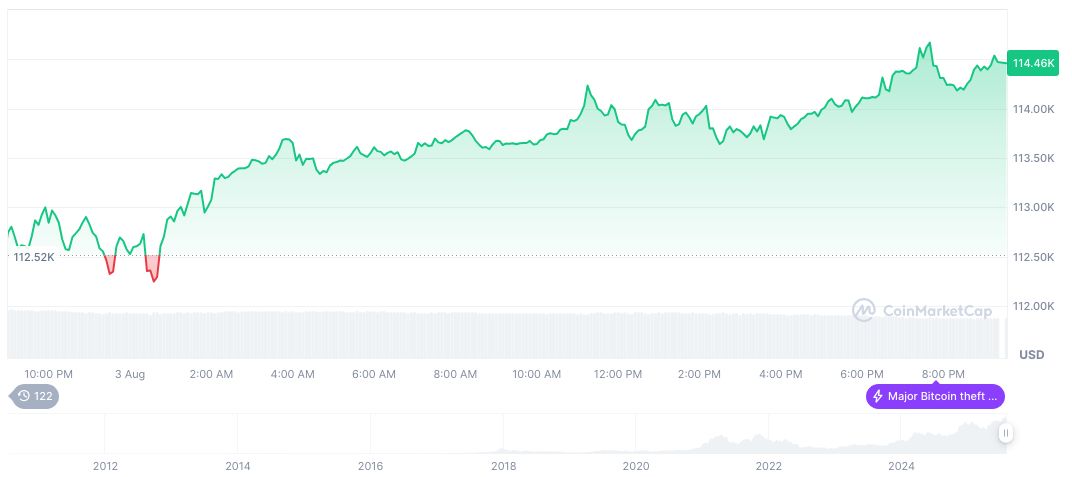

Bitcoin currently trades at $114,444.89, with a market cap of $2.28 trillion, occupying 61.24% market dominance. Trading volume over the past 24 hours is $48.69 billion, but there’s a 14.53% decrease. Over the last 90 days, Bitcoin price has increased by 21.17%, according to CoinMarketCap.

The Coincu research team suggests Convano’s Bitcoin push exemplifies a strategic financial approach, potentially enhancing equity strength and reducing exposure to traditional currency volatility. The move may spur further East Asian corporate cryptocurrency integrations, although broader regulatory clarity remains crucial for sustained momentum.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/convano-co-ltd-invests-bitcoin/